The 2008 recession was a financial crisis that sent shockwaves around the world and had lasting impacts on economies as well as societies for years to come. It’s considered one of the most catastrophic crises ever recorded.

Many factors contributed to the crisis, including the build-up of the recession, the role of major financial institutions, and the collapse of the financial system. In this article, we’ll explore each of these factors along with their impact on the global economy.

1. The build-up to the 2008 recession

The build-up to the 2008 recession was a culmination of several factors that set the stage for the impending crisis. Two significant contributors were the housing bubble and the prevalence of subprime mortgages along with predatory lending.

Related article: Make more, spend less – 5 steps to wealth generation

However, these were not the only factors at play. Other factors included the increasing globalization of financial markets, the growth of the shadow banking system, and the failure of regulatory agencies to keep pace with the changing financial landscape.

1.1 The housing bubble

Between 1997 and 2006, the value of homes in the United States rose by more than 120%. This increase led many to invest in real estate, leading to a housing bubble. The housing bubble, combined with easy access to credit, led to an increase in demand for housing as well as inflated housing prices.

Many financial institutions took advantage of this, providing easy access to credit for subprime borrowers. As housing prices continued to rise, many borrowers took out mortgages with adjustable interest rates, assuming that they would be able to refinance their loans at a later date.

Michael Burry in “The Big Short” movie, source: theguardian.com

However, when housing prices began to decline, many borrowers found themselves unable to refinance their mortgages and unable to make their monthly payments. This led to a wave of foreclosures along with a sharp decline in the value of mortgage-backed securities, which were held by many financial institutions.

1.2 Subprime mortgages and predatory lending

Subprime mortgages were loans given to borrowers who had poor credit and little chance of repaying their debt. Throughout the housing boom, borrowers were offered subprime mortgages with adjustable interest rates that were more likely to default over time.

Furthermore, financial institutions used predatory lending practices, which often involved misleading borrowers and encouraging them to take out loans they couldn’t afford. Many borrowers were not aware of the risks associated with subprime mortgages and were not provided with adequate information about the terms of their loans.

Furthermore, many lenders engaged in fraudulent practices, such as falsifying income information or inflating property values, in order to qualify borrowers for larger loans.

1.3 Financial deregulation and the rise of complex financial instruments

From the late 1970s to the early 2000s, financial deregulation opened up new avenues for investment banks, hedge funds, and other financial institutions to create complex financial instruments. These instruments were designed to diversify portfolios, lower risk, and increase returns.

Read more: What caused the stock market crash of 1929?

However, they were often unregulated and valued based on theoretical models, rather than their actual worth. One example of these complex financial instruments was the collateralized debt obligation (CDO), which was a type of security that was backed by a pool of mortgages.

CDOs were often rated as high-quality investments, despite the fact that they were comprised of subprime mortgages that were likely to default. When the housing market began to decline and defaults on subprime mortgages increased, the value of CDOs plummeted, leading to significant losses for many financial institutions.

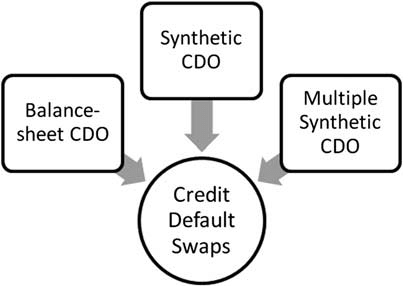

In addition to CDOs, other complex financial instruments, such as credit default swaps (CDS), were also widely used in the lead-up to the financial crisis. CDS were essentially insurance policies that protected investors against the default of certain securities. However, they were often sold without adequate capital reserves, meaning that many financial institutions were unable to pay out these policies when they were needed.

CDO in three versions and CDS, source: researchgate.net

The build-up to the 2008 recession was a complex as well as multifaceted process that involved a number of different factors. While the housing bubble and subprime mortgages were certainly significant contributors to the crisis, they were only part of a larger story that involved financial deregulation, complex financial instruments, and a failure of regulatory oversight.

2. The role of major financial institutions

Major financial institutions played a significant role in the 2008 recession, with many of these institutions engaging in risky, unethical practices. These practices ultimately led to the collapse of the housing market and a global financial crisis.

While there were many factors that contributed to the recession, such as lax lending standards and a housing bubble, the actions of major financial institutions were a significant catalyst.

2.1 Investment banks and mortgage-backed securities

Investment banks played a significant role in the 2008 recession, as many engaged in creating or selling mortgage-backed securities (MBS). MBS are bonds backed by a pool of mortgages and were marketed as safe investments. However, many of these securities were backed by subprime mortgages, which are loans made to borrowers with poor credit histories and a higher likelihood of defaulting on their loans.

Investment banks packaged these subprime mortgages together with other mortgages and sold them as MBS to investors around the world. These securities were often given high credit ratings by credit rating agencies, which led investors to believe they were safe investments.

However, when the housing market collapsed, many of these mortgages defaulted, causing the value of the MBS to plummet. This led to significant losses for investors around the world and ultimately contributed to the global financial crisis.

2.2 Credit rating agencies and misleading assessments

Credit rating agencies such as Moody’s, Standard & Poor’s, and Fitch Ratings played a crucial role in the crisis. These agencies assigned credit ratings to MBS, signalling to investors the safety along with expected returns on their investments.

US credit rating agencies, source: phenomenalworld.org

However, these ratings were often biased, based on outdated models and conflicts of interest. They did not accurately represent the actual risks of MBS. Many credit rating agencies were paid by investment banks to rate the MBS, which created a conflict of interest.

The agencies often gave high credit ratings to MBS that were backed by subprime mortgages, which ultimately proved to be much riskier than the ratings suggested. This led investors to believe they were investing in safe securities when, in reality, they were taking on much more risk than they realized.

2.3 The role of government-sponsored enterprises (GSEs)

Government-sponsored enterprises, such as Freddie Mac and Fannie Mae, played a significant role in the 2008 recession as well. These entities encouraged lending to low-income borrowers by buying as well as reselling their subprime mortgages.

Also read: Why should you start investing right now?

While this was done with the intention of increasing homeownership rates, it ultimately led to the creation of a housing bubble. When the housing bubble burst, Freddie Mac and Fannie Mae’s balance sheets were devastated, leading to a significant government bailout.

This bailout ultimately cost taxpayers billions of dollars and highlighted the risks associated with government-sponsored lending programs. The role of major financial institutions in the 2008 recession cannot be overstated.

The actions of investment banks, credit rating agencies, along with government-sponsored enterprises all contributed to the collapse of the housing market and the subsequent global financial crisis. It is important that we learn from these mistakes and take steps to prevent similar crises from occurring in the future.

3. The collapse of the financial system

This collapse of the financial system was one of the most significant events in modern economic history. It was a complex event that had far-reaching consequences for the global economy. The financial crisis was a result of several factors, including the housing bubble, subprime lending practices, and the failure of regulatory bodies to adequately oversee the financial industry.

The collapse of the financial system was the final straw that led to the 2008 recession, and the failure of Lehman Brothers was a significant contributor to this collapse. However, the roots of the crisis were much deeper than just one company’s failure. The financial industry had become increasingly complex and interconnected, making it difficult to predict the full extent of the crisis.

3.1 The failure of Lehman Brothers

Lehman Brothers was an investment bank heavily involved in creating, packaging, and selling mortgage-backed securities (MBS). These securities were considered safe investments, as they were backed by the value of real estate. However, as the value of these securities plummeted, Lehman Brothers found itself on the brink of collapse.

Bankrupt Lehman Brothers, source: theguardian.com

When the US government refused to bail out the firm, Lehman Brothers filed for bankruptcy on September 15th, 2008. This event sent a shockwave through markets worldwide, sparking a full-scale financial crisis.

The failure of Lehman Brothers was a significant event in the financial crisis, as it was the largest bankruptcy in U.S. history. It highlighted the fragility of the financial industry and the interconnectedness of the global economy. The collapse of Lehman Brothers caused a domino effect, with other financial institutions also facing significant losses.

3.2 The Troubled Asset Relief Program (TARP)

In response to the 2008 financial crisis, the US government implemented the Troubled Asset Relief Program (TARP). This program funded the purchase of troubled assets from banks, with the intent of stabilizing the financial system as well as preventing a complete collapse. While TARP was initially controversial, it did have some success in stabilizing the financial system, and many banks repaid their TARP loans with interest.

TARP was a significant intervention by the government in the financial industry, and it helped to prevent a complete collapse of the financial system. However, it was not without controversy, as many people felt that it was a bailout of Wall Street at the expense of Main Street.

3.3 The global impact of the financial crisis

The 2008 financial crisis had a global impact, with economies around the world feeling the effects of the collapse. The crisis led to a significant decline in global trade, as countries struggled to recover from the recession. Many countries experienced significant declines in GDP, increased unemployment, and social unrest. Today, many countries are still dealing with the effects of the 2008 recession.

The financial crisis was a wake-up call for the global economy, highlighting the need for better regulation along with oversight of the financial industry. While significant progress has been made in the years since the crisis, there is still much work to be done to ensure that the financial system is stable and resilient in the face of future challenges.

4. The aftermath of the 2008 recession

4.1 The Great Recession and unemployment

The 2008 recession was the most prolonged as well as severe economic downturn since the Great Depression. The recession had a significant impact on the labor market, with unemployment rates skyrocketing. Many individuals lost their jobs, and the unemployment rate rose to almost 10% in the United States.

The high unemployment rate led to a decline in consumer spending, which further worsened the economic decline. The impact of the recession was felt globally, with countries around the world experiencing rising unemployment rates.

Also interesting topic: Best stock market podcasts: List of TOP 10 podcasts you need to follow

The recession had a significant impact on young people, who found it difficult to enter the job market. Many graduates were unable to find work, leading to a generation of young people with limited work experience and reduced earning potential.

4.2 The impact on housing and foreclosures

The 2008 recession had a catastrophic effect on the housing market. The housing bubble, which had been fuelled by subprime mortgages, burst, leading to a decline in housing prices. Many homeowners were unable to afford their mortgage payments, leading to an increase in foreclosures. The foreclosure crisis was particularly severe in the United States, with millions of families losing their homes.

The impact of the foreclosure crisis was felt beyond the housing market. The decline in housing prices wiped out trillions of dollars in homeowners’ equity, leading to a decline in consumer spending and further economic decline.

4.3 The slow recovery and lasting effects

The 2008 recession had lasting effects on the global economy. While some countries have recovered from the crisis, others are still grappling with the long-term implications of this devastating financial crisis. The slow recovery from the recession has been a significant challenge for many countries, with economic growth remaining sluggish.

It had a strong impact on public finances, with many countries increasing their debt levels to fund stimulus packages along with bailouts. The increased debt levels have led to concerns about the sustainability of public finances as well as the potential for future financial crises – which has been widely discussed throughout 2022 and 2023.

The recession also had social consequences, with rising inequality and wage stagnation. The recession disproportionately affected low-income households, who were more likely to lose their jobs and homes. The long-term effects of the recession on social inequality are still being felt today.

Bottom line

The 2008 financial crisis was a result of several factors, including the housing bubble, subprime mortgages, financial deregulation, and risky, unethical practices by major financial institutions.

The collapse of the financial system had a global impact, with economies around the world feeling the effects of the crisis. The arrival of COVID along with high inflation complicated the situation even more, but the global economy has always managed to get through tough times. Remember that.

Taylor Swift declined $100 million from #FTX – here is why ❌💰

➡ Attorney Adam Moskowitz explained a question that Taylor Swift asked FTX, leading to the rejection of a $100 million #sponsorship deal.#crypto #cryptocurrency #taylorswift #investrohttps://t.co/yqGmHpQ20e

— Investro.com (@investrocom) April 22, 2023

Comments

Post has no comment yet.