Modern human history has been significantly influenced by globalization. In recent decades, the global economy has become more interconnected and dependent on one another. Conventional thinking predicts that this trend will only accelerate in the coming years, but things may change.

The process of “globalization” is how companies or other organizations gain international clout or begin conducting business on a global scale. Now it is falling for the first time since World War II. So what does it mean for our world and society?

Globalization in a decline

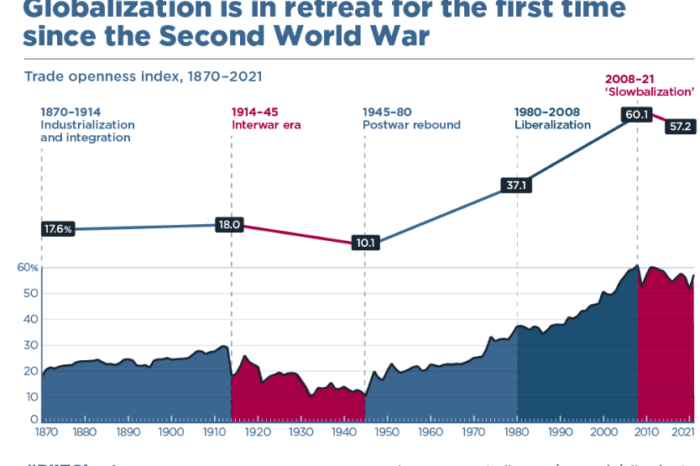

The trade openness index is calculated as the sum of world exports with imports divided by world GDP. The chart of this index clearly shows five different periods of globalization dating back to 1870. Three periods saw a healthy rise, while the time period between a World War I and World War II witnessed a decline.

“World economic integration has been in decline since the 2008–10 global financial crisis, ushering in an era of “slowbalization” or even deglobalization,” claims the report from PIIE.

It doesn’t necessarily mean that World War III is coming, but it may explain why we see a drop in the index value. A war between Russia and Ukraine is definitely adding momentum to the retreat of globalization. Moreover, product shortages, due to the war and COVID-19, cause chaos and instability.

Also read: Is the crypto space at risk because of Alameda Research?

As several governments and companies withdrew from their business ties with Russia, many have to reconsider their supply chain setup. The tension between China and United States also disrupts important supply chains and expands trade barriers to other countries.

Increasing globalization promised to create a better world. In many ways, it succeeded; as a result, more than 1 billion people were brought out of poverty in the last few decades. In addition, prices for previously thought costly goods and services have considerably decreased.

However, globalization has been falling for years. It stays unclear when this trend will reverse with the ongoing economic crisis and descending economic interdependence. However, some argue that the trend is not slowing down, but rather deepening. Globalization is taking on a new form.

How globalization changed

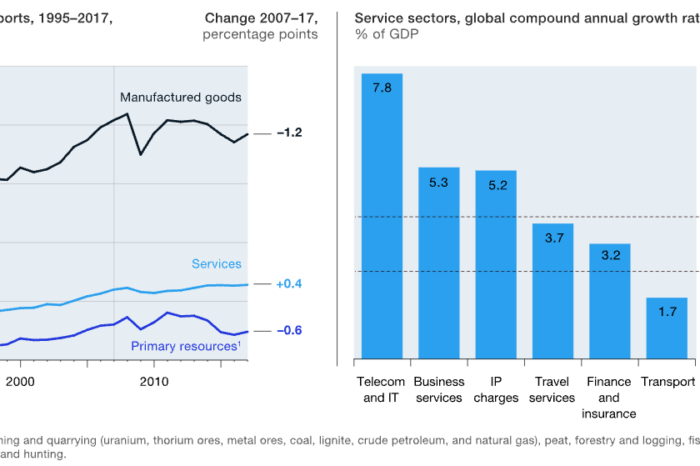

- Global trade volumes grew much more in the past than they do now. Although trade is still expanding in absolute terms, less tangible items produced globally are now traded. More specifically, from 2007 to 2017, the global ratio of gross exports to gross output fell from 28.1% to 22.5%.

- Services trade is growing faster than goods trade. The global commerce in products exceeded $17.3 trillion in 2017, dwarfing the $5.1 trillion in gross services trade that year. However, during the past ten years, trade in services has increased more than 60% faster than the trade in products. Some subsectors are expanding two to three times more quickly than others, such as telecom and IT services, business services, and intellectual property fees. As manufacturers increasingly provide new kinds of leasing, subscription, and other “as a service” business models, the line between goods and services will continue to blur in the future.

- Capitalized investment in R&D and intangible assets like brands, software, and intellectual property is increasing as a percentage of revenue across all value chains. In total, it increased from 5.4% of income in 2000 to 13.1% in 2016. The value chains for global breakthroughs are where this trend is most obvious. R&D and intangible costs account for 36% of revenue for businesses in the machinery and equipment sector, compared to 80% for businesses in the pharmaceutical and medical device sectors. Countries with highly trained labor forces, strong innovation and R&D capabilities, and strong intellectual property protections benefit from the increased emphasis on knowledge and intangibles.

Companies adapt to slowing globalization

According to BlackRock CEO Larry Fink’s 2022 letter to shareholders, the Russian-Ukrainian war and the pandemic’s effects on supply chains have “put an end to the globalization we have experienced over the last three decades.”

“The world benefited from a global peace dividend and the expansion of globalization. These were powerful trends that accelerated international trade, expanded global capital markets, increased economic growth, and helped to dramatically reduce poverty in nations around the world,” said Fink in a letter.

Companies are already being careful and concentrating on constructing supply-chain resilience in light of recent supply-chain issues, creating redundancy, diversifying vendors and suppliers, reshoring, and overstocking.

Read more: Three new players entered the “CBDC game” – who are they?

More than 90% of organizations have allegedly implemented measures to increase supply-chain resilience. These are raising stockpiles, procuring raw materials from two different sources, and regionalizing their supply chains. Yes, the world is changing fast.

Conclusion

Globalization hasn’t ended. However, some major changes caused its drop. An end to war and better country relationships would definitely slow it down, potentially reversing the rapid change.

This is still a long way to go as inflation must be tamed first, then interest rates lowered for a better economic stimulation. So many things go in the opposite direction that it is almost impossible to reverse globalization’s decline. It can take years until things get back to what they used to be.

Comments

Post has no comment yet.