BlackRock, the world’s largest asset manager, reported a significant boost in net inflows for the first quarter, amounting to $110 billion, which surpassed analysts’ expectations. As a result, the firm’s assets rose to more than $9 trillion, Bloomberg reports.

BlackRock’s AUM is expected to rise

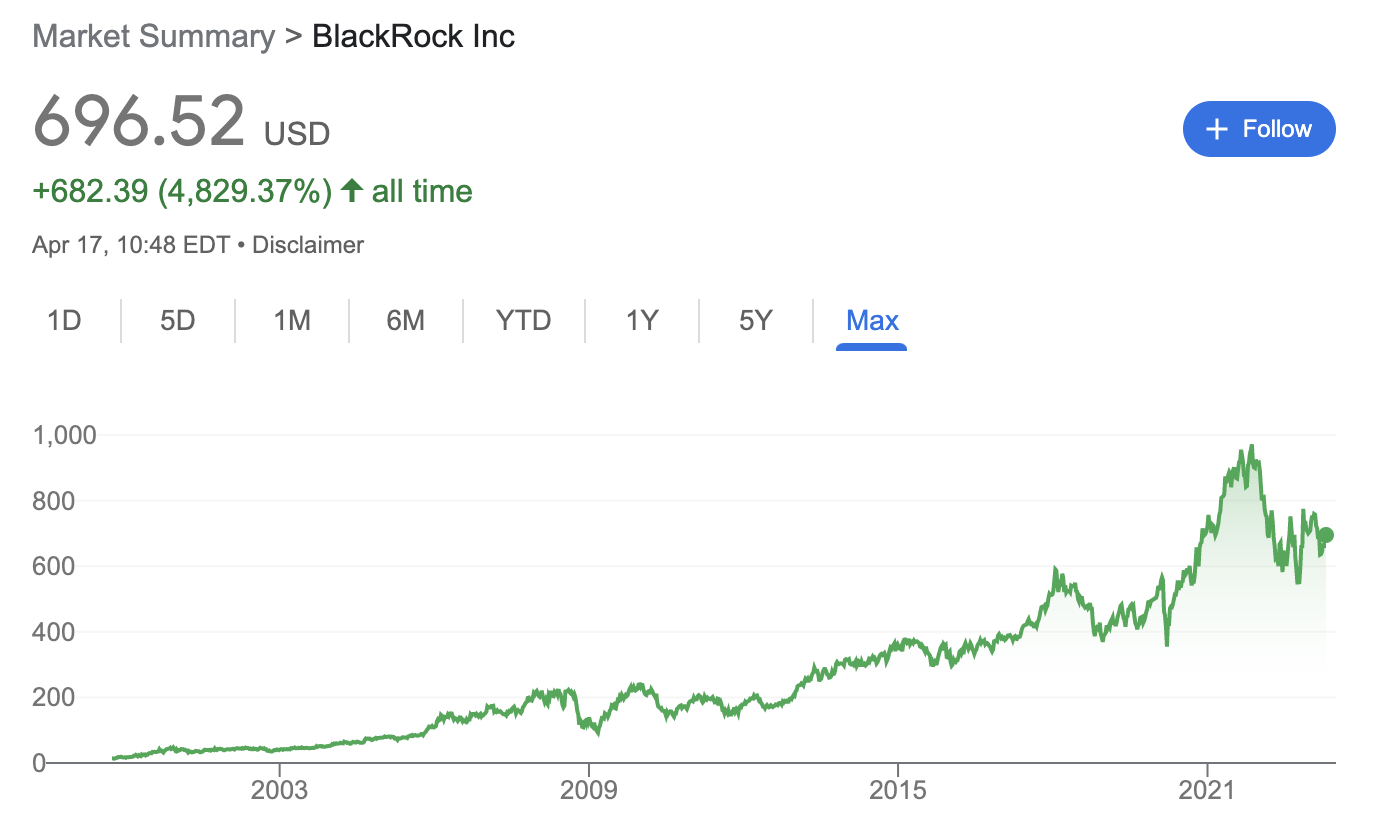

According to Morgan Stanley analyst, Michael Cyprys, BlackRock’s positive momentum is expected to continue and the capital inflow in assets under management (AUM) will grow. This has led him to increase the company’s stock price target to $861 from $829, while the current stock price of BlackRock (BLK) is $696.5.

BlackRock stock chart, source: google

Cyprys, who has always had an overweight rating on the stock, has identified four areas of growth for BlackRock. These include fixed income, cash management, private markets, and Aladdin, the firm’s investment-management technology platform.

Also read: Story of Charlie Javice or how to steal $175 million from JP Morgan

He predicts that these areas will drive an annual organic asset growth of 5% over the next three years, leading to an increase in the firm’s assets under management from $9 trillion to $10 trillion in the coming quarters. Furthermore, he predicts that the company’s assets will eventually exceed $15 trillion within the next five years.

Cyprys highlights BlackRock’s scale, diversification, disciplined investments, and efficient operations with a focus on expenses as factors that will support continued organic growth and margin expansion.

Final thoughts

Although BlackRock’s shares fell by around 22% last year and are down 2% in 2023, they have been rebounding since the arrival of March. Markets are weighing that the worst might be behind us, with BlackRock aiming at new all-time highs by 2024 or 2025 at the latest.

Comments

Post has no comment yet.