Apple (AAPL) announced that it is partnering with Goldman Sachs (GS) to offer high-yield savings accounts for Apple Card customers. The Big Tech companies are slowly but surely conquering the world of finances.

Apple’s savings product

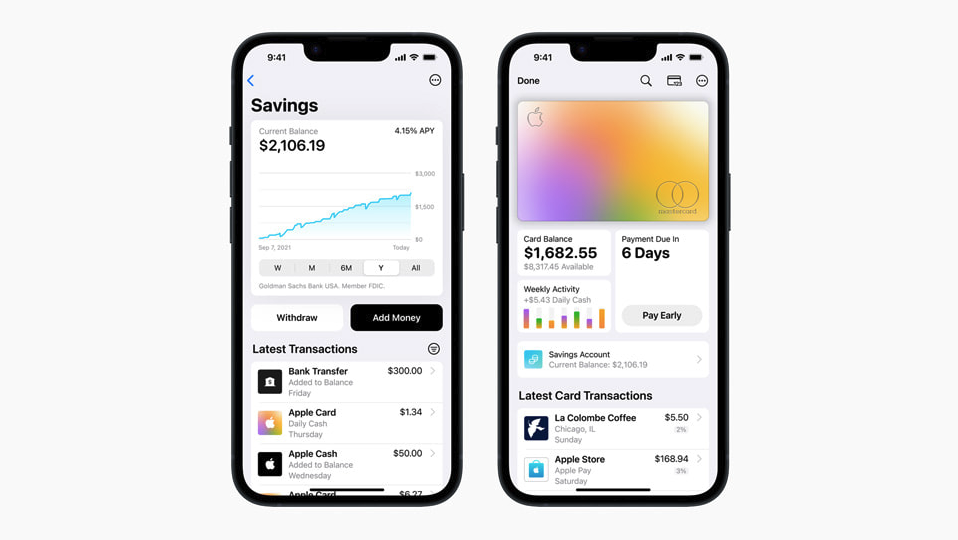

Apple claims that the accounts’ annual percentage yield of 4.15% is 10 times the national average. With depositors pulling billions of dollars due to rising interest rates and bank collapses last month, the launch means increased competition for large banks.

Also read: BlackRock’s assets are expected to rise to $15 trillion in 5 years

Apple and Goldman Sachs guarantee their customers’ deposits are protected by the FDIC. However, deposit limits of $250,000 per customer will be put in place. Customers can deposit their daily cash rewards from their Apple Cards or transfer money from another bank account into the accounts. They are compatible with Apple Wallet as well.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s VP of Apple Pay and Apple Wallet.

The announcement had a minimal effect on the stock prices of both Apple and Goldman Sachs, but it could have a positive long-term impact. Since the introduction of Apple Pay in 2014, the size of the business has increased by more than fourfold.

Do you agree with this statement? 🤷♂️ And have you already started doing something about it? 🧐 Join @investrocom 🤙#quote #investing #investor #investment #cryptocurrency #forex #commodity pic.twitter.com/uU2Ax8gRuL

— Investro.com (@investrocom) April 17, 2023

Apple has stated that it expects its expansion into the payments market to be a major factor in the future success of its service offerings. Apple CFO, Luca Maestri, stated in February’s earnings call that Apple’s services are “set an all-time revenue record of $20.8 billion,” and expect it to continue to grow.

iPhone will play a crucial role

The iPhone has become a necessity for most individuals. Apple CEO, Tim Cook, explained that iPhones contain people’s contacts, their health information, their banking information, their smart home, and so many different parts of their life. Including a savings account now seems like a no-brainer.

Apple’s savings account showcase, source: apple.com

Other digital giants are also making a play for the financial services market. Amazon has Amazon Pay and collaborates with the buy-now-pay-later service Affirm (AFRM), while Google has its own payment tool, Google Pay.

Read more: Elon Musk rebrands Twitter to X Corp, creating ‘everything app’

Jamie Dimon, CEO of JPMorgan, recently mentioned the growing pressure from Big Tech, naming Apple Pay and Apple Card as direct competitors. However, Goldman Sachs decided to collaborate instead of competing. It’s most probably a smart move.

Final thoughts

The world of finance is constantly changing and it seems that banks will not only have to compete with other banks but also companies like Apple. Products and services that Apple provides for its customers are always easy and attractive to use, so it is logical to expect Apple to make this one successful as well.

Comments

Post has no comment yet.