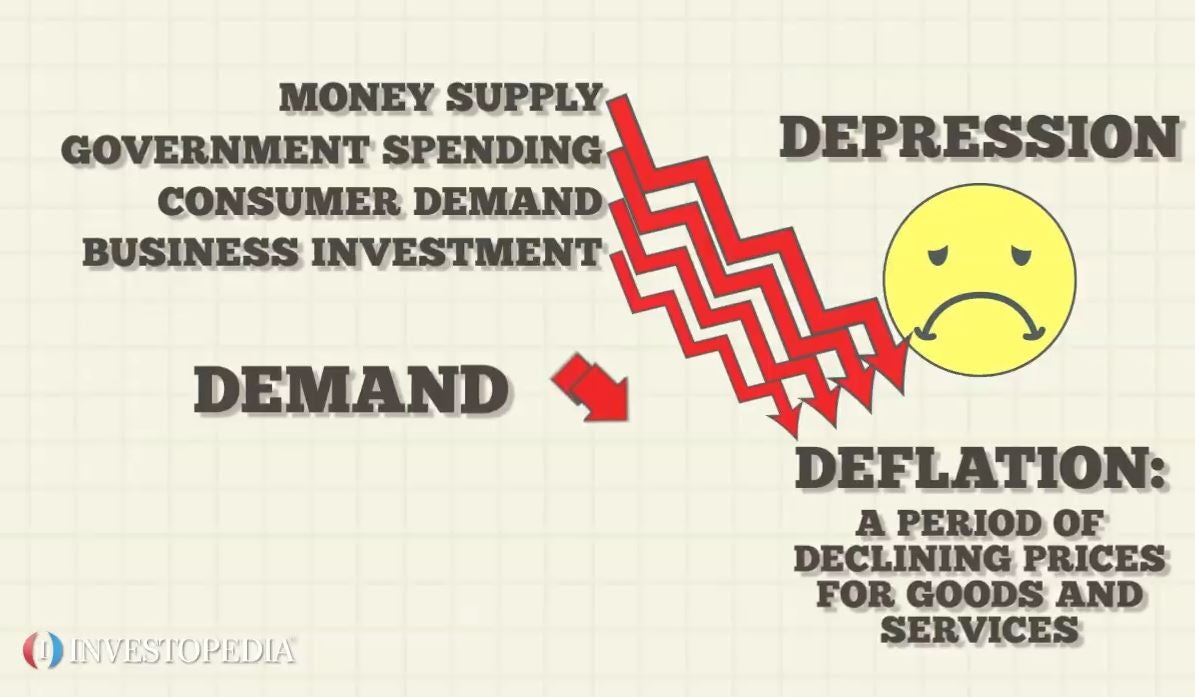

Deflation describes a prolonged period in which the overall price level of goods and services in an economy falls. Inflation, or a persistent rise in prices across the board, is the polar opposite of deflation. Deflation may result from a variety of circumstances, such as less consumer spending, higher productivity, lower monetary supply, or interventionist government policy.

How deflation begins

A drop in consumer spending typically brings on deflation. Businesses reduce prices when consumers are unwilling or unable to spend money. As a result, the overall price level of goods and services falls, bringing in a period of deflation. Deflation can also result from a shrinking money supply. This may occur if the central bank reduces the money supply, bank lending declines, or the demand for money rises. Deflation occurs when there is a decrease in the quantity of money in circulation, forcing firms to reduce their prices to attract buyers.

Rising productivity is another factor contributing to price declines. To stay competitive, firms reduce prices when they find ways to create more of their goods and services while spending less overall. Deflation can also be caused by government policy. A rise in taxes, for instance, would reduce consumer spending and, in turn, demand for products and services.

Deflation is a serious problem since it slows the economy down, makes debt more of a burden for individuals and businesses, and drives down the value of assets. Because of reduced spending by firms and individuals, deflation can slow economic expansion. As a result, the economy may slow down, meaning less production and more people out of work. In addition, the debt loads of households and corporations could grow if deflation persists.

Another great topic: Gold gains as Fed raises interest rates by 25 bps

This is because it becomes more difficult to pay off debts as the purchasing power of money increases during deflation. The result may be reduced access to credit, defaults, or even bankruptcy. In addition, real estate, equities, and commodities are only some assets whose values might fall due to deflation. That is because the value of money increases during deflation, making assets more expensive in real terms. As a result, consumer and investor confidence might fall, further dampening economic activity.

Source: https://www.investopedia.com/terms/d/deflation.asp

How to end deflation

Deflation may be combated in a number of ways, the most common of which include increases in the money supply, government expenditure, structural changes, and foreign trade. Increasing the money supply is a popular economic policy intended to combat deflation.

The central bank may accomplish this goal in many ways, including reducing interest rates, expanding bank lending, and purchasing government bonds. As a result, more money will be floating around, driving up demand for products and services and, therefore, prices. Increasing government spending is another option for mitigating deflation. Spending on infrastructure, tax reductions, and direct consumer payments are all viable options for accomplishing this goal. In light of this, demand for products and services rises, stimulating the economy and pushing up prices.

Also read: AMD falls sharply amid disappointing earnings report

Deflation may also be addressed by structural changes. Reforms to the tax system, the employment sector, and other regulatory frameworks fit under this category. These measures could boost economic efficiency by raising productivity and decreasing expenses.

As a result, output, employment, and prices may rise, ending deflation. Deflation may also be combated by increasing global trade. Boosting exports can boost economic activity and price levels by increasing demand for products and services. Increasing imports can also help bring prices down, making products and services more accessible. As a result, there may be a general increase in economic activity and a consequent increase in pricing for products and services.

Source: https://investinganswers.com/dictionary/d/deflation

Not so easy to end deflation

It’s important to remember that there may be unforeseen implications to the methods used to combat deflation. For instance, inflation might result from an excessive increase in the money supply. This can cause the value of money to fall, which in turn can cause prices to rise and reduce customers’ purchasing power. Similarly, if the government spends too much, it can rack up too much debt, which in turn can cause taxes to go up and economic development to slow down. Implementing structural reforms can take time and effort, with pushback from entrenched interests.

Dont miss: Apple jumps as investors cheer earnings results – uptrend continues

Some benefits may also result from deflation. As one possible outcome, it can raise people’s disposable income and hence their level of living. This is because deflation causes prices to fall, making products and services more accessible to middle-class customers. Borrowing costs might decrease due to deflation, making it simpler for individuals and enterprises to get loans. As businesses strive to maintain profitability in deflation, they often adopt more efficient and competitive practices.

Final words

In conclusion, deflation is defined as a long time during which the overall price level of goods and services in an economy falls. It may result from declining consumer spending, higher production rates, lower liquidity, or deliberate government action. Negative implications of deflation include slower economic expansion, higher debt loads, and falling asset values. However, deflation can be dealt with in many ways, including monetary expansion, increased government spending, structural reforms, and expanded international trade. Nevertheless, because of the potential for unforeseen repercussions, options for deflation should be adopted cautiously.

Comments

Post has no comment yet.