Debt is a typical component of personal finances, and depending on how it is managed, it may be either positive or negative. While excessive debt can be damaging to a person’s financial health, taking on debt intelligently can occasionally be a wise decision. In this article, we will explain how debt may be beneficial to one’s personal finances, especially when using a personal loan to consolidate or pay off debt.

One of the critical reasons debt may be beneficial for personal finances is that it can enable access to financial resources that would otherwise be unavailable. For instance, using a personal loan to pay off high-interest credit card debt might save considerable interest costs over time. This can free up cash flow, facilitating a quicker debt reduction.

Personal loan to pay off debt

Another advantage of obtaining a personal loan to consolidate debt is that the repayment procedure may be simplified. Instead of coordinating many monthly payments to various creditors, debt consolidation with a personal loan entails making a single monthly payment to the lender. This can make it easy to keep up with payments and avoid missing deadlines.

Don’t miss: Stunning insights from Warren Buffett´s letter to investors in 2023

Moreover, personal loans often have fixed interest rates, indicating that the interest rate will not fluctuate. In contrast, credit card interest rates are typically variable and subject to market fluctuations. A fixed interest rate can make budgeting more accessible and predictable, as one will know the precise amount of the monthly payment for the duration of the loan.

Personal loans can be a useful tool for debt consolidation, but it’s important to remember that they are not a remedy for all financial issues. Debt consolidation with a personal loan only makes sense if the loan’s interest rate is lower than the rates on the current debt. A plan to prevent incurring new debt while repaying the aggregated loan is also vital.

Also read: What is a REIT?

Another way in which debt may be beneficial to one’s finances is by helping to establish credit. When used correctly, taking out loans or credit lines and paying payments on time may help develop a strong credit history, which can be advantageous when applying for future loans or credit cards. In contrast, a lack of debt or credit history might make it harder to get credit in the future.

When considering taking on debt to establish credit, starting modestly and making payments on schedule is essential. This will indicate to lenders that the person is a trustworthy borrower who makes payments on schedule. In addition, if the credit score increases, the person may qualify for larger loans or credit lines with better conditions.

Secured debt

A secured loan, backed by collateral, is one sort of debt that may be very helpful for establishing credit. This collateral may be a car or a savings account, for example. As the lender may recuperate their losses if the borrower defaults, secured loans are typically easier to get and may have lower interest rates than unsecured loans.

Another exciting topic: Is Airbnb renting actually profitable? Over 80% of people think so!

However, it is crucial to note that secured loans have a risk: the borrower might lose the collateral if they default on the loan. So, it is essential only to obtain a secured loan if the person is sure of their ability to make payments on time and in full.

When utilized strategically, debt may be beneficial to one’s personal finances. Therefore using a personal loan to consolidate or pay off high-interest debt can save money on interest, simplify the repayment process, and make budgeting easier.

In addition, taking on debt to establish credit might be advantageous, particularly if the borrower begins with a small balance and make payments on schedule. Nonetheless, it is essential to remember that debt is dangerous and should be appropriately utilized to prevent financial difficulties.

How to lower your personal debt?

Lowering personal debt can be complicated and intimidating, but reaching financial security and independence is necessary. Start by keeping track of your monthly income and spending to understand where your money is going. A budget is one of the first stages in reducing personal debt. Design a budget that prioritizes your debt payments while allowing you to cover your basic living costs. This can help you stick to your budget and prevent overspending, which might result in more debt.

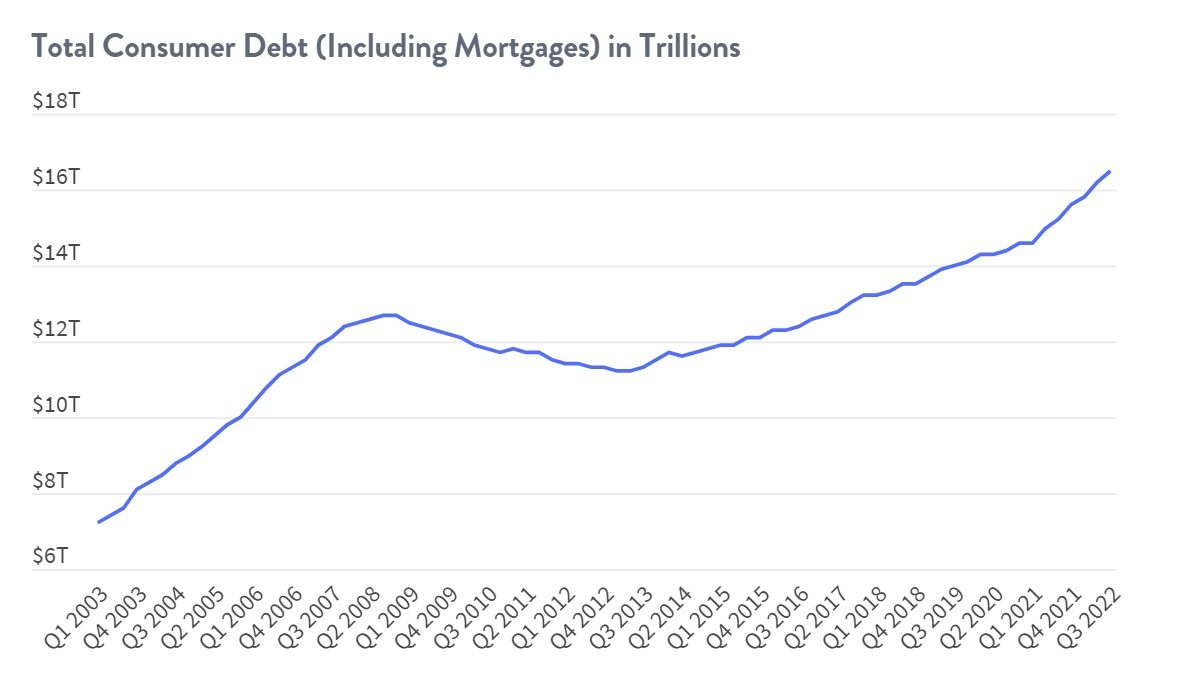

Total personal debt volume chart, source: moneygeek.com

When establishing a budget, search for methods to reduce spending. For example, try lowering your spending on non-essential products, such as dining out less, cancelling unused subscriptions, and sourcing cheaper alternatives to often purchased items. Modest adjustments to your spending patterns can accumulate over time, allowing you to pay more toward your debts.

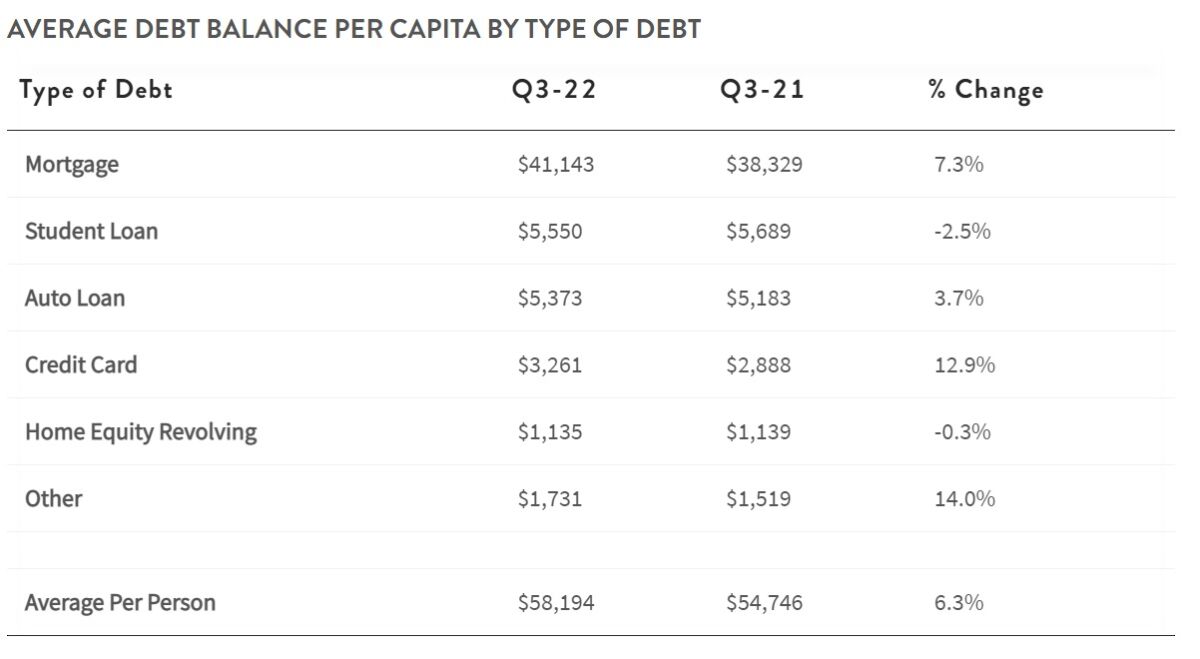

Average debt per capita, source: moneygeek.com

Comments

Post has no comment yet.