Investing in real estate is one of the lucrative ways to build wealth and achieve financial goals such as independence. Investors use several common real estate investment strategies to develop their portfolios. These include rental properties, flipping, and real estate investment trusts (REITs).

Different options of real estate investing

- The rental properties strategy involves buying and renting a property out to tenants. The rental income provides a steady stream of passive income while the property can appreciate in value over time. However, this strategy requires significant capital to purchase and maintain the property. The investor must also have strong management skills to deal with tenants and property maintenance.

More to read: How to best invest cash?

- Flipping involves buying a distressed property, renovating it, and then selling it for a profit. The investor must have an eye for identifying undervalued properties and the expertise to manage renovations and sell the property for a profit. This strategy can be more capital-intensive than rental properties, as the investor must have the funds to purchase the property and pay for the renovations.

- Real Estate Investment Trusts (REITs) are publicly-traded companies that own, operate, or finance income-generating real estate properties. Investors can buy shares in the REIT, which provides them with exposure to the real estate market without the need to own or manage a physical property. As a result, REITs typically offer higher yields than other stocks, which can be an excellent way to diversify an investment portfolio.

Each of these strategies has its advantages and challenges. Rental properties provide passive income and long-term appreciation but require a significant investment of capital and management skills. Flipping can provide quick profits but requires substantial capital and renovation expertise. REITs offer diversification and high yields but are subject to market fluctuations and management fees.

Another interesting topic: The largest financial scams in history explained – what did we learn?

Ultimately, the best strategy depends on the investor’s goals, risk tolerance, and investment capital. Therefore, it’s essential to thoroughly research each method and seek the advice of experienced professionals before making any investment decisions.

But what if the investor doesn’t have enough money for any the above-mentiondd strategies? Don’t worry, there are ways investors can still participate or invest in real estate.

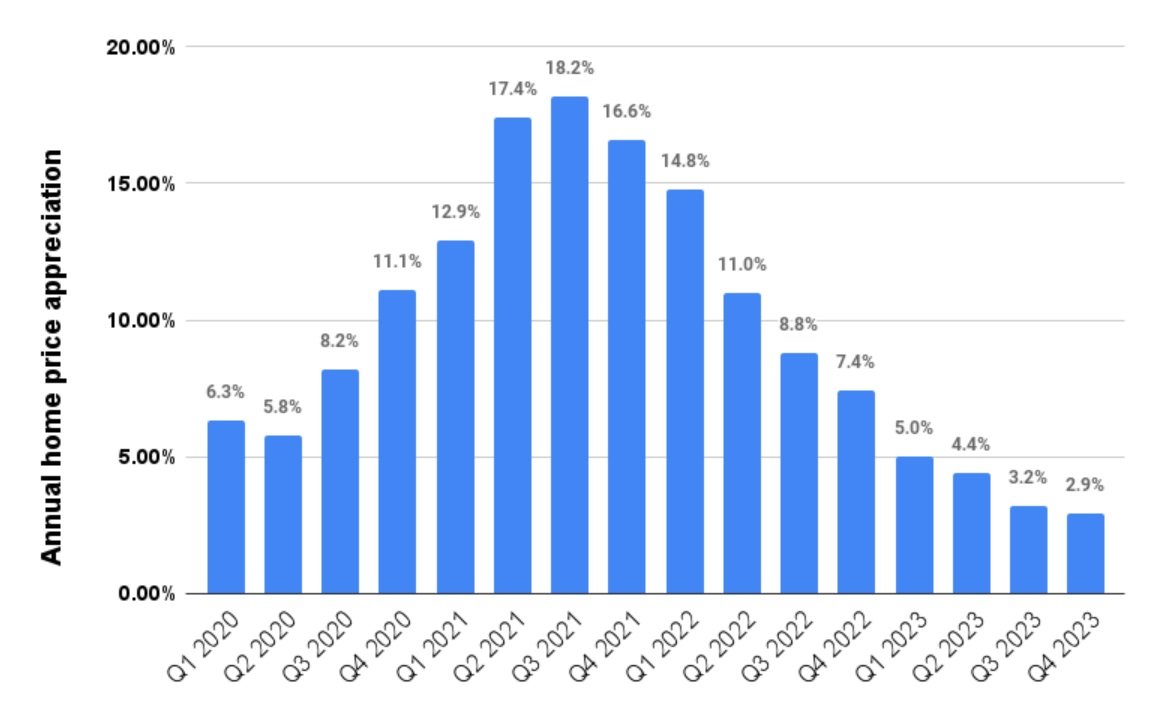

Home price chart, source: Propertyonion

How to invest in real estate with little or no money

Investing in the real estate market with little or no money can be challenging, but there are a few strategies that can be considered:

- Wholesaling is a real estate investing strategy where the investor finds distressed properties that can be contracted and sell that contract to a third party for a fee. There is no need to have money to buy the property, but investors need to have a good understanding of the real estate market and the ability to find motivated sellers.

- A joint venture is a partnership between two or more investors where they pool their resources together to invest in a property. For example, they can partner with someone with the capital to invest in the property while someone else brings expertise and knowledge of the real estate market.

You may also like: How to invest in stocks?

- House hacking is a strategy where investors live in one unit of a property that has multiple units and rent out the rest of the units to pay for the mortgage. Investors can use this rental income to build up savings and eventually invest in more properties.

- A lease option is a contract where investors agree to lease a property for a certain period, with the option to buy the property at the end of the lease term. Investors can negotiate with the seller to have a portion of the rent payments toward the property’s purchase price.

- Seller financing is when the seller of the property acts as the lender and provides investors with a loan to purchase the property. This can be a good option if the seller is motivated to sell and is willing to offer flexible financing terms.

Final thoughts

While investing in real estate with no money can be challenging, it’s possible. By considering the strategies mentioned above, investors can start investing in real estate even if they don’t have the capital to do it.

Comments

Post has no comment yet.