Derivatives are financial products used to manage risk or speculate on the future price fluctuations of assets such as stocks, bonds, commodities, currencies, and indexes. Derivatives in finance can take the shape of futures, options, swaps, and other sophisticated financial products.

Although they may be indispensable tools for investors and traders, derivatives can be difficult and dangerous. In this article, we will examine the meaning of derivatives in finance, their advantages and disadvantages, why individuals use derivatives, and how they function.

What are derivatives in finance?

The value of an underlying asset determines the value of a derivative. The underlying asset might range from stocks and bonds to commodities and currencies. Two of the key functions of derivatives are speculation on the future price fluctuations of the underlying asset and risk management.

Suggestion: Elon Musk rebrands Twitter to X Corp, creating ‘everything app’

Futures, options, and swaps are the three primary forms of derivatives in finance. Futures are contracts to purchase or sell an underlying asset at a future price and date. Options provide the right, but not the obligation, to purchase or sell an underlying asset at a fixed price and date in the future. Swaps are contracts that include the exchange of cash flows depending on various financial instruments.

Advantages and disadvantages of derivatives

Derivatives allow traders and investors to bet on market movements, hedge against potential losses, and control risk. This is one of the key advantages of utilizing derivatives. In addition to enhancing market liquidity, derivatives can help price discovery. Moreover, derivatives enable investors to get exposure to assets they may not otherwise have access to, such as commodities or currencies.

Leverage enables traders and investors to control substantial holdings with modest money. This can lead to large winnings if the underlying asset’s price rises. On the other hand, it may cause significant losses if the underlying asset’s price goes against them.

You may also read: BRICS to create their own currency – get ready for a new age

Several dangers also accompany the usage of derivatives in finance. First, derivatives may be extremely complicated and challenging to comprehend, which is one of the most severe concerns. This makes it difficult to evaluate their risk and estimate their fair worth. Moreover, derivatives may be highly volatile, resulting in major losses if the market goes against the trader or investor.

Derivatives also pose the danger of amplifying market volatility and increasing the chance of market collapses. This is due to the fact that derivatives allow traders and investors to hold significant positions that may be swiftly liquidated if the market goes against them. In addition, using derivatives can generate systemic risks that can affect the whole financial system.

Why do people use derivatives?

Individuals utilize derivatives for various objectives, including speculation, hedging, risk management, and portfolio return enhancement. Speculators use derivatives to speculate on the future price fluctuations of the underlying asset.

They seek to benefit from the price differential between the asset’s present and future value. In contrast, hedgers utilize futures to protect themselves against prospective losses. For instance, a corporation dependent on a commodity may utilize a futures contract to lock in a price and hedge against price volatility.

Risk managers utilize derivatives to manage risk. For example, banks may utilize derivatives to control interest rates and currency risk. Investors may also employ derivatives to boost portfolio returns.

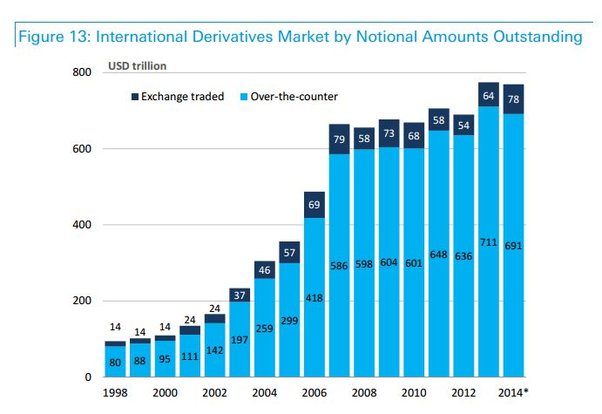

Total notional value of derivatives, source: quora.com

How do derivatives work?

The function of derivatives is to enable traders and investors to obtain exposure to underlying assets without owning them. Instead, they engage in a contract that grants them the right or responsibility to purchase or sell the underlying asset at a future price and date.

Another exciting topic: Real estate market is in danger – is this 2008 all over again?

Suppose, for instance, that an investor feels the price of gold would grow in the future. Investors can purchase a futures contract for gold, giving them the right to purchase gold at a fixed price on a future date. If the price of gold rises, the investor can benefit by selling the futures contract. But, if the price of gold declines, the investor might incur a financial loss.

The buyer of an option has the right, but not the responsibility, to purchase or sell the underlying asset at a defined price and date in the future. This implies that if the market goes against the buyer, they might choose not to execute the option, reducing their possible losses.

Swaps are more complicated. Two parties agree to exchange cash flows depending on various financial instruments. For instance, a corporation and another party may agree to trade a fixed interest rate for a variable interest rate. It enables both parties to limit their interest rate risk exposure.

Conclusion

Derivatives are an essential financial instrument, allowing traders and investors to manage risk, speculate on market fluctuations, and obtain exposure to assets they may not otherwise have access to. But they may also be sophisticated and dangerous. Therefore, before implementing derivatives, it is crucial to comprehend their dangers, benefits, and functioning. Nevertheless, with the correct understanding and risk management measures, derivatives may be a potent instrument for accomplishing financial goals.

Comments

Post has no comment yet.