What happened? Why is inflation so high that it makes the cost of living hard for everybody? Although it is a tricky topic to swallow, it’s also pretty simple. High inflation was caused by several factors that happened one by one.

1. Money printing and interest rates

The root of all problems was COVID-19. It could’ve caused one of the worst crises ever, so central banks started printing money at record levels, sending stocks and other risk-on assets to astronomic levels. Fed also decreased interest rates drastically from 1.75% to 0.25%, which boosted the economy like it was on steroids.

However, this also allowed the creation of ‘cheap money’, a rise in wages, stocks, and cryptocurrencies, which led to overvalued markets and rising inflation. The more money in circulation, the less valuable it became.

Related article: These 5 countries avoided high inflation (at least for now)

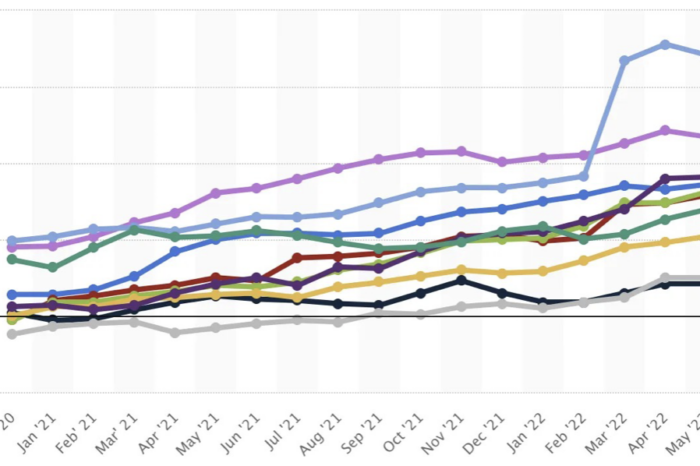

That is how inflation started to take off. Inflation in the US averaged 1% in 2020, but it jumped in 2021 from 2% to almost 10% at the beginning of 2022. But in the midst of this inflation rise, other factors started to enter the game and push it even higher.

2. Demand-pull inflation

Demand-pull inflation is when the demand for goods and services increases quicker than the economy’s production capacity. It’s the most common cause of rising prices. This is because demand was high, and supply couldn’t keep up, which was also caused by the Russia-Ukraine war in Europe.

The supply could not keep up with demand, and producers may not have had time to create the necessary manufacturing to increase the supply. A shortage of raw resources or a lack of trained labor could also prevent them from succeeding. If sellers don’t increase their asking price, they’ll sell out and soon discover they can now afford to boost pricing.

Inflation in several countries, source: link

This causes inflation if enough sellers engage in it, which is the perfect case of what happened last year, and it is still ongoing. As prices grow, inflation becomes a more common concern. Customers are encouraged to spend more now to prevent price increases in the future by this anticipation, which fosters growth even more.

3. Cost-push inflation and energy crisis

Finally, there is also cost-push inflation, which directly results from the increase in production cost and supply shortage. The supply side is impacted by a number of factors that cause inflation. Cost-push inflation, for instance, might result from interruptions in the global supply chain, such as the one brought on by the pandemic in 2020.

Read more: Paul Tudor Jones shows how to spot a market bottom

Some economists mention rising salaries as another element that can lead to inflation driven by supply. According to this hypothesis, businesses would typically respond to pressure to increase employee pay by increasing prices to cover these costs.

These 5 countries avoided high #inflation (at least for now) 🙌💸

➡ Inflation is the hottest topic in 2022, and almost everyone experiences price increases in products and services.#hyperinflation #recession #crisis #trading #trader #market #investrohttps://t.co/9gyqjOkz0y

— Investro.com (@investrocom) October 7, 2022

Also, as commodities experienced a surge in prices, this pushed the prices of food and energy significantly higher. Now that people have gotten used to higher inflation and expect it to continue to rise, it has become built-in inflation, where wages also need to increase to keep up with the status quo. However, the opposite is actually the reality as people struggle to keep up with the rising inflation.

Conclusion

It’s all basically a snowball effect that has no end when it gets out of hand. Central banks may saved the economy temporarily in 2020, but they failed to act quicker in 2021, and this may cause long-term damage to the economy in the upcoming years.

Comments

Post has no comment yet.