Alameda Research, a company closely tied to a well-known Sam Bankman-Fried, reportedly has a big chunk of assets stuck in illiquid assets. This raises doubts on whether Alameda will be able to pay its debts if necessary.

What is Alameda Research?

The company brands itself as a leading principal trading firm. It’s been in crypto since 2017, joining hands with Sam Bankman-Fried (SBF). Alameda Research is an important player in the crypto space as it is a quantitative market-making firm. It reports approximately $14.5 billion in assets and $8 billion in liabilities as of June 30th.

Related article: Problem for OpenSea – social media giant is joining NFT race

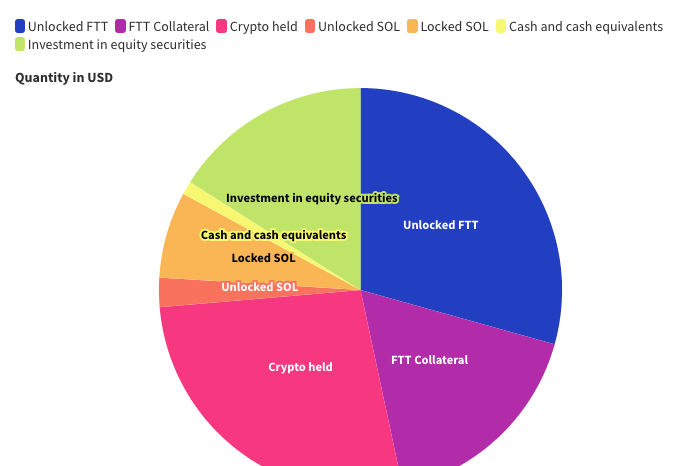

However, most of these assets are stored in FTX (FTT) and “FTT collateral” tokens. $3.66 bn in FTT tokens and $2.16 bn in FTT collateral (locked tokens) make many wonder how the token could end up with its $3.5 bn market cap.

Alameda Research in trouble?

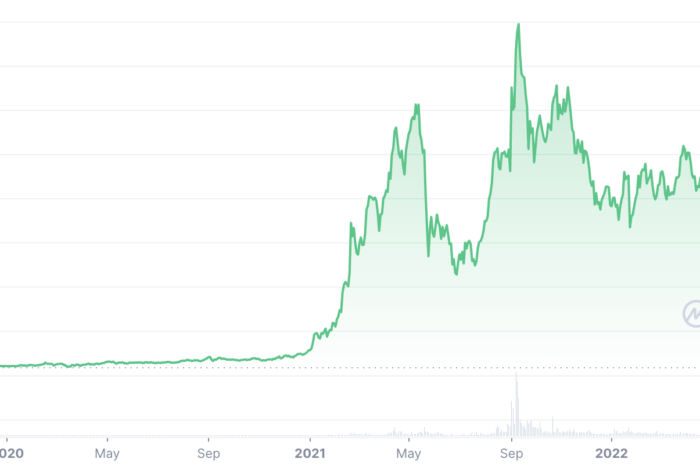

If the company’s positions are sold, it may draw the token with the entire industry even lower. That means Alameda holds the key to the future of the FTT token. To put it in perspective, this is something that’s not possible with Bitcoin, as it has millions of holders. Not one user owns more than 1% of all bitcoins.

Alameda Research is all in on FTX and their position is currently bigger than the token’s market cap, as only 38% of FTT tokens are circulating at the moment. This is trouble for both companies. But it may be trouble for all crypto investors as well.

Almost half of all company’s assets are in FTT tokens, at about 160% of the total market cap. This fact implies the real value of these tokens is much smaller. Alameda Research and FTX Ventures have separate investment activities, but there are undeniable ties between these two companies. The exposure of Alameda in FTX is just far too great.

SBF hasn’t shied away from utilizing his platform to promote FTT tokens. He recently tweeted an image of the FTX interface on October 10th that displays an order for $2.7 million in FTT. SBF did make sure to state that the tweet was not financial advice. It seems both FTX and Alameda Research would like to bring more liquidity to the FTT token.

that time of the weekhttps://t.co/R8zegY2CyC

NOT FINANCIAL ADVICE pic.twitter.com/OUMEfQvtnz

— SBF (@SBF_FTX) October 10, 2022

Our point of view

First, these numbers are from June and come from CoinDesk. We are unsure whether their position has changed over the past few months. However, that doesn’t change the fact they are in deep trouble because of the illiquidity of their cryptocurrencies. It’s just impossible to liquidate a multi-billion dollar position in this market in a short time.

Also read: Bitcoin adoption increases with African retailer Pick n Pay

Alameda Research reportedly has about $8 billion in liabilities made of loans. That raises the question of how are they going to settle their obligations with illiquid assets. The answer is probably more complex than we can imagine.

As FTX bailed out several crypto projects this year, it could also save Alameda Research if necessary because of their close ties. What TerraLuna crash started, SBF may save. The bleeding of the cryptocurrency market stopped as SBF stepped in and bailed out Voyager, BlockFi, with several other crypto projects.

He may also save Alameda Research if needed, but holders of FTT tokens will live in uncertainty because if the company sells its stake, it could send FTT to zero. However, SBF will probably not allow this to happen.

Comments

Post has no comment yet.