People have seen conflicting reports on whether or not the economy is ready to enter a recession. Experts and investors alike are worried about the economy collapsing due to bank failures, high inflation, and a volatile stock market.

It can be difficult to sort through the noise and gain clarity on how people’s own money will be impacted. For economists to declare a recession, they need to see a sustained drop in GDP, employment rates, production, and other economic indicators over an extended period of time. Let’s explain what a recession is first.

What is a recession?

A prolonged and considerable drop in economic activity is known as a recession. Two consecutive quarters of decreased gross domestic product (GDP) is a standard criterion used by analysts to evaluate if the economy is in a recession.

Related article: From Great Depression to GFC – overview of worst recessions in history

However, several factors, such as high unemployment rates, low retail sales, and slowing manufacturing activity all contribute to identifying a recession. Recessions are a normal part of the economic cycle, although others, like the one precipitated by the financial crisis of 2008, are more severe and have lasting effects.

The government’s economic policies can largely contribute to the creation of recessions. The Federal Reserve’s monetary policies as well as government regulation and deregulation can strongly influence the economic cycles. For instance, aggressively rising interest rates by the Fed always tighten the economy, which results in falling stock prices.

Key elements that contribute to economic downturns

Recessions can be sparked by only strong events that impact whole economies. For instance, when countries went under lockdown because of the COVID-19 outbreak, economic activity slowed, and it had severe impacts on the whole world.

Recessions can also be caused by financial imbalances, such as excessive amounts of debt or asset bubbles like in 2021. When these bubbles pop, it’s bad news for everyone involved, and the economy as a whole suffers as a result.

Because of their impact on consumer spending and income, both out-of-control inflation and severe deflation can contribute to a recession. Inflation is fought by the Federal Reserve by increasing interest rates, which can have a chilling effect on the economy.

How do experts predict recessions?

Multiple indicators of economic activity need to be decreasing or weak for one to declare the economy to be in recession. Signs that the economy is tanking include rising unemployment, dropping retail sales, negative GDP growth, and a decline in manufacturing. A decline in GDP is the most popular indicator that we are in a recession, but it is not the only one.

Read more: How to hedge against inflation? Must-know tips to protect your capital

For instance, in 2022, GDP fell for two consecutive quarters, but many analysts claimed that this didn’t constitute a recession because of the robust state of the job market. What’s more important, experts try to forecast recessions all the time and they are wrong in most cases. That is why it is better to invest long-term with a diversified portfolio instead of trying to predict recessions.

Do this to protect yourself from a recession

Having cash is necessary so that you aren’t compelled to sell your assets during a downturn, which is why it’s also important to diversify your investments. Attempting to time the market is a losing game for most investors, despite the fact that it may feel enticing to get out of the market when the economy is failing.

A diversified, long-term investment portfolio is the most resilient during market downturns. If you stick to a reasonable budget and avoid making hefty purchases that you won’t be able to afford, you’ll be in good shape to weather economic storms.

Designing an investment strategy that targets long-term growth while limiting exposure to risk is crucial for creating lasting wealth. Just look at Warren Buffett. He has been investing successfully for more than 6 decades. He has achieved marvelous results thanks to patience and long-term strategy.

How to know the end of the recession?

Recessions range in duration from a few quarters to several years, depending on the causes. Recessions, on average, last far less time than their counterparts, expansions. Since World War II, recessions have typically lasted for a total of 11 months on average.

Also read: Survey finds half of Millennials in developed countries own crypto

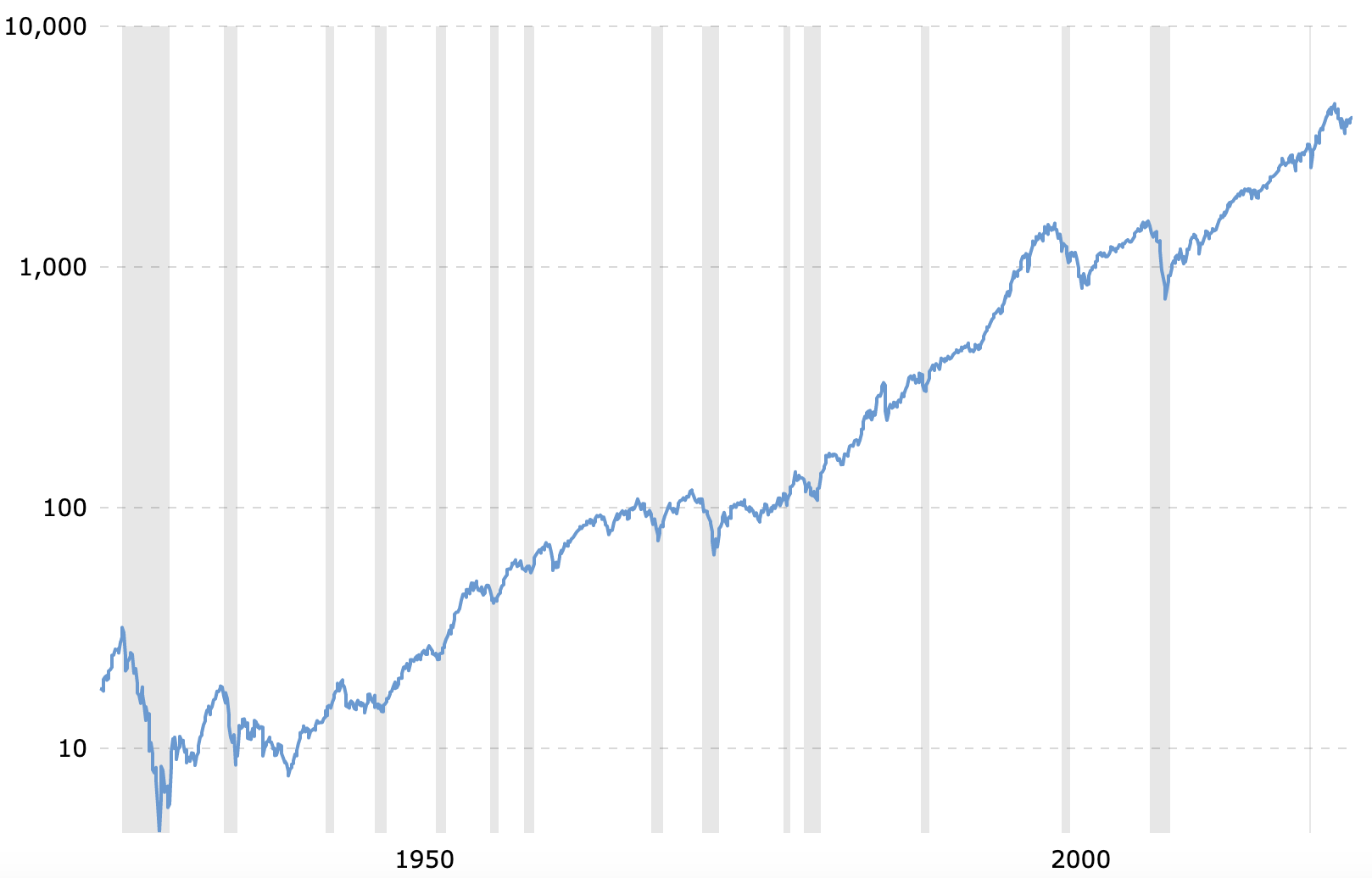

When you look at recessions from the perspective of stock indices, they usually fall for a few months. However, they always recover and continue on an upward trajectory. The rate at which an economy recovers from a recession can be affected by monetary policy, fiscal policy, government investment, and technological innovation.

S&P 500 long-term chart (not adjusted for inflation), source: macrotrends.net

For instance, in order to curb inflation, the Fed has been gradually increasing interest rates over the course of the previous few months. Combining efforts from the public and private sectors is a common strategy for ending recessions. For instance, the US government sent stimulus checks to citizens during the outbreak of the COVID-19 pandemic to cushion the blow of the recession on individuals and families and kickstart the economy.

Comments

Post has no comment yet.