If you’re looking to create your wealth, there are several ways to do it. First and foremost, you need to make more money. But how? Consultants and financial planners often recommend making more money by spending less and investing wisely.

While smart investing is an important part of the equation, it’s not the only thing you should focus on if you want to become a millionaire or even just accumulate enough money for retirement one day. Take a look at this guide on how to make more money and accumulate wealth.

1. Grow your income

It doesn’t matter how. There’s always a way to do this. You can make more money by getting a raise, getting promoted, landing a new job, or starting your own business. But you don’t have to wait for those things to happen – you can start earning more right now if you put yourself on a mission. A mission to financial freedom.

Related article: What is dollar-cost averaging (DCA)?

If you’re not going to get a raise anytime soon and are not in a position to switch jobs, consider taking on side gigs like freelance writing, selling some of your stuff online, being a bartender on weekends, or helping someone with anything you’re skilled in. You might be amazed at how much money this can bring in over time!

If you are looking for a job, it’s important to keep in mind that the current economic climate is tough. Many people have been laid off and many businesses have had to cut back on hiring. If you’re not sure what your next step should be, consider taking some time off and plan what’s in your power to change that will help you to accomplish your goals.

2. Spend less

The easiest way to have more money is to spend less. The fact is that most people don’t have an income problem but a spending problem. Spending less may be a difficult task, as most Americans are in debt, and out of their comfort zone when it comes to their monthly budget. However, you need to change your mindset and start thinking about your purchases as investments rather than just expenses.

For example, buying an item that costs $500 may sound like a lot of money but if it saves you time or improves your quality of life in some way and lasts for several years then it will be well worth “the investment.” But that doesn’t necessarily mean you should be on a shopping spree any time you can.

Also, don’t underestimate the power of saving up for those larger purchases instead of financing them with credit cards or loans! You won’t spend less if you take up unnecessary loans. Simply put, if you really want to get wealthy, you must fix this first: make more money than you spend. Then just gradually increase your income and lower your expenses on the way.

3. Invest your capital

Investing is a long-term game. It’s not a get-rich-quick scheme, and it’s not gambling. You can’t expect to make millions overnight by investing, but you can make the majority of your money through careful investing over time. Just look at what Warren Buffett does. Most people don’t follow in his footsteps because getting rich slowly is not what they want.

Investing is putting money into something that will make more money for you in the future, like real estate or stocks, and letting this investment grow over time. It’s not about getting rich fast but building up your net worth from the ground up by making smart decisions with your money over many years.

Also read: Retail investors expect the bottom in 2023 – warning sign?

There are several types of investments that work well for most people. This may be directly investing in stocks, bonds, or mutual funds and exchange-traded funds (ETF). Stocks are shares of ownership in an individual company; when you buy stock in Apple, for example, you’re actually buying shares from Apple itself. Bonds are another type of security issued by companies or governments; they promise to pay back investors their original investment plus interest within set deadlines.

Simple, right? Now all you have to do is find out which stocks to buy. Our experts will be happy to help you with that 🫶💪

➡ https://t.co/GO8D6x9dsH ⬅#stocks #shares #stocktrader #crypto #cryptocurrency #forex #commodity #analysis #trading #trader #market #investro pic.twitter.com/nAz8HrjuAp

— Investro.com (@investrocom) December 6, 2022

If you’re not sure where to start, talk to your financial advisor who can help you map out your investment strategy and find the right investments for your needs, or just Google around. Do your own research (DYOR) and create your investment portfolio. However, you can also start with ETFs or mutual funds, which are collections of tens or even hundreds of stocks and other investments held by an investment fund.

When you buy a mutual fund, you’re investing in the whole pool of assets rather than just one company. This is why a lot of people have investment plans of, for instance, S&P 500 ETF for $100 per month. This way, people are able to accumulate $50,000 or $100,000 within 20 or 30 years. But this is just $100. If you really want to generate wealth, you need to take this to a whole new level.

4. Grow your portfolio

It’s a great step if you are on your way to investing. If you have started, now you need to grow your portfolio regularly. In order to get wealthy, you need to invest as much as possible, whether it be in a business or financial markets. You can invest in your own business. There’s a common misconception that only wealthy people can start their own businesses, but if you have an idea and the drive to make it happen, there’s no reason not to give it a shot.

If you don’t have the money to invest at first, look into crowdfunding platforms like Kickstarter or Indiegogo – these sites allow anyone with an idea and some initial capital investment to raise funds for their project. You can also do simple business like opening a café or a shop, but keep in mind you need to make it profitable. Several income streams and investments in financial markets will open new doors for you.

You’ll want your investments to be held outside of retirement accounts so that you’re able to withdraw them before retirement age and invest freely. If you grow your income, you can always grow your portfolio. By investing $750 instead of $100 a month in stocks, you’ll accumulate much bigger wealth.

Read more: The underrated power of long-term investing

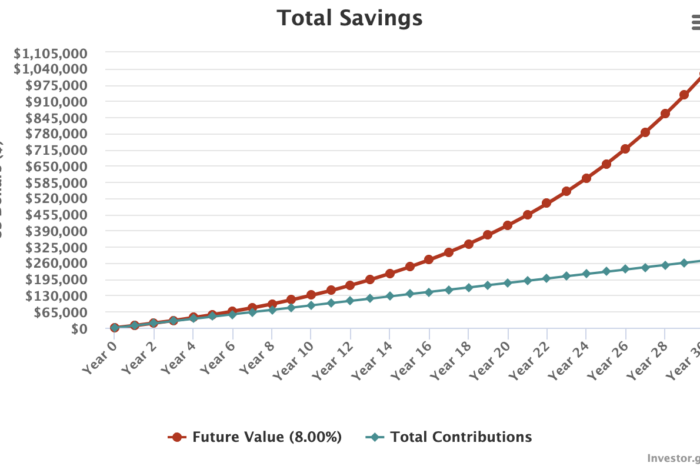

Let’s have a look at how this may look in the future. Let’s say you want to make $1 million before retiring. In order to do that, you should invest $750 monthly for 30 years with an expected average annual interest of 8%. But stocks can do even more than that. And don’t forget about compound interest, which can do wonders if you really invest long-term.

5. Accumulate wealth

The final step is to accumulate wealth. As you accumulate wealth, be sure to invest in yourself. I’m not just talking about buying books and courses that are relevant to your goals. There’s also a huge benefit in investing time in self-education, learning new skills, outsourcing your work, generating new streams of income, etc. But it will probably take years until you get here. Just start with the first step.

Start with growing your income in the aforementioned ways, then follow this guide step by step. It’s hard to define wealth as it differs from country to country, but let’s say you need to accumulate one hundred worth of average incomes in your nation. After you have several incomes and money invested in markets, they could generate wealth for the rest of your life.

Conclusion

In today’s economy, it is more important than ever to make sure you are making as much money as possible and spending less. However, it doesn’t necessarily mean you need millions or billions. Start small, be patient, disciplined, and follow this guide if you want to reach financial freedom one day.

Comments

Post has no comment yet.