What is next for Fed?

The Fed is set to raise its baseline lending rate to a point not seen in almost sixteen years at the meeting that begins on Tuesday. On Wednesday, policymakers are likely to announce a 0.25% (25 basis point) hike in the benchmark rate of interest, marking a possible plateau that would put the economy to the test.

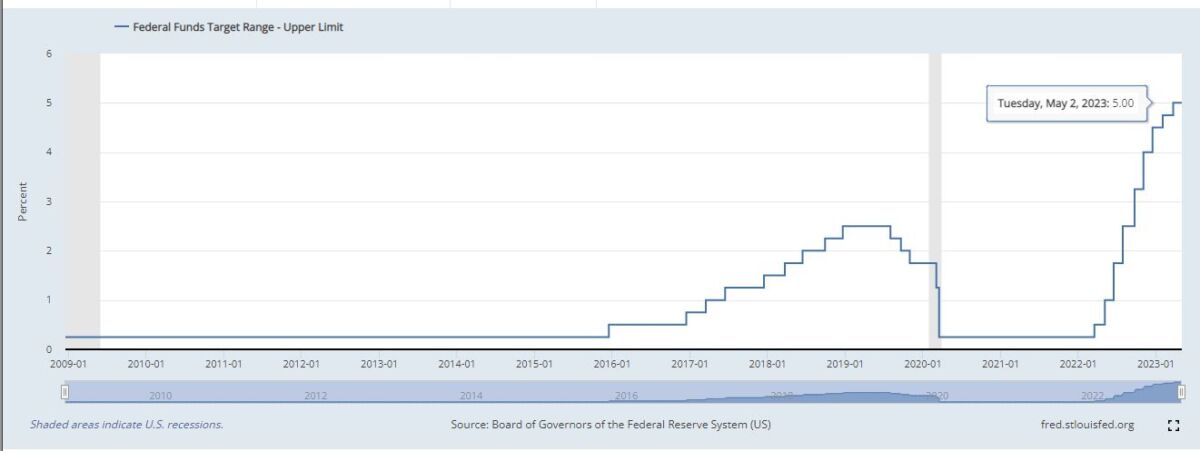

With this expected rate hike on Wednesday, the Fed will have raised the range of its goal for the fed funds rate. This would mean 5%-5.25% since March 2022, the highest it has been since September 2007. This is the Fed’s greatest rate hiking initiative since the 1980s.

This will be the second consecutive meeting called by the Fed after a major US bank sector failure. JPMorgan’s move on First Republic Bank on Monday is a proof that the central bank’s historically rapid increase is having an impact on, among others, the monetary system.

More to read: Recent surge of PEPE brought memecoins back – who are the new players?

Most Fed officials predicted in March, that interest rates would increase beyond 5% this year and stay there for the foreseeable future. According to the CME Group, traders are pricing in a 95% likelihood of a rate hike by the Federal Reserve on Wednesday.

After aggressively tightening lending conditions to manage the worst rise in inflation in 40 years, central banks around the world are now all inching towards a likely halting point for rate rises. The ECB on Thursday, and the BoE the following week are also likely to raise interest rates after the Fed’s meeting,

What is happening with the economy from the Fed’s standpoint?

It’s far from resolved. The economy is displaying both indicators of continued expansion and slowing. The Fed’s primary price index has been progressively declining, although it remains much higher than the 2% objective set by the Fed.

The official’s handling loans will present a poll at this week’s conference. It is expected to hint condition tightening. This is despite a stabilization in bank lending following a roughly 1.7% decline following the bankruptcies of SVB and other regional lenders.

You may also like: How did Russia-Ukraine war affect corn stocks?

Excluding more volatile expenses of food and energy, the most current inflation figures from the personal consumption expenditures index indicated that prices grew 4.6% over the previous year in March. Workers’ compensation and benefits increased by 1.2% in Q1 of this year, or 4.8% on an annualized basis, which is higher than the 1.1% increase seen in the previous quarter.

Will we see a recession?

In a tightening drive that has seen the federal funds rate rise by a total of 5%, the expected move on Wednesday would be the 10th consecutive rate hike since March 2022. This is an average of 0.5% at each meeting.

In contrast, the Fed began tightening policy in June 2004, on the cusp of what turned out to be a destabilizing real estate bubble, and increased interest rates in “measured” quarter-point increments from 1% to about 5.25% over the course of two years.

You can listen to: Podcasts – Investro.com

Most Fed officials in December and March stated they believed that level to be appropriate. These officials think the rate would be high enough to continue reducing inflation, and, they hope, not inflicting more economic slowdown and further job loss.

Fed terminal rate chart, source: FRED

After the last increase in the federal funds rate to above 5%, the Fed waited a little over a year before beginning the dramatic rate reduction that brought that rate to the near-zero level by late 2008. This was after the mortgage crisis.

We can see the recession periods marked by the shaded areas on the above chart, which both came after the rates had been significantly hiked. Fed officials have been unwavering in their insistence that high interest rates would remain in place until they are confident that inflation has been broken.

Comments

Post has no comment yet.