Recessions are a natural part of the economic cycle. They are periods of economic decline characterized by a significant decrease in economic activity, such as a drop in GDP, rising unemployment, and falling stock prices. Throughout history, the world has experienced several large recessions, with lasting impacts on individuals as well as societies.

While 2022 was really difficult for investors, it is far from what investors had to go through in the toughest recessions. In this article, we will take a look at the biggest recessions, including the Great Depression in 1929, the Dotcom bubble in 2000, and the Global Financial Crisis in 2008.

The Great Depression

The Great Depression is arguably the most infamous recession in history. It began in the United States in 1929 but quickly spread throughout the world, lasting for a decade in some places. The recession was triggered by the stock market crash of October 1929, also known as Black Tuesday. The crash caused many investors to lose their savings, leading to a decline in consumer spending and investments.

Several factors contributed to the Great Depression, including a decrease in international trade, a decline in agricultural prices, or the failure of several banks. President Herbert Hoover tried to address the crisis by raising tariffs and cutting government spending, but his policies only worsened the situation.

Also read: The 8th Wonder of the World – what is compounding effect?

The stock market has been soaring for years, with insider trading being done on a daily basis. To protect investors and make markets more transparent, the US Securities and Exchange Commission (SEC) has been formed in 1934 after the recession ended. The stock market basically used to be a wild west like cryptocurrencies still are nowadays.

During the Great Depression, unemployment rates in the United States skyrocketed, peaking at nearly 25% in 1933. This was the highest jobless rate ever recorded in the history of the United States. Many people lost their homes, while poverty and homelessness were widespread.

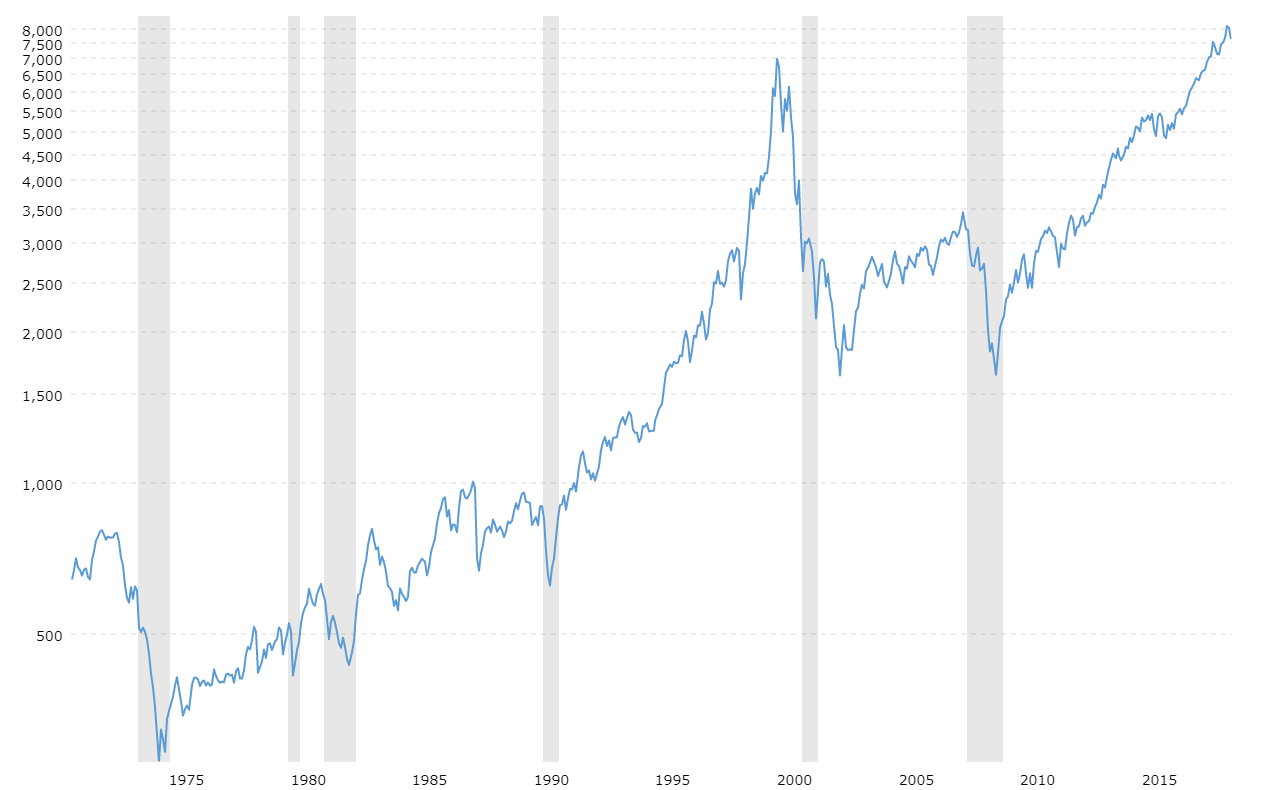

The recession had a lasting impact on the US economy. It took until the early 1940s for the country to fully recover from the damage. The Great Depression caused Dow Jones Index to experience the largest drop in history, falling by over 80% in three years. Never in the history did this index tumbled as hard as during this recession.

Dow Jones chart, source: macrotrends.net

Not everyone is aware that the Great Depression also had a profound impact on global politics. It contributed to the rise of totalitarian regimes in Europe or the outbreak of World War II. The Great Depression also led to the creation of the New Deal, a set of policies aimed at providing relief, recovery, and reform to the American people.

Dotcom bubble

The Dotcom bubble caused a recession that occurred in the late 1990s and early 2000s, during an entry into a new millennium. It was fuelled by the rapid growth of internet-based companies, which led to a surge in stock prices. Many investors believed that these companies would change the world, and as a result, they poured their money into them.

This led to a stock market bubble, with prices far exceeding the actual value of the companies. In 2000, the bubble burst, and the stock prices of many internet-based companies plummeted more than investors could have ever imagined. As a result, business investments and consumer spending declined rapidly, with people losing faith in the future of these companies.

Understanding the market #cycles: the key to successful #investing 🎓📈

➡ Unlock #investment success by discovering key #indicators and strategies for navigating #market cycles in this informative article.#stocks #crypto #investor #trader #investrohttps://t.co/UqyVHWKmb9

— Investro.com (@investrocom) February 16, 2023

The recession had a severe impact on the tech industry, with many startups going bankrupt and larger companies struggling to stay afloat. The Dotcom bubble was caused by a combination of factors, including unrealistic expectations, a lack of business fundamentals, and a failure to understand the risks associated with investing in new technologies.

Not everyone is aware that the bubble also had a profound impact on the broader economy. It contributed to the 2001 recession in the United States, and it led to a significant decline in global economic growth. The American technology stock index Nasdaq suffered heavy losses, falling by more than 70%.

Nasdaq chart, source: macrotrends.net

However, most stocks fell even much more than that as Nasdaq is the average of thousands of stocks. For example, Amazon dropped by as much as 90% in this recession, but many companies went bankrupt as well.

Global Financial Crisis

The Global Financial Crisis of 2008 was one of the most severe economic downturns in modern history. It was triggered by the collapse of the housing market in the United States, which led to a decline in the value of mortgage-backed securities. These securities had been sold to banks and investors around the world, and when they lost value, it had a ripple effect throughout the global financial system.

The crisis had several causes, including the deregulation of the financial industry, a lack of oversight, and a failure to understand the risks associated with complex financial products. The crisis led to the failure of several large banks and financial institutions, including Lehman Brothers, which took the global economy south.

This financial crisis caused a huge decline in economic activity, with many countries experiencing a recession. Unemployment rates rose, many people lost their homes and savings. The Global Financial Crisis is unique in that it was caused by systemic failures within the financial industry.

Read more: Make more, spend less – 5 steps to wealth generation

Not everyone is aware that the crisis also led to a major increase in government regulation of the financial industry. Governments around the world implemented new laws and regulations to prevent another crisis from happening, including the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States.

Another interesting fact is that the crisis also had a strong impact on the perception of capitalism. Many people began to question the fairness and sustainability of the capitalist system when all went crashing down. For instance, the S&P 500 stock index tumbled approximately 50%, but quickly recovered in early 2009, surprising many investors who thought the “capitalism is dead.”

S&P 500 chart, source: macrotrends.net

Final thoughts and lessons

Recessions are a natural part of the economic cycle, but some have had a more significant impact than others. The Great Depression, Dotcom bubble, along with Global Financial Crisis are three of the most extensive recessions in the last 100 years, each with its own unique causes and consequences.

The Great Depression was caused by a stock market crash, having a lasting impact on the US economy and global politics. The Dotcom bubble was caused by unrealistic expectations, significantly impacting the tech industry along with the global economic growth. The Global Financial Crisis was caused by systemic failures within the financial industry. Moreover, it had a strong impact on the global economy and the perception of capitalism.

While these recessions are eye-catching, they also highlight the resilience of the global economy. Despite these setbacks, the world has continued to innovate, grow, with new technologies and economic models emerging in response to the challenges posed by these recessions.

As we move forward, it is important to learn from the past, take steps to gain on the future economic crises, not lose in them. Diversifying portfolio, dollar-cost averaging, or not using leverage may all help investors to sustain even the largest market drops and still profit in the end.

Comments

Post has no comment yet.