The sentiment turned sour with investor worries

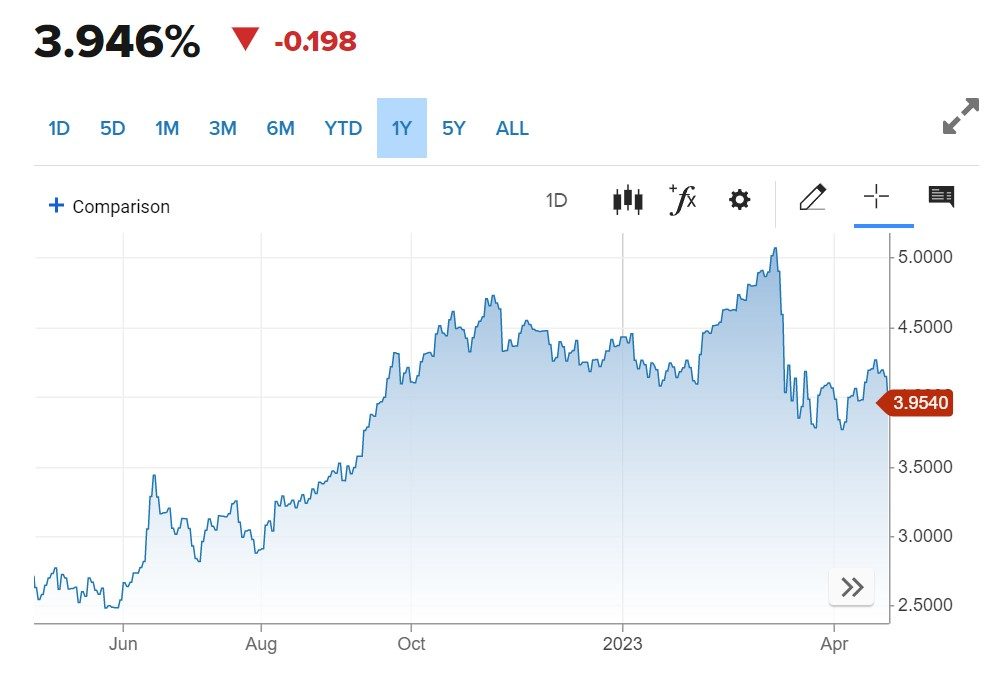

Investors fled risky assets for safer havens on Tuesday, pushing US equities dramatically down. Benchmark Treasury rates slid lower as worries of a recession were fueled by poor profits and sluggish economic data. The US 2-year yield fell to 3.946%

US 2-year yield chart, source: CNBC

Rate hikes are anticipated at the next meetings of the Fed, the BoE, and the European Central Bank. The Fed will have a meeting on May 2 and 3.

When First Republic Bank reported poor first-quarter earnings and a fall in deposits of $104 billion a year before, investors panicked again. This was substantially more than the $40 billion drop that had been anticipated. The stock fell more than 49%. UBS stock also fell as some uncertainties are going on with Credit Suisse’s buyout, as well as poor earnings.

More to read: Lawsuit time: Coinbase sues SEC, seeks “regulatory clarity”

The Nasdaq, which is heavily weighted by technology and technology-related momentum stocks, was the worst performer of the three main indices. Data showing a sharper-than-anticipated drop in consumer confidence compounded those losses. The Dow Jones dropped 1%, the S&P 500 dropped 1.4%, and the Nasdaq dropped 1.7%.

US dollar boosted by safe haven strength

On Tuesday, as risk aversion spread across the market in response to concerns about profits and the future of the world’s economy, the dollar strengthened. This risk aversion sent the euro down from a near 10-month high.

After falling more than 3.3% since the start of March, the US dollar index rose 0.6% to 101.81. After gaining 1.7% in April and more than 4% in March, the euro fell 0.6% versus the dollar today to $1.0979.

You may also like: Coca-Cola enjoys increased trading on earnings day

Sterling was trading 0.6% down at $1.24 but was still very near to a 10-month top of $1.2545 that was hit earlier this month. As investors awaited Wednesday’s inflation report, the Australian dollar fell 0.9% to US$0.6636, while the kiwi fell 0.4% to $0.6144 against the greenback.

Oil turned back to the red zone with risk-averse sentiment

Oil prices in the United States fell on Tuesday as investors fretted over a weakening economy. Traders think that a weaker economy may dampen demand.

Also, the US dollar strengthened one day before the release of new crude inventory data. Brent crude oil dropped $1.96, or 2.4%, to $80.77. WTI crude oil decreased by $1.69, or 2.2%, to $77.07. Both contracts turned red after gaining more than 1% on Monday.

You can listen to: #4: How to trade earnings season with Andrew Aziz

It didn’t take long before gold basked in its shine again. The yellow metal grew on safe haven status and broke above $2,000 again. Gold futures for June ended 0.35% in the green at $2,006.85.

Silver wasn’t as lucky, as traders moved into less volatile assets. The white metal fell more than 1%, however, kept its value above $25 at $25.238

Comments

Post has no comment yet.