No change in the stock market

On Monday, stocks wavered between rising and falling as investors sought fresh triggers for direction ahead of the week’s final big tech reports. Although, the markets ended basically flat. There was no change in the S&P 500, a gain of 0.1% in the Dow Jones, and a drop of 0.3% in the Nasdaq.

Big IT companies like Microsoft, and Alphabet which drove the market surge that occurred in the first quarter of the year, will begin reporting their earnings shortly. On Wednesday, we’ll hear from Meta, and on Thursday, we’ll hear from Amazon.

Tech enthusiasts on Wall Street are still making optimistic claims before the onslaught of quarterly results. Despite this, market sentiment on tech has been muddled in recent weeks as the possibility of a less aggressive than expected Fed diminishes ahead of the central bank’s rate decision on May 3rd.

You can listen to: #4: How to trade earnings season with Andrew Aziz

Also, despite posting quarterly earnings that exceeded expectations as higher pricing offset increased expenses, the shares of Coca-Cola fell. Bed Bath & Beyond declared bankruptcy on Sunday, sending its stock price 33% down after the company was unable to raise sufficient capital to continue operations.

Traders are already factoring in a rate cut on the US dollar

Investors continued to price in a rate cut this year by the Fed after a generally anticipated rate hike at next week’s policy meeting. The dollar sank to a more than one-week low versus key currencies on Monday in weak trading.

On the other end of the world, the Japanese yen suffered as new Bank of Japan chairman Kazuo Ueda made comments on the necessity of maintaining monetary easing before a highly anticipated BoJ conference on Friday.

The dollar index hit a 10-day low early in the day and then dropped 0.3% to 101.34 in afternoon trade. The euro gained 0.5% against the dollar to $1.1045, having previously reached a 10-day peak of $1.1050.

More to read: Bitcoin down 13% – is uptrend over or is it just a correction?

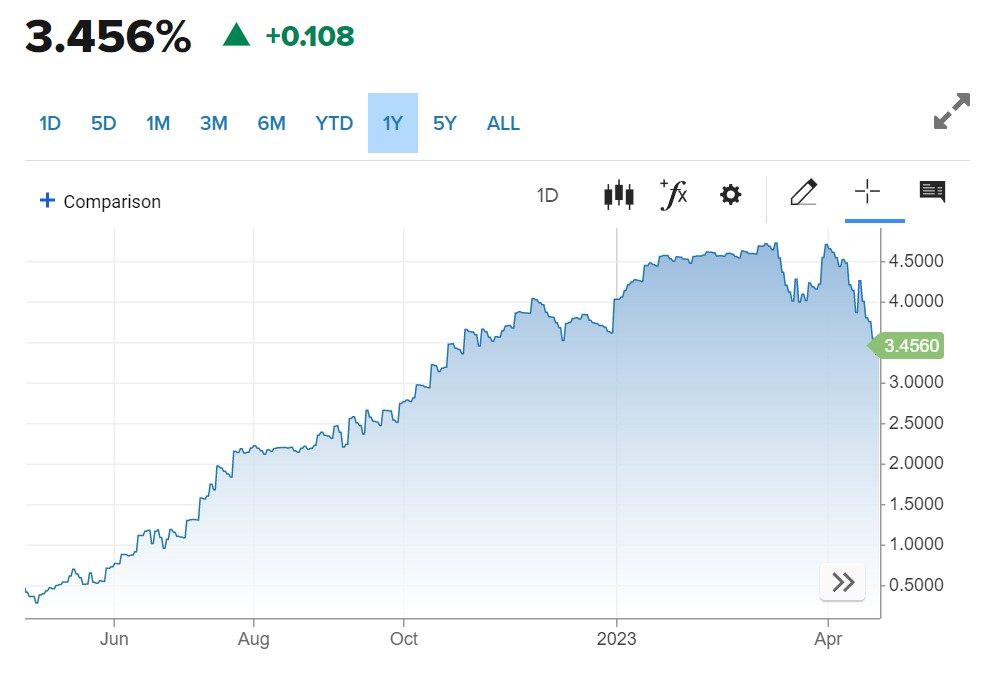

With investors seemingly growing more nervous about the possibility of a showdown over the US debt ceiling, one-month Treasury rates bounced from October lows on Monday. Starting the month around 4.7%, the yield on the one-month Treasury note rose 10 bps to 3.456%.

US 1-month yield chart, source: CNBC

Are the commodities bulls back?

For two consecutive days since Friday last week, crude prices advanced on Monday as bulls took advantage of the US dollar’s decline. Investors’ confidence is also elevated, as travel and gasoline demand due to China’s May Day holiday is rising.

WTI crude increased 89 cents, or 1.1%, to close at $78.76 a barrel. The price of Brent crude rose $1.07, or 1.3%, to $82.73 at the close of Monday’s trading. Both benchmarks closed more than a 0.5% green Friday, despite a red week

Also interesting: How to read live forex trading charts

Gold bulls are barely scratching the surface of $2,000 after Friday’s decline. The yellow metal ended at $1,999.15, with a 0.43$ gain. Silver pumped 0.64% as well, with prices just below the higher half of the $25 mark at $25.442

Comments

Post has no comment yet.