The GBP/USD pair traded with low volatility today, sliding toward 1.24 as investors await this week’s US data for a new short-term trend.

In April, there was evidence of a slowing rise in home prices.

According to Rightmove’s newest index, property prices in the United Kingdom showed symptoms of cooling off in April.

Average asking prices rose by 0.2% month-over-month to £366,247, according to the index, which is much less than the 1.2% annual gain and the 0.8% monthly increase observed in March.

You may also like: Coca-Cola enjoys increased trading on earnings day

Rightmove speculated that economic challenges and a return to the housing market’s pre-pandemic pace might be to blame for the slowdown. However, the average asking price for first-time buyers rose by 0.2% in April and by 2% year-over-year, reaching a new all-time high of £224,963.

Rightmove’s director of property science, Tim Bannister, noted that “many sellers have transitioned out of the frenzied multi-bid market mindset of recent years” and recognize the need to offer a competitive price to attract buyers in the spring.

Potential sellers who have been thinking about moving in the previous several years but were discouraged by the market’s fierce speed may be tempted by the present unexpectedly steady conditions. In the past several years, buyers may have had trouble finding a property that met their criteria due to a lack of inventory, but they now have more options.

Another exciting topic: BBBY goes into bankruptcy, shares plunge 20%

In other news, Bloomberg reported on Tuesday, citing individuals with knowledge of the situation, that British Prime Minister Rishi Sunak is hoping to negotiate an agreement to make it simpler for British citizens to travel to the European Union (EU).

One more rate hike in the US

Despite rising speculation that the Federal Reserve of the United States would begin decreasing interest rates later this year, rates are projected to rise by another 25 basis points at the Fed’s policy-setting meeting next week.

This week, though, we will get more information about US Durable Goods Orders and GDP figures. Forecasts for March durable goods orders are 0.8% higher than a 1.0% drop previously. Furthermore, investors anticipate a slowdown in Annualized (Q1) GDP to 2.0% later this week, down from the previous announcement of 2.6%. If GDP growth were to drop, it would add to concerns about a potential economic downturn in the United States.

Dont miss: Bitcoin down 13% – is uptrend over or is it just a correction?

Because of this, the Federal Reserve may be compelled to maintain a consistent posture on future interest rate recommendations. On the other hand, it would take a significant upward surprise from the PCE price index on Friday, the Fed’s preferred inflation indicator, to shift the dovish narrative.

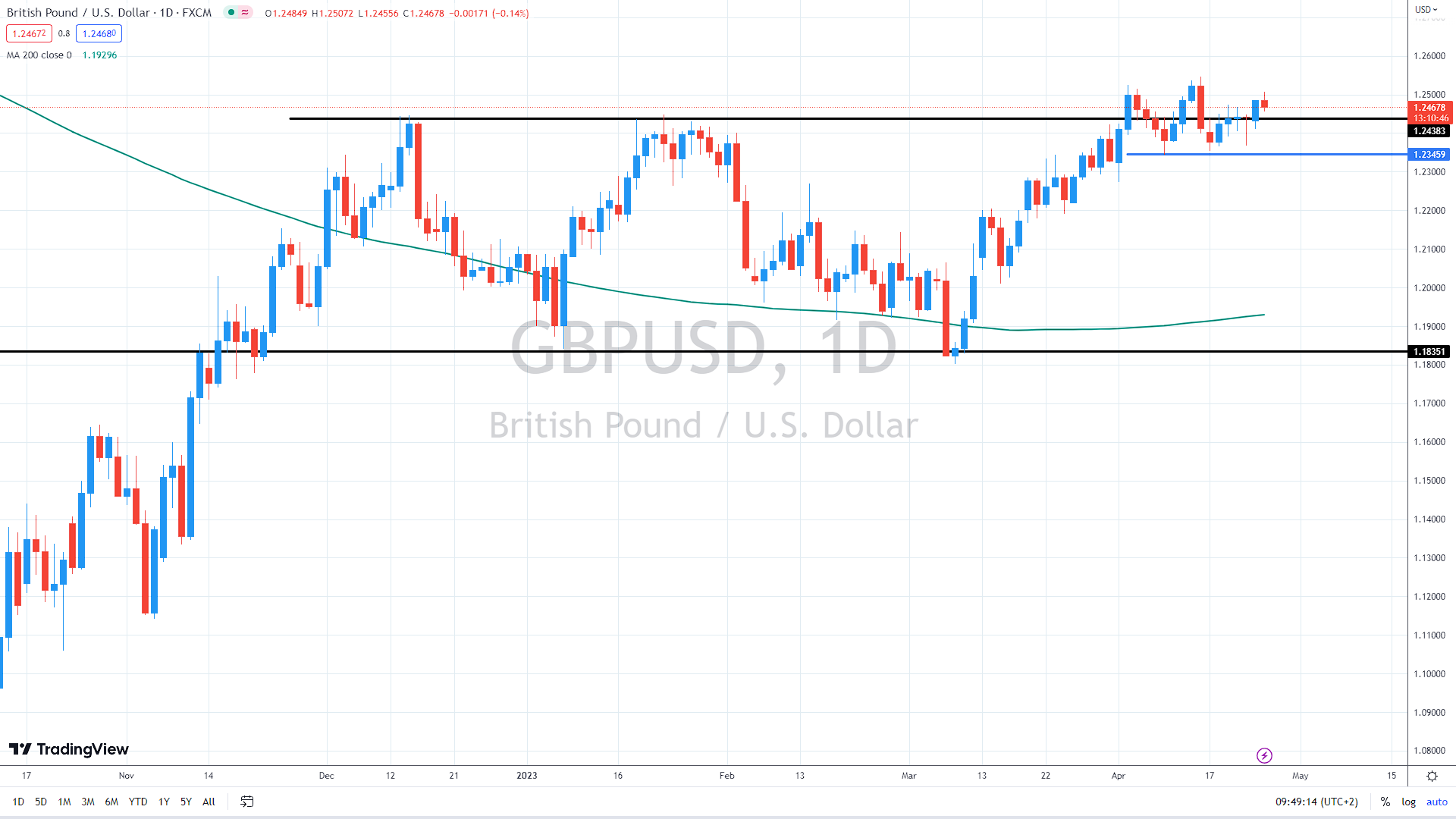

There has been no change in the direction of the GBP/USD exchange rate, as the pair has moved nowhere over the previous days. The resistance remains at around 1.25, while the support is at 1.2350.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.