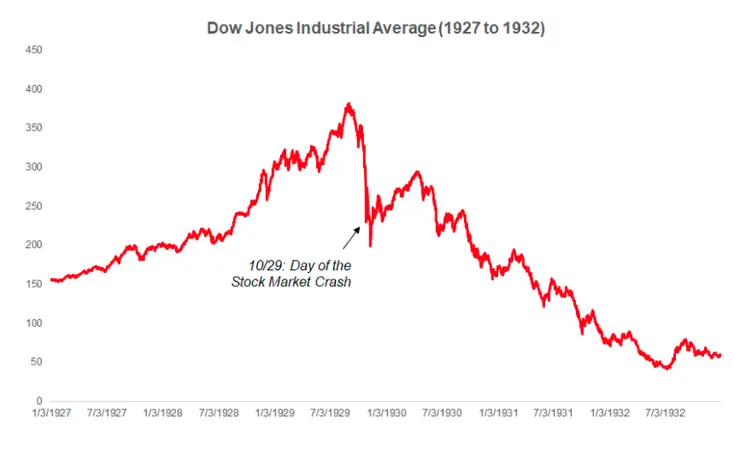

The stock market crash of 1929, also known as Black Tuesday, was a catastrophic event that marked the beginning of the Great Depression. It was one of the most devastating economic collapses in the history of the United States, with lasting impacts felt for years to come. The crash was triggered by a complex web of economic and social factors that came to a head in the fall of 1929. This article will try to examine the main causes of the stock market crash of 1929, exploring the underlying economic conditions that set the stage for disaster.

Source: Investopedia.com

Excessive risk-taking

One of the key factors contributing to the stock market crash of 1929 was the over-speculation in stocks, particularly by inexperienced investors. In the years leading up to the crash, stock prices had risen dramatically, fueled partly by a wave of optimism that swept the country following World War I.

Another exciting topic: How to control emotions in trading and protect your capital

Many Americans, including those who had never invested in the stock market before, poured their savings into the market, hoping to make a quick profit. This trend was amplified by using margin trading, which allowed investors to purchase stocks on credit. As stock prices continued to climb, more and more investors entered the market, driving prices even higher.

However, this trend was unsustainable, and eventually, the market reached a heavily overbought territory. When prices began to fall, many investors were caught holding stocks worth far less than they had paid for them, leading to widespread panic and selling.

Uneven wealth distribution

Another major factor in the stock market crash of 1929 was the uneven distribution of wealth in American society. While the wealthy elite enjoyed significant financial gains during the 1920s, many Americans struggled to make ends meet. The agricultural sector, in particular, was in a crisis, with falling crop prices and mounting debt. In addition, the working class had seen little in the way of wage increases, despite the economy’s growth as a whole.

You may also like: The largest financial scams in history explained – what did we learn?

This unequal distribution of wealth had a ripple effect on the stock market, as many ordinary Americans could not afford to invest in the market. This left the market vulnerable to the whims of a small group of wealthy investors who had the power to manipulate prices and create a false sense of stability.

Missing regulation

Another critical factor in the stock market crash of 1929 was the failure of regulatory bodies to monitor and regulate the market effectively. While there were some attempts to control the market, such as the creation of the Securities and Exchange Commission in 1934, these efforts came too late to prevent the crash.

In the years leading up to the crash, there were few restrictions on stock market practices, such as margin trading and insider trading, which allowed investors to manipulate prices and create a false sense of stability. The lack of effective regulation left the market vulnerable to manipulation and abuse, further exacerbating the economic instability that led to the crash.

Source: Businessinsider.com

The stock market crash of 1929 had far-reaching impacts on the American economy, leading to a prolonged period of economic depression and social upheaval. As a result, millions of Americans lost their life savings, and many businesses were forced to shut.

The crash also had a ripple effect on the global economy, contributing to the economic instability that led to World War II. As a result, in the aftermath of the crash, there were calls for greater regulation and oversight of the stock market and measures to address the underlying social and economic conditions that had contributed to the crisis.

Thus, the stock market crash of 1929 was the result of a complex web of economic and social factors, including over-speculation, the uneven distribution of wealth, and the failure of regulatory bodies to monitor the market effectively. While the crash devastated the American economy and society, it also led to significant reforms and changes that helped prevent similar future crises. Today, the lessons learned from the stock market crash of 1929 continue to inform discussions about economic policy and regulation and serve as a reminder of the dangers of unchecked speculation and inequality.

In the wake of the stock market crash of 1929, the US government implemented measures to prevent future economic crises. These measures included the establishment of the Securities and Exchange Commission, which was tasked with regulating the securities industry and controlling insider trading, and the creation of the Federal Deposit Insurance Corporation, which provided insurance for bank deposits to prevent bank runs. Additionally, the government implemented a range of policies aimed at promoting economic growth and reducing inequality, such as the New Deal programs of President Franklin D. Roosevelt.

Source: Thebalancemoney.com

Have we learned anything?

Today, the lessons learned from the stock market crash of 1929 continue to inform economic policy and regulation, particularly in the wake of the 2008 financial crisis. Many experts argue that the financial industry’s lack of effective regulation and oversight contributed to the 2008 crisis and have called for more robust regulatory measures to prevent future problems. In addition, discussions about income inequality and the need for social safety net programs continue to be informed by the lessons of the Great Depression and the stock market crash of 1929.

In conclusion, the stock market crash of 1929 was a complex event with far-reaching economic and social impacts. While a range of factors caused the crash, it ultimately led to necessary reforms and changes that helped to prevent future financial crises. Hopefully.

Comments

Post has no comment yet.