The PC giant lost value on Tuesday as investors sold the stock following news the company will integrate more artificial intelligence into its operations.

More AI, fewer people

Bloomberg reported that IBM CEO Arvind Krishna said the firm would stop filling positions it believes can be automated soon. According to an interview with Krishna, this means hiring for administrative support roles like human resources would be put on hold or stalled. Krishna estimated that there were about 26,000 people working in these “back office” positions.

Over the next five years, AI and automation could easily replace 30% of that. About 7,800 jobs would be lost as a result. A representative for IBM stated that part of any decrease would be not filling positions lost due to attrition.

Also read: Chinese manufacturing data slashed crude – will oil also react to Fed?

It’s safe to assume that most corporations will follow IBM’s lead and lay off tens of millions, if not hundreds of millions, of people in the future years as a result of the fast advancement of technology, and Krishna’s plan is only one of the significant labor initiatives unveiled in reaction to this.

Krishna predicts that routine administrative processes, such as transferring workers across departments or sending employment verification letters, will eventually be computerized. So it’s just a matter of time until AI takes over all of HR, although some tasks, including assessing the composition and output of the workforce, are unlikely to be replaced in the next decade.

About 260,000 people are employed by IBM, and the company is always looking for people to fill software development and customer service positions. However, the race for talent has decreased since last year, according to Krishna. As a result, the corporation has announced layoffs this year that could affect as many as 5,000 people. Despite this, Krishna said that IBM had expanded its staff overall, hiring an estimated 7,000 individuals in Q1.

Cutting costs, but buybacks remain

Expense control, including the previously reported job reduction, helped IBM of Armonk, New York, surpass earnings projections in the most recent quarter. In addition, IBM’s stock price has been artificially inflated in the past by billions of dollars in stock buybacks (at far higher prices).

However, the buyback game ended when its debt load became too large, Warren Buffett sold his shares, and the stock price stagnated for over five years. The only way forward for the firm at this point is to dramatically reduce overhead costs because revenue is, at best, flat.

Another great topic: AUD/USD stages a massive rally after a surprising RBA rate hike

CFO James Kavanaugh indicated on results day that additional “productivity and efficiency” procedures, aka replacing humans with algorithms, will result in annual savings of $2 billion by the end of 2024.

The upcoming economic downturn will aid the company’s planned transition to an AI-staffed organization. Then, Krishna predicted that a recession in the United States would be avoided until late 2022. Now, he anticipates a recession that will be “shallow and short” by the year’s end, though it is unclear how one can predict such a thing.

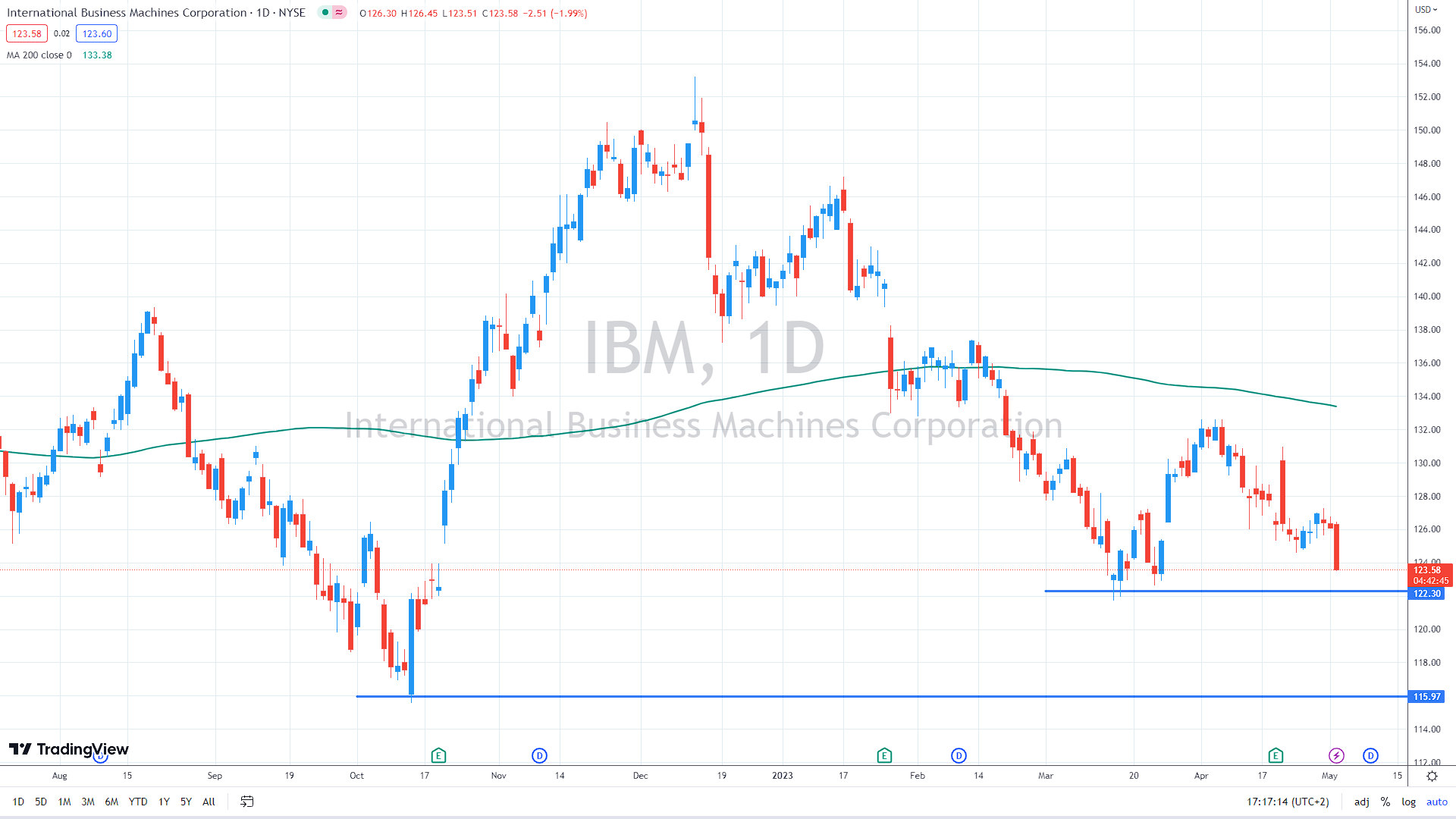

Technically speaking, the following line of defense is at this year’s low, near $122. If not held, the price could decline further, targeting October 2022 through at $115.

IBM daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.