A famous short-selling company Hindenburg Research found a new victim. This time, it’s going after an American billionaire, Carl Icahn. What’s this all about?

Carl Icahn as the new target

On Tuesday, Hindenburg accused Icahn of employing a “Ponzi-like” economic system at his investment company, causing his fortune to fall by billions of dollars instantly.

Related article: How to lose $60 billion in 5 days – the story of Gautam Adani

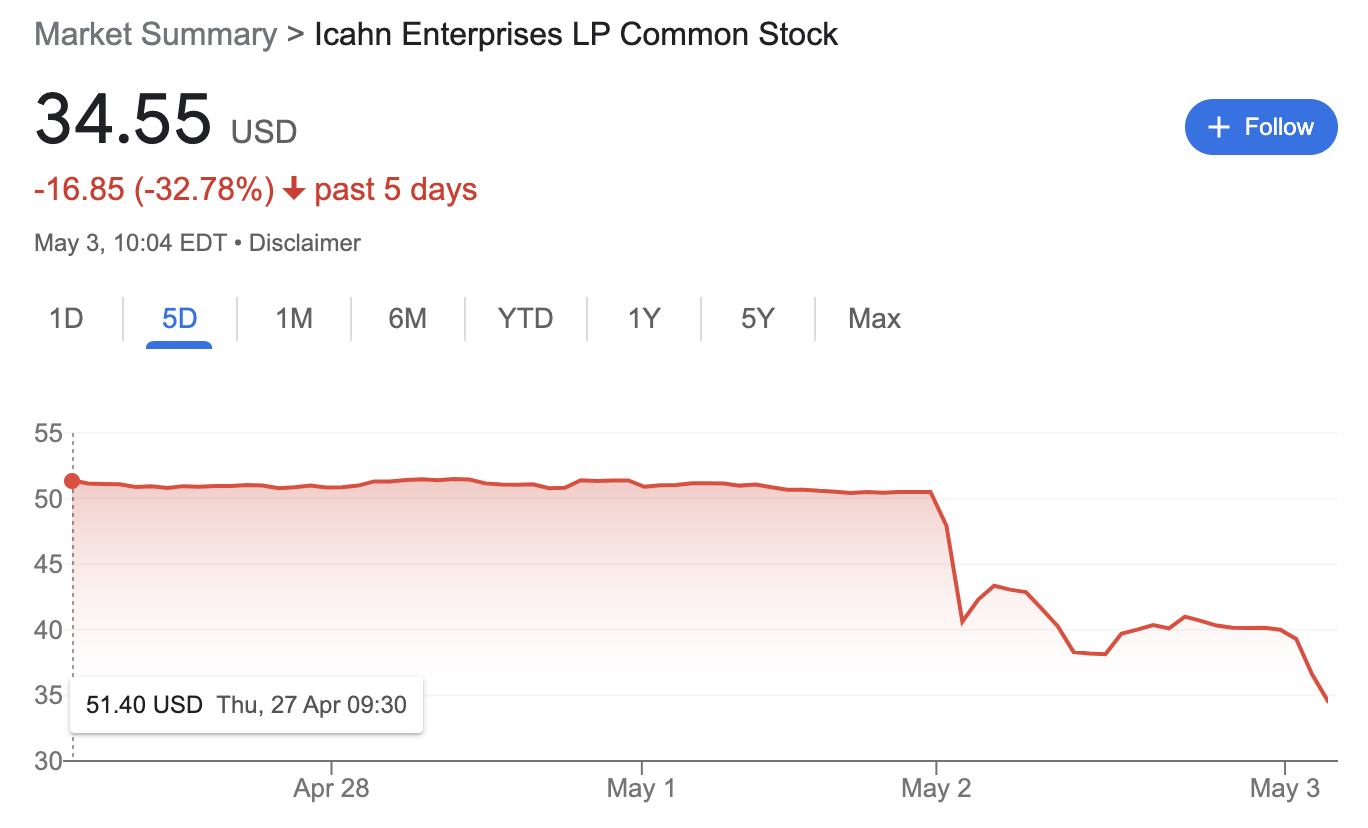

This has been one of the largest drops ever, as the value of Icahn Enterprises LP (IEP), his publicly traded limited partnership and holding company, shrank by one third. Icahn went from being the 58th richest person in the world to the 119th.

Icahn Enterprises LP (IEP) stock, source: google

This is after a record 41% loss in his fortune to $14.6 billion, as measured by the wealth index according to Bloomberg.

Icahn is not the only target

Just a few weeks earlier, Hindenburg was going for India’s Gautam Adani and Jack Dorsey’s Block Inc. New York-based short-seller Hindenburg has moved onto a financial titan Icahn. The vast majority of his wealth comes from his ownership of Icahn Enterprises’ units through numerous corporations.

Hindenburg claimed that the corporation was over-leveraged and trading at a huge premium to its net asset value. This is reportedly because it had interests in funds managed by Icahn and held controlling positions in businesses in the energy, automotive, food, and other sectors.

Icahn released a statement in which he criticized the research, calling it self-serving and “intended solely to generate profits on Hindenburg’s short position.” Like with every company that is being shorted by Hindenburg, they don’t like it.

Hindenburg argued that the fact that distributions to other unit holders were paid in cash made the company more appealing to individual investors. According to the short-seller, this is only conceivable because Icahn elected to be compensated in units rather than cash.

In 2021, Icahn had committed roughly 65% of his shares as collateral for a margin loan. After increasing the number last year, the company’s annual report for 2022 shows that he had over 181 million shares worth $9.2 billion supporting the loan. These shares are now worth almost $6 billion with the stock’s downfall.

Read more: AMD falls sharply amid disappointing earnings report

Shares are used as collateral for obtaining a loan called a margin loan. Lenders have the right to demand repayment of the loan or extra security if the stock’s value drops. They can even sell the shares themselves if the borrower stops making payments.

Is this the end of Icahn Enterprises?

For not disclosing the loan amount, interest rate, and loan-to-value maintenance ratio linked with the margin loan, Hindenburg condemned Icahn. Icahn Enterprises recently stated that “Mr. Icahn has sufficient additional assets to satisfy any obligations pursuant to these loans without recourse to the depositary units.”

Adani and Dorsey both saw declines in their wealth this year due to attacks from Hindenburg, with Adani losing $58 billion and Dorsey $500 million. Icahn’s net worth also plunged drastically, but it shouldn’t necessarily mean the end.

Comments

Post has no comment yet.