Margins are getting a solid hit

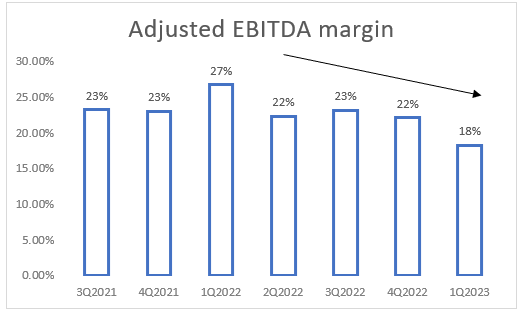

The whole car industry is feeling the effects of falling profit margins, which is a reason why other car companies are also lowering their prices. Tesla didn’t quite meet their revenue expectations, but that’s not the main thing to pay attention to. Most investors will probably keep an eye on these falling profit margins, like we’ve seen in recent times. The trend in adjusted EBITDA margin is negative, thus giving a impulse for a bears for short-selling. This trend could continue as price cuts continues.

EBITDA margin is declining, source: Investro analytics team

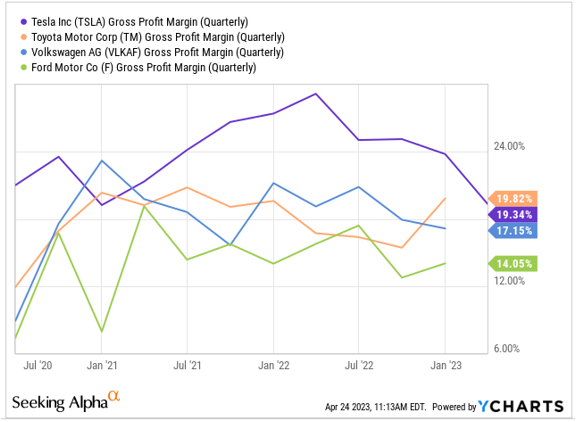

Just look at Tesla´s and its competitors’ gross margins. Even though Tesla is still leading in margins, there’s a noticeable drop happening. But since the company keeps cutting prices, we can expect this trend to go on, even with the cost savings from being more efficient. The following chart shows the comparison of the gross margin of its main competitors. While we believe other competitors will also feel the drop in the margins, impacted by tightening economic cycle, Tesla´s margins dropped as well, but is still a leader.

Tesla´s competitors – gross margin, source: Investro analytics team

The management at Tesla says they’re focusing more on selling lots of cars instead of making big profits on each one. This isn’t just a Tesla thing, though – everyone is competing for customers in this tough market. We’ll soon see if Tesla’s plan is working, but their first round of price cuts definitely helped.

Don´t miss any news: BBBY goes into bankruptcy, shares plunge 20%

The good news is that Tesla is still one of the best in the industry when it comes to margins, so these tough times might hit other companies harder than Tesla.

Tesla revealed the strategy in very detail

The main goal right now is to grab as much of the market as possible, and there’s probably still some room for profit margins to shrink. Tesla plans to make money with self-driving technology and Full Self Driving (FSD) features. Just like Elon Musk revealed:

“However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we’re like laying the groundwork here, and then it’s better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future as we perfect autonomy.”

Tesla recently announced that their goal is to keep making and selling as many cars as they can, even though the economy is a bit shaky. The company’s management sees this as a great chance to grow their market share.

Did you think about the future of NVIDIA: Nvidia maintains traction due to AI – analysts changed price targets

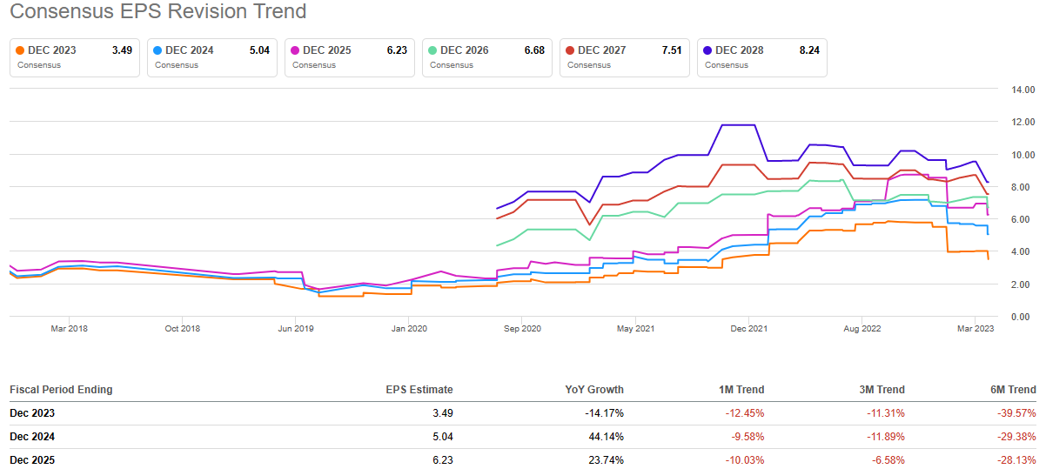

We believe that´s a significant opportunity in the long-term, but the company faces now great headwinds due to worsening conditions in the global economy. As s result of worse than expected margins, the analysts started to cut the EPS estimates immediately.

Tesla – EPS revision trend, source: Seeking Alpha

Cybertruck is coming

With the Cybertruck launch coming up, and big investments in things like in-house battery production, energy storage, and AI-powered products, the future looks really bright for Tesla’s products. Their competitors just can’t offer the same things.

More of our deep research: Silicon Valley Bank: Bankruptcy as a result of poor management

Concerning the Cybertruck, the company continues to construct Alpha versions on the pilot production line for testing purposes. It’s an impressive product, and the installation of the high-volume production line at Giga Texas is being completed. Anticipation is high for a fantastic delivery event, which is likely to happen in Q3.

Diversification

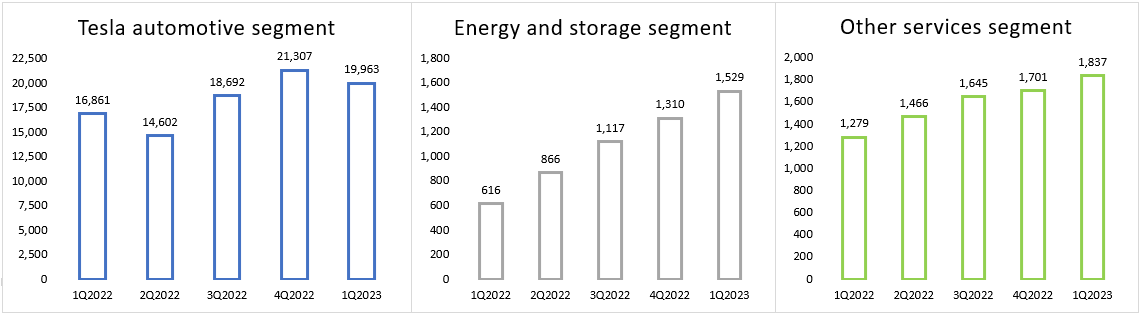

Tesla has begun to excel in areas other than automobiles, including energy, services, and more. These other industries are experiencing robust growth, whereas the automobile industry reached its peak in the latter half of 2021. Since then, other revenue sources have increased at a faster rate, reducing the big pressure of the development of automobile industry. It indicates that Tesla is less dependent on a single product and has a broader range of offerings.

Look at our previous research on Tesla in January: Three reasons to be bullish on Tesla

To be objective, Tesla is significantly more than a car company. It has a diversified business model with multiple revenue streams that have tremendous future potential. The automotive segment includes sales of automobiles and related services. It also incorporates Full Self Driving (FSD) revenue features. Elon Musk strives to deliver as many automobiles as possible, even at the expense of profit margins, in order to generate a future FSD revenue stream.

Imagine FSD as a paywall model with a monthly subscription fee, allowing the motorist to test FSD. The development of the FSD beta is proceeding at a rapid rate, and within the next two to three years, Tesla vehicles may be capable of full autonomy with the appropriate software installed. If the strategy is effective, it could result in a massive revenue stream.

You may also like: Oils’ earnings week is here – so is volatility

Tesla offers solar energy products, such as solar panels and Solar Roof, and energy storage products, such as the Powerwall, Powerpack, and Megapack, for residential, commercial, and utility-scale use in the energy and storage segment. These products are designed to store energy generated from solar or other sources, allowing consumers to use it during peak demand or as backup power.

As the world transitions to cleaner energy sources, demand for renewable energy and energy storage solutions is projected to rise consistently. Government policies, incentives, and a greater emphasis on sustainability may mitigate the effects of economic cycles on this market segment.

Tesla revenue streams, source: Investro analytics team

There’s more. Tesla Insurance is one of the newest segments. Insurance is generally regarded as a non-cyclical business, as people need vehicle coverage regardless of economic conditions. This would provide a stable revenue stream for Tesla Insurance even during economic downturns. As there will be no need for a mediator or agent, and as all profits will be retained by the company and not by insurance companies, Tesla could earn a substantial amount of money. Likewise, the potential here is enormous.

Look at the legend: How is Warren Buffett investing – top picks of legendary investor

Energy and other segments exhibit a strong and consistent upward trend, whereas the automotive industry may be more susceptible to the economic cycle. Regardless, Tesla is doing exceptionally well. Certain segments appear to have a bright future, providing the company a significant competitive advantage over its rivals, the other automakers. None of its competitors have such substantial revenue streams.

Valuation

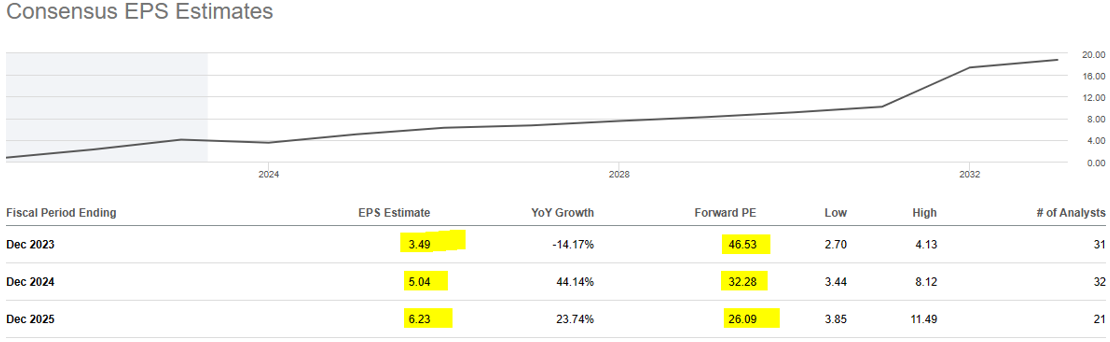

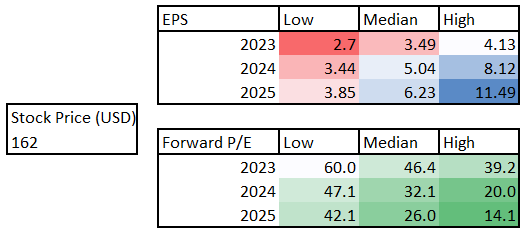

Based on Forward Price to Earnings (Price / Forward EPS), it appears that the ratio of 46.5 for estimated 2023 EPS (3.49 USD per share) indicates a very overvalued metric, while the ratios of 32.28 for 2024 and 26 for 2025 are not too terrible. However, it always matters what you take into account when calculating. Seeking Alpha employs median estimates, which seem quite reasonable.

Tesla – consensus EPS estimates, source: Seeking Alpha

Nonetheless, the forward EPS range (low and high) deviates significantly, and if you calculate the high boundary for each year, you would obtain the following:

Forward EPS and forward P/E, source: Investro analytics team

We can conclude, based on the median estimates, that such pricing could result in overvalued metrics. However, high-boundary estimates indicate that the P/Forward Earnings (2024) ratio, if realized, is 20, which is extremely favourable for the company. However, there is a low likelihood of exceeding the high estimates. From this perspective, Tesla would be a solid deal if its price fell below 145–150 USD, which would reduce its valuation to a cheap area near 23–24 P/E (forward median EPS for 2025).

Disclaimer: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.