The Australian dollar jumped sharply on Tuesday, adding more than 1% during the EU session as investors sent the Aussie flying following the latest RBA monetary policy decision.

Reserve Bank of Australia delivers a surprise rate rise

Interest rates in Australia have been unexpectedly raised by the Reserve Bank by 25 basis points (bps), bringing the overall rate to 3.85%. The market was betting on an unchanged interest rate of 3.6%.

Despite the monthly Australian CPI regularly falling from December, RBA Governor Philip Lowe has raised the Official Cash Rate (OCR) to 3.85%. As a result, inflation in Australia has fallen from a high of 8.4% in November to 6.3% in March. As the RBA anticipates a slowdown in the Australian economy, a further decline in inflationary pressures is also projected.

You may also read: What are Forex robots and how do they work?

Furthermore, the Board of Governors believes that more monetary policy tightening may be required as the central bank is still committed to bringing inflation back down to its target level. Of course, inflation will take some time to return to the desired range, but even at 6%, it is still too high.

The RBA anticipates inflation to average 3.5% by the middle of 2025, down from 4.1% in 2023. Moreover, it is forecast that by mid-2025, the Australian unemployment rate will have risen to roughly 4.5%.

Lastly, the growth in gross domestic product is expected to reach 1.25% this year and 2% by mid-2025. In addition, the unemployment rate is reaching a 50-year low, and the data suggest that the labor market is quite tight. Nevertheless, a safe landing is still challenging to achieve.

“Softer core inflation gave the Bank some breathing space, particularly on concerns around mortgage rates, but the focus in this instance is high services prices and rising labor costs,” said Dwyfor Evans, Head of APAC macro strategy at State Street Global Markets. “This is a decision that will support the AUD, particularly against currencies where the hiking cycle has come to an end.”

US macro events in focus

In the US, In April, the ISM Manufacturing PMI rose to 47.1 from 46.3, above market expectations. In addition, the 0.3% MoM increase in March construction spending beat the 0.1% drop predicted by market participants. However, a decrease from 50.4 to 50.2 in the final S&P Global Manufacturing PMI estimate for the same month is not promising.

Dont miss: How to understand Forex leverage

The broader markets forecast a 25 basis point rate rise from the Federal Reserve at its meeting on Wednesday. However, given that inflation has been stubbornly high recently, investors are still determining whether the Fed will signal a pause in its rate hike cycle. Since the spread between risky and low-risk yields is narrowing, high US interest rates are bad news for Asian and Antipodean currencies.

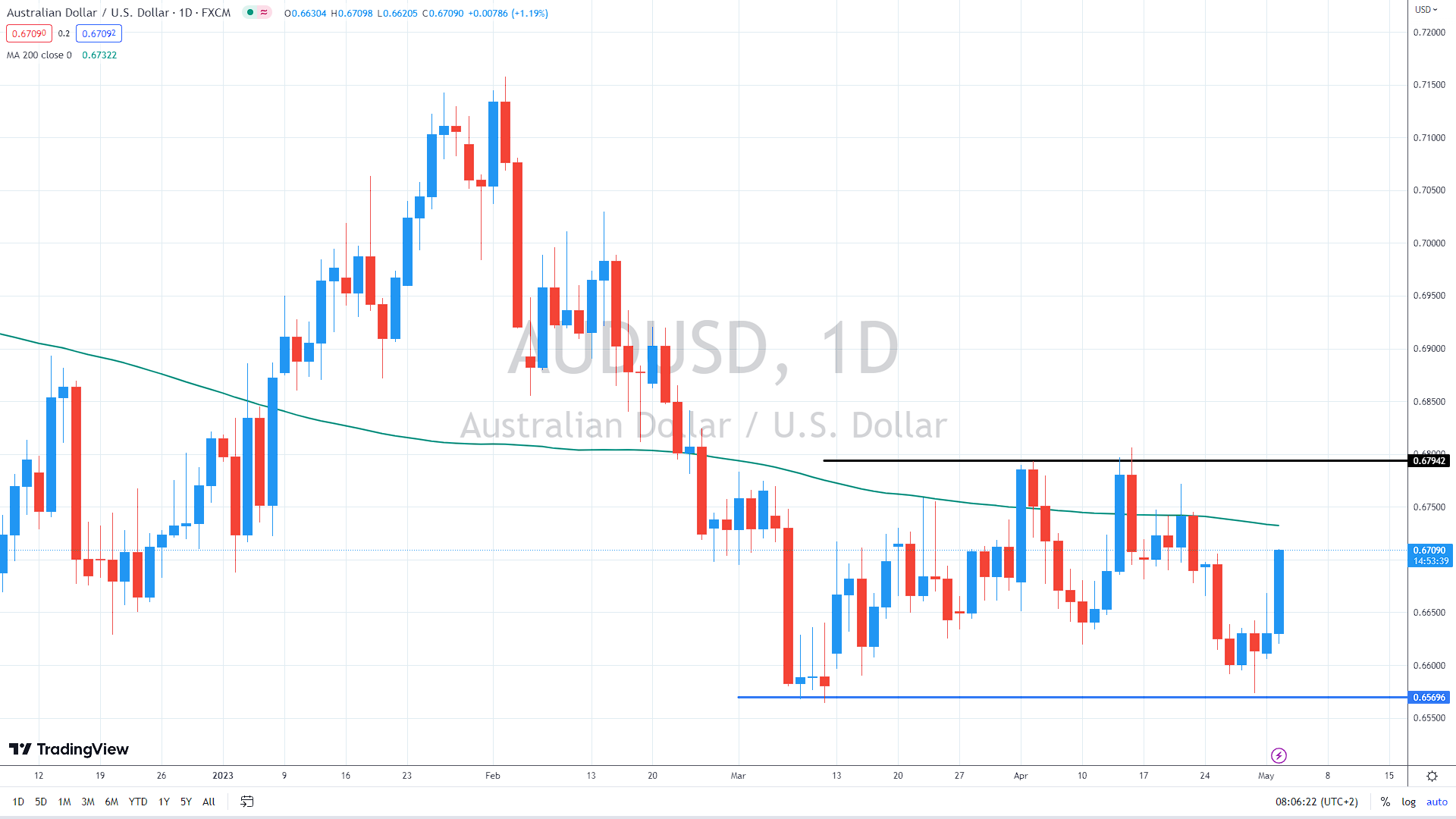

Technically speaking, the AUD/”USD pair remains stuck in a trading range between 0.68 and 0.6570. It needs to break to one side to start a meaningful momentum. Until then, the trend seems neutral.

AUD/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.