The USD/JPY pair dropped notably on Wednesday, with more selling seen today as the pair is about to drop below the first important support.

Fed delivered the last rate hike of the cycle

On Wednesday, the Fed hiked rates by 25 basis points, as predicted. The Federal Reserve has removed a reference to “some additional policy firming may be appropriate” from their policy statement, indicating that they intend to soften the rate guidance in a manner typical with previous pauses.

Clearly referring to the financial meltdown: There was a change from “Recent developments are likely to result in tighter credit conditions” to just “tighter credit conditions.”

For his part, WSJ Fed Whisperer Nick Timiraos said that the FOMC statement used language broadly similar to how officials concluded their interest-rate increases in 2006, with no explicit promise of a pause by retaining a bias to tighten.

“This should mark the end of this hiking cycle as the Fed may rely on the impact of financial conditions deriving from the recent banking crisis to deliver the final bit of tightening,” said analysts at ING, in a note.

US data in the spotlight again

In other news, the ADP Employment Change report in the United States provides insight into the state of private hiring in the country and showed an unexpected increase of 296,000 in April, compared to March’s statistics of 142,000. The ADP Research Institute found that while hiring did increase, incomes decreased from 14.2% to 13.2%.

Also read: GBP/USD creeps higher before Fed concludes its meeting

Moreover, figures revealed the US ISM Non-Manufacturing PMI increased in April to 51.9 from March’s 51.2. While hiring slowed, the analysis showed that a measure of prices paid remained close to its lowest level.

On Friday, the official US Employment figures will be crucial. The jobless rate is predicted to stay at 3.5%. Nonfarm Payrolls (NFP) are expected to show a decline from the previous report of 236,000 to 179,000 in April.

In light of that, average hourly earnings will be closely monitored. The indicator is forecast to remain stable at 0.3% on a monthly basis and 4.2% on an annual basis.

Another exciting topic: Florida Governor calls for ban of CBDCs and ESG investments

Additionally, after Bloomberg reported that PacWest Bancorp would investigate potential strategic alternatives on Thursday, the bank’s stock price plummeted by more than 50% in after-hours trading on Wednesday.

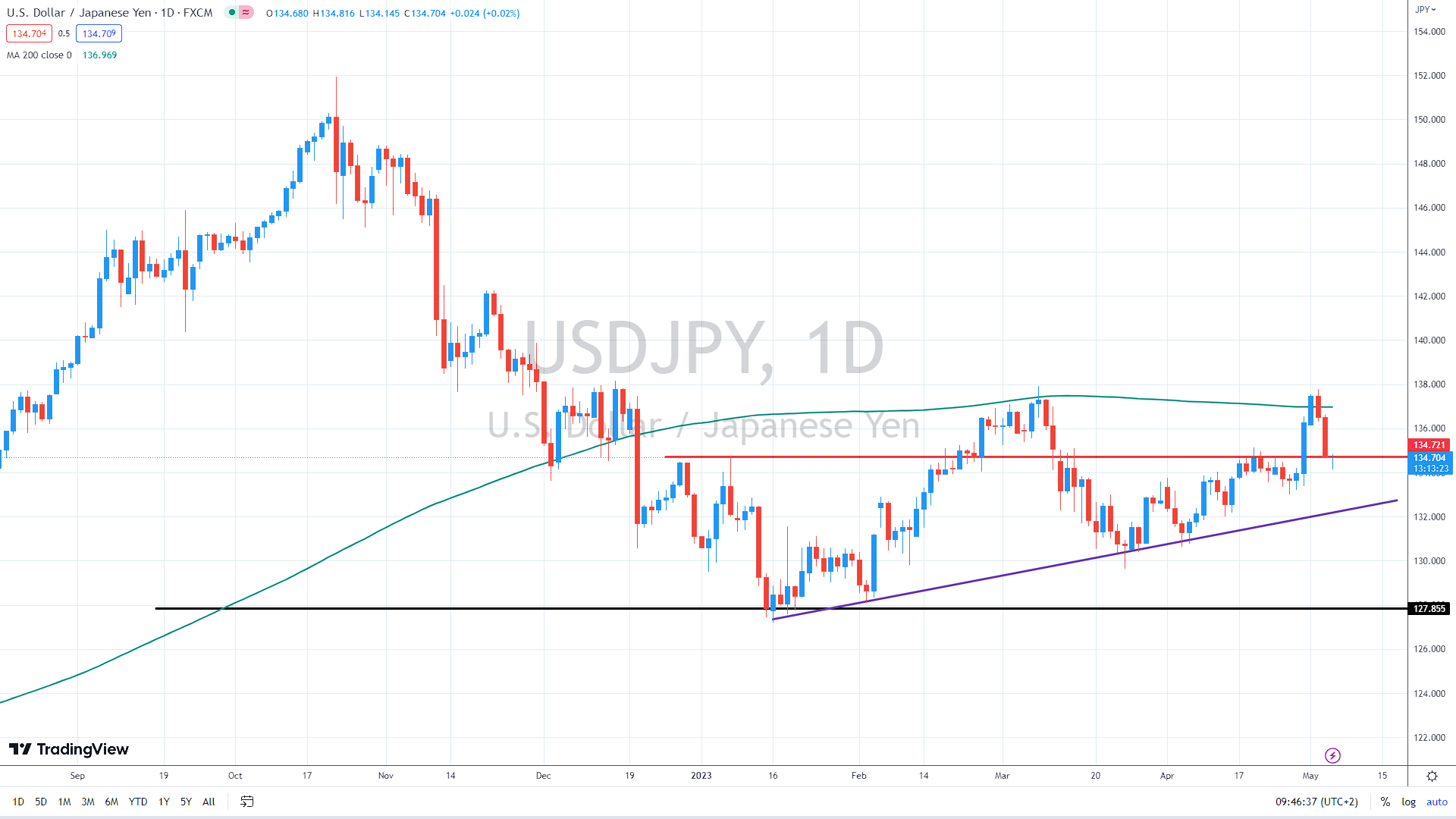

The dollar is now testing the first major support of previous highs in the 134.70 zone. If not held, the price will likely drop to the medium-term uptrend near 132.50.

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.