With the arrival of the 2020s, cryptocurrencies have been gaining much more traction than in the 2010s. While fiat currencies like the euro or US dollar have been around for centuries, crypto is becoming extremely popular fairly recently.

While both of these assets share some similarities, there are fundamental differences between them. Understanding these differences is vital when it comes to evaluating and maximizing their potential. In this article, we will review the key differences between fiat and crypto.

1. Understanding fiat and cryptocurrency

Understanding the difference between fiat currency and cryptocurrency is essential in today’s world, where digital transactions are becoming increasingly common. Some may think fiat crypto is the same thing.

Related article: TOP 5 ways you can spend your Bitcoin

While both may serve as mediums of exchange, they differ in several ways. To start, let’s define what fiat currency and cryptocurrency actually are.

1.1 What is a fiat currency?

Fiat currency is a legal tender backed by the government that issued it. It has no inherent value as an object, but its value is derived from the relationship between supply and demand. The most commonly used fiat currencies include the US dollar, euro, Japanese yen, and British pound (sterling).

One of the main advantages of fiat currency is that it is widely accepted and stable (in most cases). Governments regulate the supply of fiat currency, which helps to maintain its value. Additionally, fiat currency is widely accepted, making it easy to use for transactions.

However, fiat currency is not without its drawbacks. Governments can manipulate the supply of fiat currency, which can lead to higher inflation as we have been experiencing since 2021. Moreover, fiat currency is vulnerable to counterfeiting, but only in rare cases as the bank notes have increased in quality.

1.2 What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography. In most cases, cryptocurrencies are decentralized, meaning they are not controlled by any institution or government. Bitcoin is the first cryptocurrency that was created in 2009, and today there are thousands of cryptocurrencies in circulation.

💣🔥 #Podcast 5: What actually is #Bitcoin with Endo Rivers

🎬 What Proof of Walk is and why the $BTC is going to survive all market collapses? With founder of @BitcoinWalkOrg, we will speak about the importance of using #BTC as a day tool 💪😎https://t.co/1QSqfLZ9pP

— Investro.com (@investrocom) May 3, 2023

One of the main advantages of cryptocurrency is its decentralization and increased privacy. This makes it more secure and less vulnerable to manipulation. For instance, it is difficult to manipulate the price of Bitcoin as its market cap is over $500 billion, with its network running on thousands of devices (no central authority controls it. Additionally, in some cases, cryptocurrency transactions are faster than traditional transactions.

Read more: Survey finds half of Millennials in developed countries own crypto

However, cryptocurrencies are not without their downsides. The value of cryptocurrency is highly volatile, which can make it difficult to use as a medium of exchange. Bitcoin is accepted as a payment method in several places. Furthermore, cryptocurrencies are not widely accepted, which can limit their usefulness for transactions. There are also many cases of crypto frauds, which makes it hard for many people to navigate in this space.

While both fiat currency and cryptocurrency serve as mediums of exchange, they differ in several ways. Understanding these differences is essential for anyone looking to participate in the world of digital transactions.

2. Key differences between fiat and crypto

While fiat currencies have been in use for centuries, cryptocurrencies are relatively new and have gained popularity in just the past few years. Understanding the differences between the two can help individuals make informed decisions about their financial transactions and investments.

2.1 Centralization vs. decentralization

The primary difference between fiat and cryptocurrency is centralization. Fiat currencies are centralized, meaning they are controlled and issued by governments and central banks. Cryptocurrencies are decentralized, meaning they are not controlled by any central authority or bank.

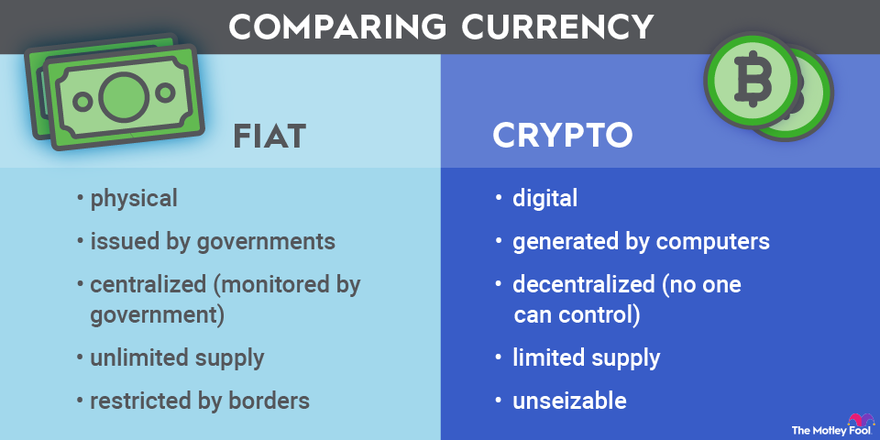

Fiat vs crypto, source: fool.com

Transactions are validated and recorded by a network of users called miners or validators, depending on the type of blockchain. Bitcoin uses Proof-of-Work (PoW) mechanism, but Ethereum runs on Proof-of-Stake (PoS) system.

Small coins with a few million-dollar market caps may be prone to centralization (and fraud) as owners can own 20% or even 30% of all tokens in circulation. The centralization of fiat currencies means that governments can control their supply and value. They can print more money, adjust interest rates, and regulate the flow of money in and out of the economy.

Also read: What is the difference between cryptocurrency mining and staking?

This control can be both a positive and negative factor, depending on the economic situation and the government’s policies. On the other hand, the decentralization of cryptocurrencies means that they are not subject to government control or manipulation.

2.2 Physical vs. digital

Fiat currency exists in both digital as well as physical forms, including notes and coins. Cryptocurrencies, on the other hand, exist only as information and have no physical form. Transactions are recorded on a public ledger called a blockchain.

The physical nature of fiat currencies can make them more convenient for everyday transactions, such as buying groceries or paying for services. However, physical currency can also be lost, stolen, or damaged, which can be a disadvantage.

Cryptocurrencies, on the other hand, are entirely digital and can be stored on a crypto exchange, crypto wallet, or even a hardware device (Trezor or Ledger). This makes them more convenient for online transactions and international transfers. However, the digital nature of cryptocurrencies also makes them vulnerable to hacking and cyber attacks.

2.3 Inflation and deflation

Inflation impacts fiat currencies, with prices of goods and services naturally increasing over time. Governments can control inflation by adjusting interest rates, printing more money, or reducing the money supply. Cryptocurrencies, however, are deflationary by design as the supply of cryptocurrency is limited to a specific amount that cannot be altered.

Also interesting topic: How to hedge against inflation? Must-know tips to protect your capital

The limited supply of cryptocurrencies can make them more valuable over time, as demand increases and the supply remains the same. In some cases, it decreases due to “token burns.” This can be a positive factor for investors and individuals who hold cryptocurrencies as a long-term investment.

2.4 Transaction speed and costs

One benefit of cryptocurrencies is their transaction speed and low costs. Transactions are processed within seconds to minutes, and transaction fees are often significantly lower than traditional banking methods.

Fiat currency transactions can take longer to process, depending on the payment method and the location of the parties involved. Additionally, traditional banking methods often charge higher transaction fees, which can be a disadvantage for individuals and businesses.

While sending money from one bank account to another in the same country is basically free and fast, it can take a few days from Europe to the US, with a cost of at least a few dollars. On the other hand, crypto transactions usually cost a few cents. But that can also increase depending on the gas fees.

2.5 Privacy and security

Cryptocurrencies are more secure than fiat currency due to encryption, which makes them harder to counterfeit (they are on the blockchain). Furthermore, transactions are anonymous, making it harder to trace them to any individual.

In contrast, fiat currency transactions can be traced and monitored by central authorities. That is why central banks aim to fight crypto by releasing central bank digital currencies (CBDCs), which are basically fiat currencies on the private blockchain.

Related topic: Stablecoins vs CBDCs – what’s the difference?

The anonymity of crypto transactions can be a positive factor for individuals who value their privacy and security. However, it can also be a disadvantage, as it can make cryptocurrencies more attractive to criminals and hackers.

3. Advantages and disadvantages of fiat and crypto

Overall, both fiat currency and cryptocurrency have their advantages and disadvantages. Understanding the differences between the two can help individuals make informed decisions about their financial transactions and investments.

3.1 Advantages of fiat currency

Fiat currency has been around for centuries and is widely accepted as a form of payment. Its acceptance is not limited to a specific country or region, making it easily accessible to everyone. Moreover, fiat currencies are backed by governments, which strengthens their credibility. As a result, fiat currency is relatively stable and not as volatile as cryptocurrencies.

Another advantage of fiat currency is its ease of use. It is accepted by most businesses and can be used to purchase goods and services without any restrictions. Fiat currency is also regulated by governments, which helps to prevent fraud. No one can just create a new fiat currency like there are new cryptocurrencies created each day.

3.2 Disadvantages of fiat currency

One disadvantage of fiat currency is its inflationary nature. Governments can print more money, leading to a decrease in its value. This can cause prices to rise, making it harder for people to afford basic necessities. Inflation can also lead to a decrease in the value of savings and investments.

Another disadvantage of fiat currency is its susceptibility to economic and political factors. Financial crises and political instability can cause the value of fiat currency to plummet, leading to economic hardships for individuals and businesses. This is usually in developing countries like Zimbabwe.

3.3 Advantages of cryptocurrency

Cryptocurrencies provide users with more financial privacy and security, as transactions are traced only through crypto addresses, not real names. This makes them a popular choice for individuals who value their privacy. Transactions are also processed quickly due to blockchain technology, which eliminates the need for intermediaries like banks.

Another advantage of cryptocurrency is its decentralized nature. It is exempt from government control, making it resistant to inflationary pressures when compared to fiat currencies. This means that the value of cryptocurrency is not affected by government policies or economic factors.

3.4 Disadvantages of cryptocurrency

One of the main disadvantages of cryptocurrencies is their volatility. Cryptocurrencies can fluctuate greatly in price, which can lead to significant losses for investors. This volatility can be caused by a variety of factors, including market speculation and regulatory changes.

Another disadvantage of cryptocurrency is its limited real-world usage. Although some businesses accept cryptocurrency as a form of payment, it is not yet widely accepted. This limits its usefulness and makes it difficult for individuals to use it for everyday transactions. Ultimately, the choice between fiat currency and cryptocurrency depends on individual preferences and circumstances.

4. Real-world applications and use cases

Fiat currency and cryptocurrency are two types of currency that are used in different ways in our everyday lives. While fiat currency is widely used and accepted, cryptocurrencies are still in the early stages of adoption and integration into mainstream society. Let’s have a look at the real-world applications and use cases of both types of currency.

4.1 Fiat currency in everyday life

Fiat currencies are widely used in everyday life to purchase goods and services, pay rent or mortgage, and invest in stocks and bonds, among other things. Fiat currency is easily accessible through banks and ATMs, and the stability of fiat currency makes it a reliable form of payment.

Read more: Taylor Swift declined $100 million from FTX – here is why

One of the advantages of fiat currency is that it is widely accepted and recognized around the world. This means that it is easy to use fiat currency when traveling to different countries. However, there are also some disadvantages to using fiat currency.

One of the biggest disadvantages is that the value of fiat currency can be affected by inflation. This means that the purchasing power of fiat currency can decrease over time, which can be a disadvantage for people who are saving for the future.

4.2 Cryptocurrency adoption and integration

Cryptocurrencies are still in their early stages of adoption and integration into mainstream society. However, they are becoming increasingly popular as more businesses along with major retailers begin accepting cryptocurrencies as payment.

Paying with #bitcoin in Costa Ricapic.twitter.com/OQQvime38s

— Documenting ₿itcoin 📄 (@DocumentingBTC) March 30, 2023

One of the biggest disadvantages of cryptocurrencies is that they are not widely accepted or recognized around the world. This means that it can be difficult to use cryptocurrencies when traveling to different countries. Additionally, the price of cryptocurrencies can be volatile, which can be a disadvantage for people who are saving for the future. Nevertheless, it can also go well for those who buy at a great price.

Bottom line

Understanding the differences between fiat currency and cryptocurrency is important with the increasing usage of digital payments.

While each type of currency has distinct features and purposes, the adoption and integration of cryptocurrencies into our daily lives will continue to accelerate due to their technological advances and financial potential.

Comments

Post has no comment yet.