Paxos has been ordered to stop issuing BUSD, the third-largest stablecoin in the crypto space. Although Binance will have to stop using BUSD over time, the usage of stablecoins increases with each year, and the issuing companies expand by creating non-dollar stablecoins (e.g. euro).

Stablecoins exploded in popularity

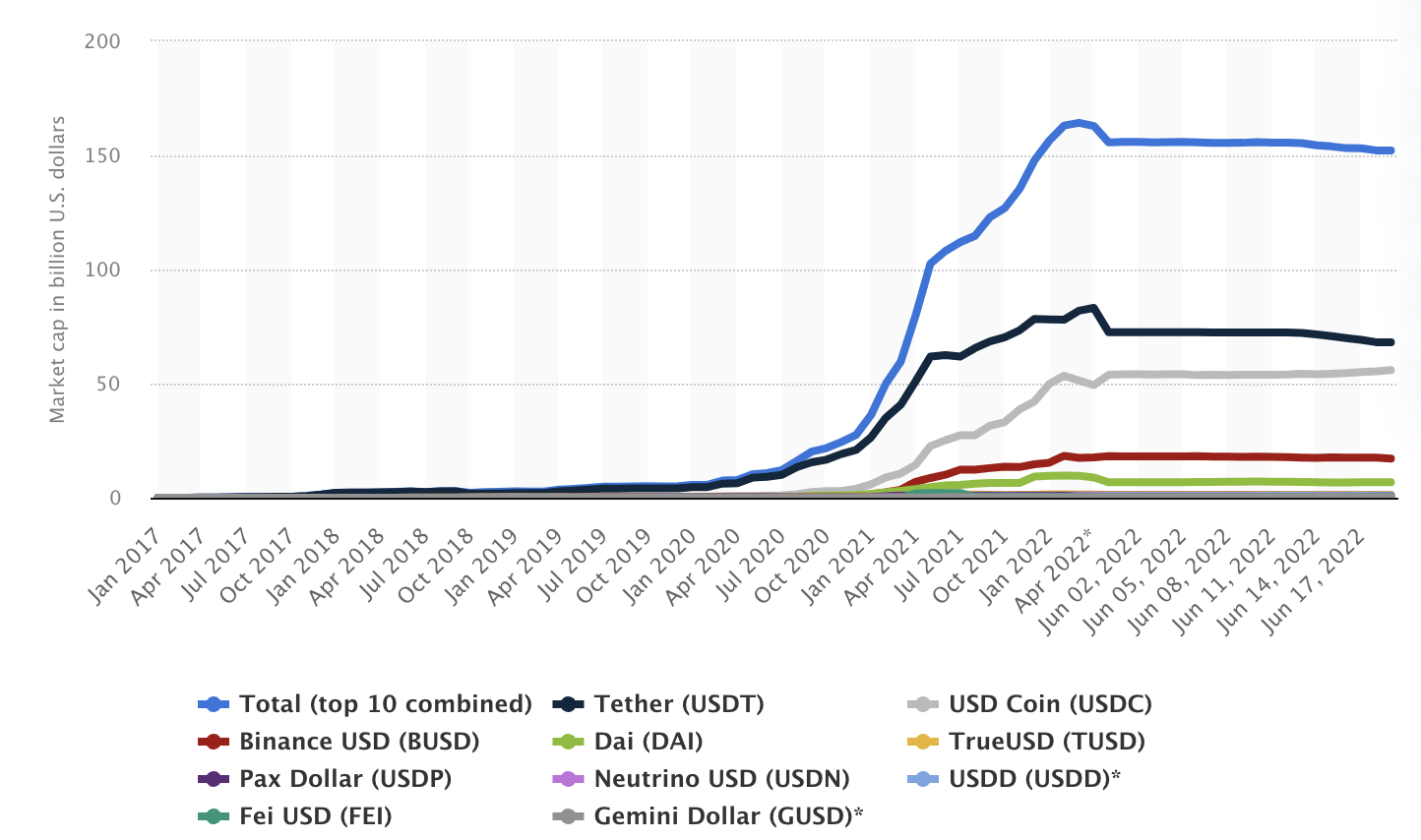

Market cap of the 10 biggest stablecoins from 2017 to 2022, source: statista.com

Stablecoins used to settle transactions in millions of dollars in 2017, but they have quickly grown over the past few years. Now there’s a multi-billion dollar trading volume on all stablecoins daily. Tether alone records $50 billion in transactions in a single day, beating Visa or Mastercard in 2022.

Related article: The craziest crypto debut in 2023 – what happened with Blur?

This growth is happening despite the fact that Terra USD, Terra Luna’s stablecoin, crashed in early 2022 and caused a massive selloff in the crypto market. Shorftly after, Huobi stablecoin (HUSD) collapsed, bringing more uncertainty to the markets. Fortunately, the three largest stablecoins USDT, USDC, and BUSD have remained stable.

Is #Bitcoin mining bad for the #environment? ⚡🌱

➡ The #mining of cryptocurrencies is becoming more popular than ever, fuelling the #crypto market with eco-friendly solutions.#cryptocurrency #btc $btc #trading #trader #cryptotrader #investrohttps://t.co/DlgASzLfYx

— Investro.com (@investrocom) February 15, 2023

After all, it’s very profitable for companies to create these stablecoins as they profit with each transaction. This helped Tether make $700 million in the fourth quarter of 2022. But that’s not all.

Non-dollar stablecoins are coming

Stablecoin issuers are looking for other alternatives, such as Chinese Yuan stablecoin, or euro Tether (EURT) – the whole list is available on Tether.to. Basically, every major fiat currency such as the euro, pound, along with commodities like gold are or will be available as stablecoins. There are already two gold stablecoins as well – PAX Gold (PAXG) and Tether Gold (XAUT).

The issuing companies will hold reserves of these assets and offer them to individuals, merchants, or exchanges in a digital form on the blockchain. This makes financial transactions faster, easier, cheaper, or even more transparent. While USD-backed stablecoins dominate the market, non-dollar stablecoins are poised to explode in popularity in the upcoming years.

CZ, the CEO of Binance, said the crypto space is likely to adopt euro, yen, or Singapore dollar-based stablecoins on Binance AMA. That should help decrease the dependence on the American dollar.

“I think that given the current pressure and current stances taken by the regulators on the US dollar-based stablecoins, I think that, as you said, the industry will probably move away to non-US dollar-based stablecoins,” explained CZ.

According to CZ, algorithmic stablecoins may also play a larger role in the future of the crypto industry. He did, however, warn that algorithmic stablecoins have “inherently going to have risks” that fiat-backed stablecoins do not.

“As a result of this, we probably will see more euro-based or other Japanese yen- or Singapore dollar-based stablecoins, so it’s actually prompted us to look for more options in different places,” CZ stated.

Stablecoins vs CBDCs

Governments around the world are currently working on launching their own CBDCs to increase their control over the currency system and prevent the rise of company-issued stablecoins. However, stablecoin issuers like Tether are also gaining significant market share due to the freedom they offer to people.

Tether is not directly subject to government control and can be used by anyone, anywhere, at any time. This freedom is particularly attractive to individuals who are looking for an alternative to traditional banking systems, which can be restrictive and time-consuming.

Read more: Stablecoins vs CBDCs – what’s the difference?

As stablecoins continue to gain popularity, governments may attempt to regulate them in order to maintain control over the payment system. However, stablecoin issuers are likely to resist government intervention, as it could compromise the freedom that their products offer to people. In the coming years, we are likely to see a growing battle between governments’ CBDCs and stablecoin issuers for market share in the fiat currency system.

Final thoughts

Overall, it is clear that stablecoins and CBDCs are the future of the payment system. They offer numerous benefits to individuals and businesses, including faster transactions, lower costs, and increased accessibility.

However, the battle for market share between stablecoin issuers and governments’ CBDCs is likely to intensify, as each seeks to establish itself as the dominant force in the payment system. After all, it’s the governments that issue fiat currencies and want to have control over them.

Comments

Post has no comment yet.