Tether as the largest stablecoin company released a report, which points out some intriguing numbers. Last year was game-changing for the company, as it beat Visa and Mastercard in transaction volume. Now let’s have a look at its profits, assets, and liabilities.

Tether made $700 million in Q4 2022

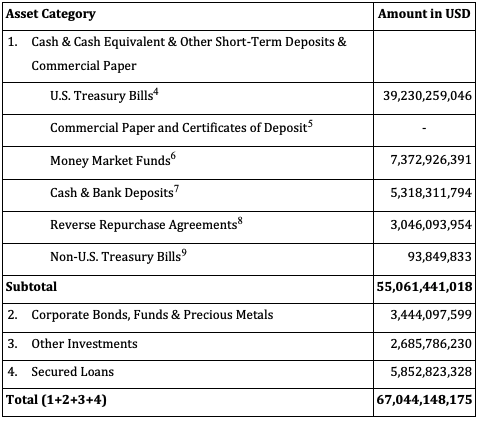

Tether assets by category, source: tether.to

There had at least $960 million in excess reserves based on Tether’s consolidated total assets of at least $67.04 billion and its consolidated total liabilities of at least $66.08 billion. The $700 million gain is claimed to be part of shareholders’ equity beyond cash reserves. It’s essentially more money already invested in Tether, which will only serve to boost Tether.

“Tether’s reserves remain extremely liquid, with the majority of its investments being held in cash, cash equivalents, and other short-term deposits. This latest report shows its commitment to transparency and highlights a $300 million reduction in secured loans and the highest percentage (58%) of assets allocated in US Treasury Bills,” the report stated.

Tether’s CTO, Paolo Ardoino, claimed in a report that the firm had “once again proven its stability” despite the difficulties the crypto market went through in 2022. In fact, while some stablecoins like Terra USD or Huobi’s stablecoin HUSD collapsed, Tether’s biggest depeg was less than 0.5%. And that was in one of the most turbulent market conditions.

Related article: Stablecoins are being adopted on a global scale

To demonstrate the continuous organic growth and adoption of Tether, he added, “not only were we able to smoothly execute over $21 billion dollars in redemptions during the turbulent events of the year, but Tether has on the other side issued over $10 billion of USDT.”

Conclusion

In reality, Tether has been the biggest stablecoin issuer for several years in a row, dominating the stablecoin market with its USDT. However, the future may bring even more for the company as Tether is issuing other stablecoins such as Euro Tether, Chinese Yuan Tether, etc.

Comments

Post has no comment yet.