The greenback traded broadly higher on Friday as investors bought the US dollar following better-than-projected US jobs market figures.

Current numbers came out great, but revisions showed weakness

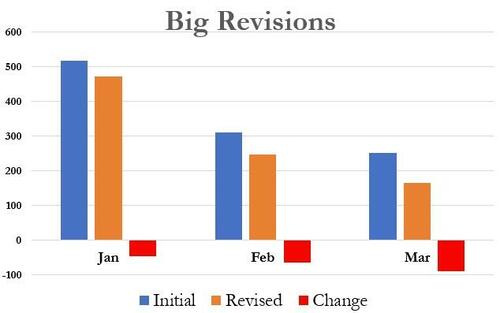

Nonfarm Payrolls increased by 253,000 in April, according to statistics released by the US Bureau of Labor Statistics (BLS) on Friday. The number was higher than the 179,000 increase projected by the market. Payrolls have now exceeded estimates for a record 12 straight months. Unfortunately, March’s original 236,000 was reduced to 165,000 after revisions.

Another great story: Apple jumps as investors cheer earnings results – uptrend continues

The downward revision of 78,000 in February’s reading brought it from +326,000 to +248,000, missing the February expectations. As a result of these changes, employment in February and March as a whole fell by 149,000. In addition, January saw a negative revision as well.

This is how the whole downward adjustment looked:

According to Friday’s report, 77,000 jobs were created in the education and healthcare sector last month. In April, the total amount of people working in business services climbed by 41,000, while the number of people employed in the leisure and hospitality sector rose by 31,000.

Furthermore, the average hourly pay increased to 4.4% from 4.3% annually, while the unemployment rate fell to 3.4% from 3.5%, according to the report’s additional data. The labor force participation rate came in at 62.6%, matching the prior reading but below the consensus forecast of 62.5%.

Dont miss: LNG keeps moving sideways – will it sink below $2?

Lastly, the BLS stated that the number of persons not in the labor force who currently want a job increased by 346,000 over the month to 5.3 million. However, because they were either not actively seeking employment in the four weeks before the poll or were unavailable to accept a job, they were not counted as unemployed.

The Fed’s outlook should not be altered

The jobs report on Friday follows a week in which initial jobless claims were higher than expected. The data was published on Thursday and showed a total of 242,000 requests for unemployment benefits, a rise of 13,000.

Fed Chair Jay Powell raised rates on Wednesday and said the labor market remains “very tight.” Still, he also said, “There are some signs that supply and demand in the labor market are coming back into better balance,” citing an increase in the participation rate among prime-age workers (those between the ages of 25 and 54), a moderation in wage gains, and a decrease in job openings.

You may also read: Stocks slide lower a day before next big data – focus shifts to NFP

Andrew Hunter, Capital Economics’ deputy chief US economist, emailed clients after Friday’s data came out, saying, “We doubt [Friday’s data] will have the Fed reconsidering its plans for a pause given the wider evidence that labor market conditions are cooling.”

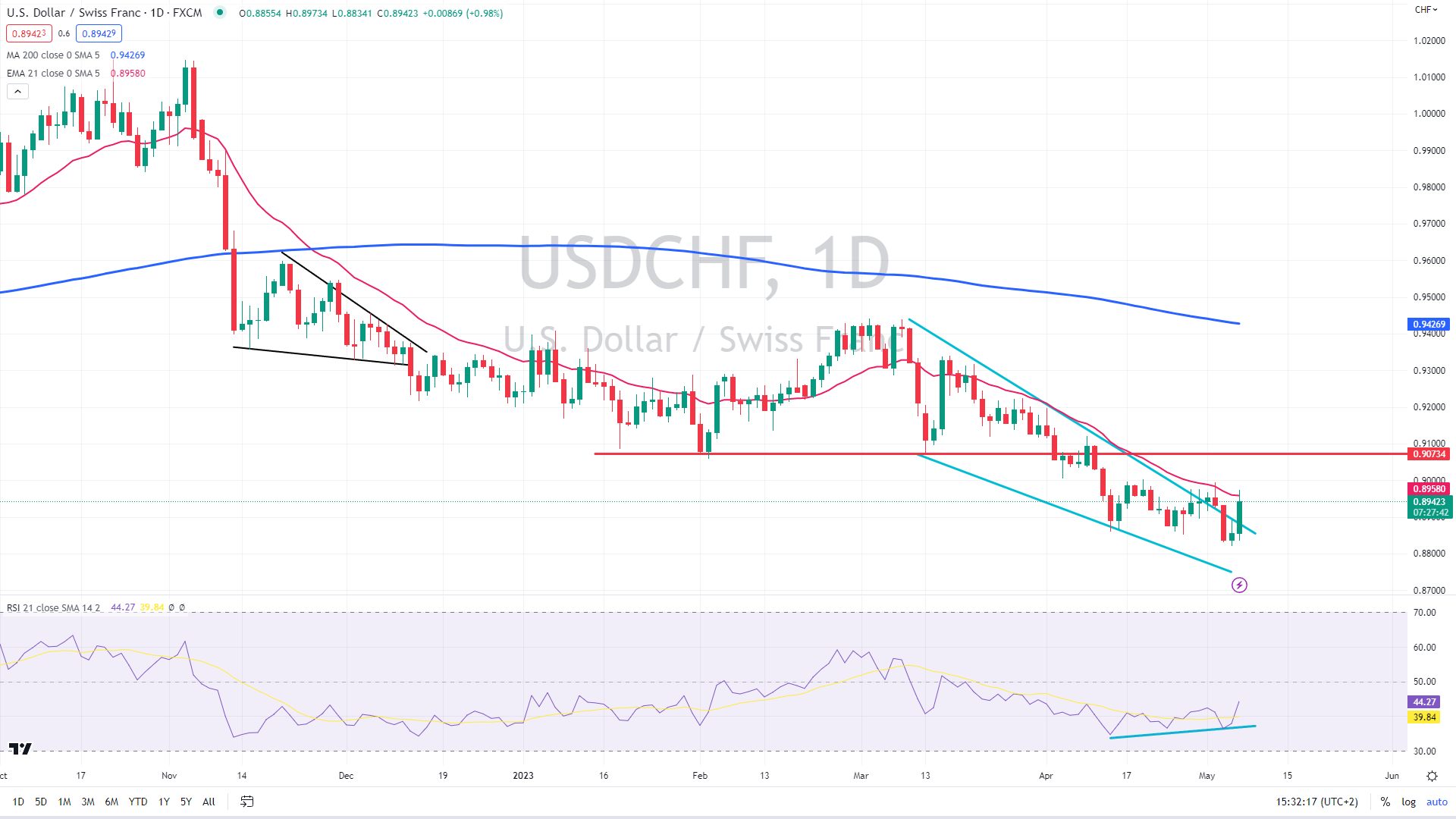

Technically speaking, the USD/CHF pair is trying to jump from the falling wedge pattern, a bullish reversal formation. There is also a small bullish divergence between the last two lows in price and the last two lows in RSI, implying a possible reversal, likely targeting the 0.90 barrier. The next target could be at previous lows at around 0.9070.

USD/CHF daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.