Many investors find Forex trading to be a thrilling and possibly lucrative business. However, one might require a sizable initial investment to trade FX. Many traders, especially novices, find this a difficult obstacle to overcome. One solution to this problem is to use forex leverage. Here, we’ll cover what leverage is, how it applies to foreign exchange trading, the pros and cons of utilizing a great deal of it, and some real-world applications.

What is leverage in Forex trading?

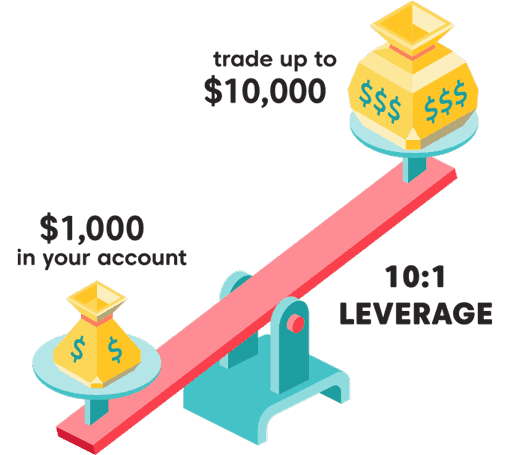

With the help of leverage, investors may manage greater market positions than their initial money would permit. Simply put, margin allows the trader to take on larger trades than their current account balance would enable. With leverage of 1:100, for instance, a trader with $1,000 in their trading account may manage a $100,000 position.

Dont miss: EUR/GBP ignores recent data dump – sideways trading continues

Leverage in the foreign exchange market can range from 1:10 to 1:500. Capital required to control a position of a given size (represented by the first number in the ratio) is compared to the position size (represented by the second number in the ratio). With leverage of 1:100, for instance, a $1,000 investment would give the trader control over a $100,000 stake.

Source: https://www.axi.com/int/blog/education/what-is-leverage-in-trading

High leverage in forex trading

Forex traders like the high leverage the market provides, allowing them to manage greater positions with the same cash. High leverage can enhance both earnings and losses since it magnifies both. If the leverage is set at 1:100, for instance, every 1% change in the market will cause the account to change by 100%. This implies that the losses might swiftly snowball if the market turns against the trader.

High leverage in foreign exchange trading and its advantages

The main benefit of high leverage in Forex trading is controlling larger positions with smaller amounts of capital. As a result, even those with a smaller trading budget have a chance to make a profit. In addition, traders may benefit from even the smallest price swings thanks to the high leverage that the market provides.

You can listen to: How to trade earnings season with Andrew Aziz

Higher earnings are another perk of using plenty of leverage. For example, a trader’s gains on a profitable transaction with a leverage of 1:100 will be increased by 100. This is because high leverage magnifies even a slight gain.

High-risk scenarios associated with foreign exchange trading

Significant losses are the primary danger of using a lot of leverage when trading foreign currencies. Because high leverage multiplies both wins and losses, even a seemingly insignificant shift in the market can wipe out a trader’s capital if the trade goes against them. This is why traders should employ stop-loss orders and other risk management forms to reduce their potential losses.

Overtrading is another potential outcome of excessive leverage. Those overconfident or greedy in the markets may be tempted to trade recklessly and expose themselves to greater danger than they can comfortably bear.

Forex leverage – some real-world examples

Let’s examine some actual Forex trading instances to see how leverage is used.

For starters:

Trader A uses a leverage of 1:100 on his trading account balance of $10,000. As a result, Trader A can have a $1,000,000 stake. For example, a trader purchases 100,000 EUR/USD at 1.1200 and places a stop loss order at 1.1100. Since each pip in the EUR/USD pair is worth $10 when trading one lot, if the market swings in Trader A’s favor and the price climbs to 1.1300, trader A will make a profit of $1,000.

Also read: How to read live forex trading charts

If the market turns against Trader A, however, and the price drops below 1.1100, the stop-loss order will be executed, and Trader A will incur a loss of $1,000. In both examples, the trader would either gain or lose 10% of his account ($11,000/$9,000) as he used leverage to magnify the potential profit or loss.

Exhibit 2

Trader B uses a 1:500 leverage on a $5,000 trading account. As a result, Trader B can now exercise control over a $2,500,000 position. Trader B places a buy order for £200,000 worth of GBP/JPY at 153.00, with a stop-loss order set for 152.50. Since each pip in the GBP/JPY pair is worth $20 when trading two lots, Trader B will gain $4,000 if the market swings in his favor and the price climbs to 154.00. Conversely, the stop-loss will be activated, and Trader B will suffer a loss of $2,000 if the market turns against him and the price drops to 152.50.

Exhibit 3

Trader C uses a leverage of 1:1000 on a trading account balance of $1,000. As a result, Trader C can take over a $1,000,000 stake. C places a stop loss order at 109.50 and buys $10,000 USD/JPY at 110.00. Each pip in the USD/JPY pair is worth $0.50 when trading one lot; therefore, if the market swings in Trader C’s favor and the price climbs to 110.50, he will make a profit of $500. In contrast, Trader C will lose $500 if the market turns against him and the price drops below 109.50, at which point the stop-loss will be activated.

Conclusion

High leverage in Forex trading is a potent instrument that allows traders to manage greater assets with less cash. However, it should be used responsibly and with an understanding of the dangers associated. Traders should always use stop-loss orders and other risk management strategies to prevent them from losing more money than they can afford. Traders may boost their earnings and achieve success in the Forex market by understanding the benefits and hazards of Forex leverage and employing it correctly.

Comments

Post has no comment yet.