The use of borrowed funds or margin to improve the possible return of an investment is frequently referred to as leverage. Leverage enables traders to multiply their earnings, but also losses, by utilizing little capital to control a more significant market position.

Benefits of leverage

There are several reasons why traders apply leverage. First, it can boost the possible earnings that traders can earn from their trades. By utilizing leverage, traders can create bigger positions than they could with their own capital alone, enhancing the possible return on their investment. In addition, leverage enables traders to capitalize on modest market price fluctuations, which may build higher gains over time.

A second reason traders deploy leverage is that it enables them to trade in markets that would otherwise be unavailable due to high capital requirements. For instance, trading in the forex market needs substantial cash, but with leverage, traders may open positions with considerably less capital.

Don’t miss: ADBE pumps after strong earnings and upgraded guidance

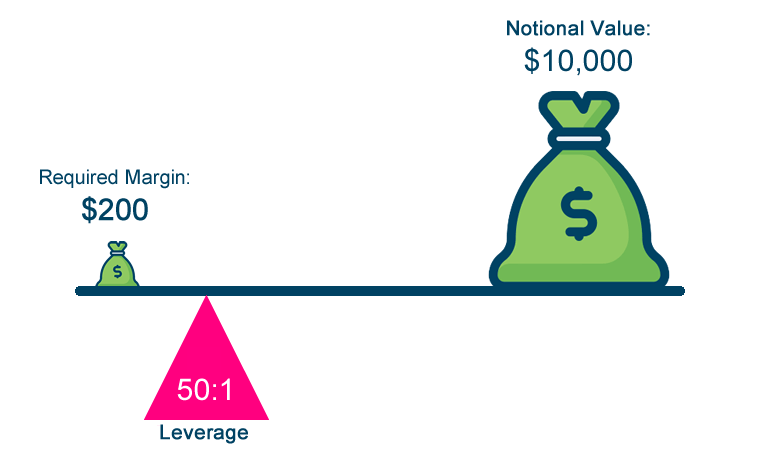

To trade with leverage, traders must create a margin account with their broker. This enables them to borrow cash from the broker so that they can open greater positions in the market. The level of leverage available to traders depends on the broker and the market being traded. For instance, certain brokers may provide 50:1 leverage for forex trading, allowing traders to manage positions 50 times greater than their initial investment.

What leverage looks like in theory, source: babypips.com

Leverage may be an effective trading technique, but it has both advantages and disadvantages. Some benefits of employing leverage are the possibility for bigger returns, the opportunity to trade in markets that would otherwise be unavailable, and the capacity to capitalize on slight price fluctuations in the market.

Nonetheless, there are hazards involved with the use of leverage. The greatest danger is that it can exaggerate both losses and gains. If the market swings against a position with leverage, the losses can quickly exceed the initial investment, potentially resulting in a margin call and the loss of the entire investment. In addition, excessive leverage can result in overtrading and greater risk-taking, which can damage a trader’s long-term profitability.

How to minimize risks when using leverage in trading

Leverage is a robust tool in trading, but wrong execution can result in severe losses. To reduce the risks involved with trading using leverage, traders must be disciplined and stick to a well-defined plan. The following are some of the best strategies for minimizing risks associated with leveraged trading.

When utilizing leverage, it is vital to understand the related dangers. Traders must comprehend how leverage functions, how it may compound both gains and losses and the possible repercussions of a margin call (see below). This knowledge will assist traders in employing leverage prudently and avoiding excessive trading or risk-taking.

Another interesting topic: Credit Suisse ends up being bought by UBS for a bargain price

Second, traders should select an acceptable leverage ratio based on their trading style and risk tolerance. More leverage can enhance possible earnings but also potential losses. Traders must thus select a leverage ratio that balances their prospective gains and losses.

Traders must always employ stop-loss orders to limit their losses. Stop-loss orders are instructions that automatically close a transaction when the market swings against the trader. Traders can limit their losses and preserve their capital with stop-loss orders. In addition, it is crucial to monitor and alter stop-loss orders when market circumstances fluctuate frequently.

What is a margin call?

A margin call is a demand from a broker to a trader to deposit additional cash into their trading account. This message is sent when the trader’s account exceeds the required minimum margin due to open trade losses. In other words, it occurs when the trader’s account balance goes below the necessary margin needed to retain their open positions.

Margin is the amount of capital traders must maintain in their trading accounts to cover any possible losses in open positions. The margin need varies according to the broker, the traded product, and the leverage employed. When a trader’s account balance falls below the minimum margin requirement, the broker will issue a margin call to request additional money be deposited.

You can also read: Best stock market podcasts: List of TOP 10 podcasts you need to follow

If the trader fails to deposit further cash, the broker may terminate some or all of the trader’s open positions in order to prevent additional losses. This is referred to as margin call liquidation. The margin call may be an effective risk management technique since it protects traders from incurring losses in excess of their initial investment.

Final remarks

In conclusion, leverage is a powerful instrument for increasing the possible profits on trading assets. Nonetheless, traders must be mindful of the risks of employing leverage and apply it responsibly. Traders may achieve higher market success by adequately managing risk and using leverage with a sound trading strategy.

Comments

Post has no comment yet.