If you’re like many people, the prospect of investing can be scary. But there’s no need to be afraid—investing is actually quite simple. All it takes is some time, effort, and capital on your part and you can start building wealth. It’s not all about being rich, but creating a financial reserve that will help you get a house, a car, or a retirement.

Understand this first

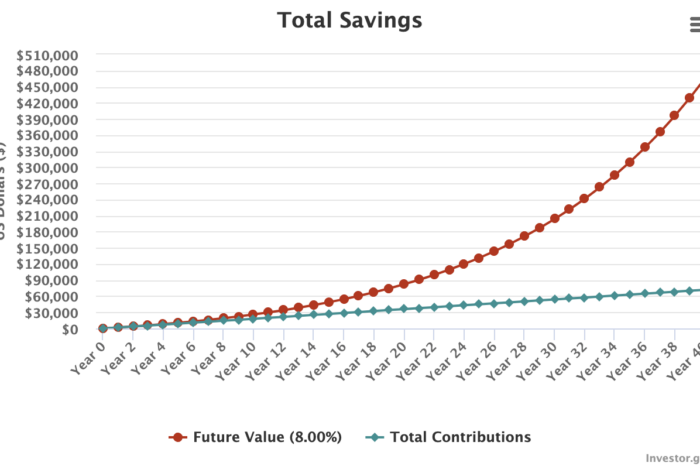

The first thing you need to know is that time is your best ally because the longer you invest, the more time your money has to grow. For example, if you invest $10,000 at age 20 and let it grow over 50 years at an 8% average yearly return, by the time you reach age 70, that investment would be worth $469,016. This is the true power of compound interest.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it” – Albert Einstein.

If you wait until age 30 to start investing and then continue doing so for another 40 years (i.e., until age 70), then by that same model your investment would only be worth $217,245. That’s a huge difference and it’s the reason why Warren Buffett is so rich, who has been an investor for more than 70 years. What this tells us is simple: Investing early will help you benefit from compound interest—and this can make a huge difference in how much money ends up being available for retirement or other uses later on in life.

Related article: The underrated power of long-term investing

Compound interest refers to the idea of earning interest on top of what was previously earned. This means that if an investor earns 8% annually on their portfolio’s value during year 1 but also earns 8% during year 2 (which is on top of whatever earnings were made during year 1), they won’t just have earned 16% overall; it’ll be 16.64%.

1. The sooner you start investing, the better

Money has time on its side when invested right. Time is one of the most valuable assets not just in life, but in an investment portfolio as well. The longer your money is invested, the more likely it is to generate returns. If those returns are higher than average over time, your investments become even more valuable. The before mentioned 8% annual return is average. Warren Buffett delivered a 20% return over since the 1970s.

It’s crucial to understand that you don’t need $10,000 to start. You can invest a certain amount every month. For example, by investing $150 for 30 years, you may end up with approximately $203,909. That’s all just by investing $150 every month. Using the same method for 40 years would even bring $466,301.

Investing early has a massive impact on your financial future. The longer you invest, the more money you’ll accumulate. And that’s not all. The earlier in life that a person starts investing, the less risky it becomes. The more you invest, the more you learn. With each dollar in your portfolio, you’ll become smarter and able to make better decisions overall.

2. Compound interest is the key ingredient

Compound interest is the magic of investing. It’s the interest that accrues on the principal, so when you invest your money, you earn interest not only on your initial contribution but also on other previous returns. The longer your investments remain untouched and invested, the more money you will make because compound interest allows your earnings to continue compounding over time.

Also read: Rise of internet and social media – what you did not know

You need to invest for at least a few years for the compound interest to kick in. Investing is not a get-rich-quick scheme. It’s a long-term strategy, which means you need to be patient and disciplined. You need to be willing to take risks and make mistakes along the way. However, it’s a well-known fact that stocks rise in the long run.

If you pick certain stocks, there may be a high risk. However, investing in major American and European stock indices should most certainly deliver returns as they create a new all-time high (ATH) regularly after every recession. Just have a look at the S&P 500 chart over the last few decades.

3. The earlier you start investing, the less risky it is

This is because the longer money has to grow, the more time there is for volatility to even out. The longer your investments have to grow, the lower their volatility will be, and therefore (on average) they will experience lower swings in value. This is also why Warren Buffett is not concerned about his investments, as he mostly holds them for several decades.

The riskiness of an investment can be measured by its volatility. The higher its volatility, the riskier it is considered. For example, Bitcoin’s drawdown during bear markets is around 80%. That’s pretty volatile. However, Apple’s stock hasn’t dropped by more than 40% in the last decade.

Shorter-term investments have more uncertainty about returns compared to longer-term investments with identical expected rates of return. In other words, when you look at two different portfolios over different periods of time, their risk levels will differ on how long each portfolio was invested for and how much money was invested in total during that time.

4. Inflation will slowly eat up your savings if you don’t invest

Inflation is the rise in prices of goods and services over time, and it can be good or bad depending on the point of view. As a consumer, high inflation means that your money has less buying power than it did before.

But if you’re an investor, inflation is great because it means your money will grow—you won’t lose purchasing power as quickly to inflation as the things around you get more expensive. Reportedly, inflation has slowed down to 7.1% in the US but is still considered high for investors who rake in 8% yearly on average.

The degree of risk taken is one of the most critical factors that must be considered in any investment or trading 🤔 learn how with Investro 🎓✊

➡ https://t.co/GO8D6x9dsH ⬅#stocks #shares #crypto #cryptocurrency #forex #commodity #analysis #trading #trader #market #investro pic.twitter.com/lsaJYiqOKH

— Investro.com (@investrocom) December 5, 2022

For those who didn’t invest at all for years and have, for example, $50,000 in their bank account, that same amount has become worth approximately $43,000 in just one year. That’s just a year. Some people have savings not been invested for like five or ten years. Inflation is dangerous, especially nowadays.

Start investing right away, and invest as much as possible to reduce the impact of investment risk and inflation. As mentioned earlier, the risk is smaller with every year invested. Investing for at least 20 years lowers the risk of a loss to almost zero chance.

5. The more you invest, the better off you’ll be

But how much should you be investing? The truth is that there’s no easy formula for determining how much of your paycheck should go into financial markets—there’s no set rule about how much an individual needs to succeed. You don’t need to be an expert or know much about investing—nothing that a few hours of research won’t fix.

Read more: Three dividend stocks you should consider for 2023

You can do it yourself, but you can always hire a professional to help guide you through the process. You will have more success investing if you take the time to learn as much as possible before jumping in headfirst. Take it slow, start small, and build your knowledge base over time by reading books or watching YouTube videos. Just start.

Conclusion

Investing is not complicated. It’s actually very simple, and you don’t need a lot of money to get started. You just need some basic knowledge about how investing works and how it can benefit you in the long run. The sooner you start, the better off your retirement will be when the time comes for it. So what are you waiting for?

Comments

Post has no comment yet.