The perks of real estate

Real estate investing has been a popular approach for accumulating money for centuries, and it remains a viable alternative for investors today. Even though it may initially appear intimidating, investing in real estate may provide substantial rewards and development potential.

In this article, we will discuss many points of investing in real estate. Why people should consider investing in real estate, the ability to broaden one’s investment portfolio, the advantages of real estate as a hedge against inflation. There are also tax benefits of investing in real estate, and the increased investment control that comes with real estate investing.

Real estate has the ability to provide significant profits first and foremost. Real estate investors can generate earnings through appreciation. Typically, the value of real estate rises with time, and investors who purchase property at the right time and in the appropriate place can make substantial returns when they sell.

More to read: Midjourney V5 is out – how to make top quality pictures thanks to AI

In addition, rental revenue can offer a continuous cash flow that can be reinvested in the property or utilized for other ventures. Real estate investment can also be leveraged using borrowed funds to acquire properties and improve prospective profits.

Second, investing in real estate may be an excellent strategy to diversify one’s portfolio. Unlike stocks and bonds, real estate is a physical asset with actual value. This indicates that real estate investments are less subject to swings in the stock market and other economic factors. By adding real estate to their portfolios, investors could lower their total risk and boost their profits.

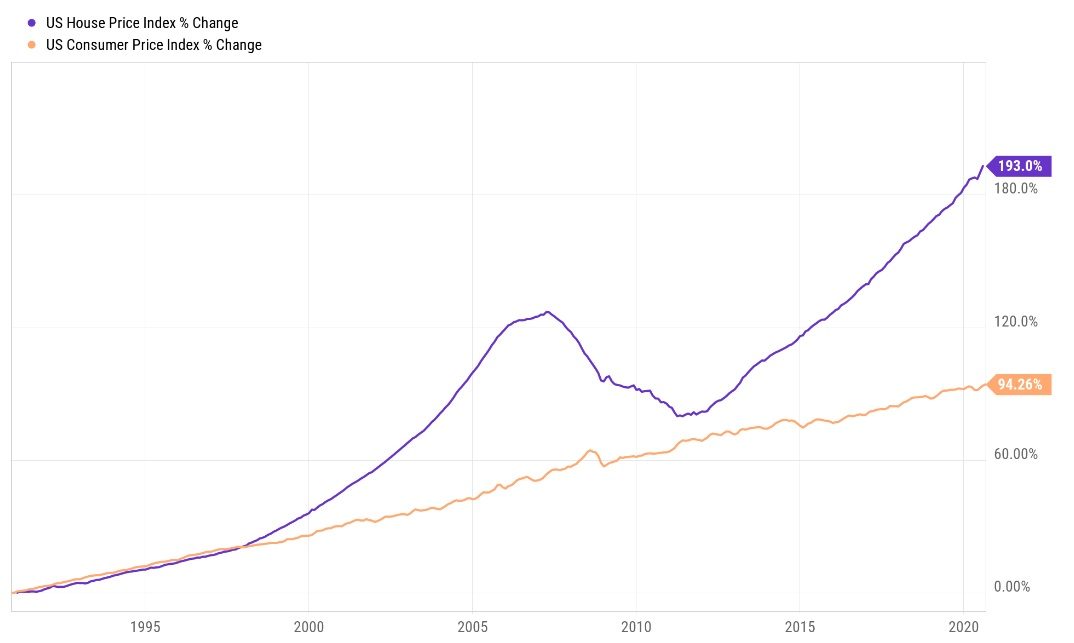

Moreover, real estate is an efficient hedge against inflation. When the cost of living rises, rental and property values also rise. This indicates that real estate investments may keep their worth over time, despite the declining purchase power of the currency. Moreover, rental income might provide a consistent cash flow stream to keep up with inflation.

Real estate vs CPI chart, source: awealthofcommonsense.com

Real estate investment also offers tax advantages that can lessen an investor’s overall tax burden. For instance, rental property owners can lower their taxable income by a significant amount by deducting depreciation and mortgage interest. Real estate investors can also employ tax-deferred swaps to avoid capital gains tax when selling one property and purchasing another. Furthermore, certain forms of real estate investments, such as Real Estate Investment Trusts (REITs), can offer investors tax-free income.

Investing in real estate ultimately offers investors greater control over their holdings. In contrast to stocks and bonds, which are vulnerable to market fluctuations, real estate investors may select the property, location, and financing conditions. This implies that investors may customize their investments to their individual aims and aspirations. In addition, real estate investing offers chances for active management, such as upgrading buildings to raise their value and implementing cost-cutting strategies to increase cash flow.

Dont miss: From bank run to depression – a vocabulary of financial doomsdays

Investing in real estate may be a wise and lucrative approach for accumulating money and safeguarding one’s financial future. Real estate investing offers a variety of advantages and growth opportunities, including the potential for high returns, the ability to diversify one’s portfolio, the advantages of real estate as an inflation hedge, the tax benefits of investing in real estate, and increased control over one’s investments. Real estate investment may be a lucrative and enjoyable method to generate long-term wealth; however, it may involve some study, knowledge, and careful thought.

Real estate investing for beginners

Beginners should first educate themselves on the fundamentals of real estate investment, including the numerous types of properties, financing choices, and legal and tax issues, before investing in property. That can be accomplished by reading books, attending seminars or workshops, or talking with real estate experts.

After a novice has a solid grasp of the fundamentals, they may begin searching for investment properties. It may require collaborating with a real estate agent, networking with other investors, or completing independent research. Again, it is crucial to consider location, condition, rental income possibilities, and appreciation potential while analyzing suitable properties.

Another interesting topic: Seven simple investment strategies to make steady returns

After identifying a property, the investor must acquire finance, if necessary, and negotiate the conditions of the sale. They will also be required to manage the property, which may entail tenant screening, repairs and upkeep, and rent collection.

In conclusion, real estate investors can, over time, amass a portfolio of properties, diversifying their assets and potentially creating substantial passive income. Yet, it is essential to remember that investing in real estate entails risk and requires careful planning and management.

Comments

Post has no comment yet.