US stocks went up after inflation data came in as expected. This gave investors hope that the Fed will only raise interest rates by a small amount next week.

Hurray for good data

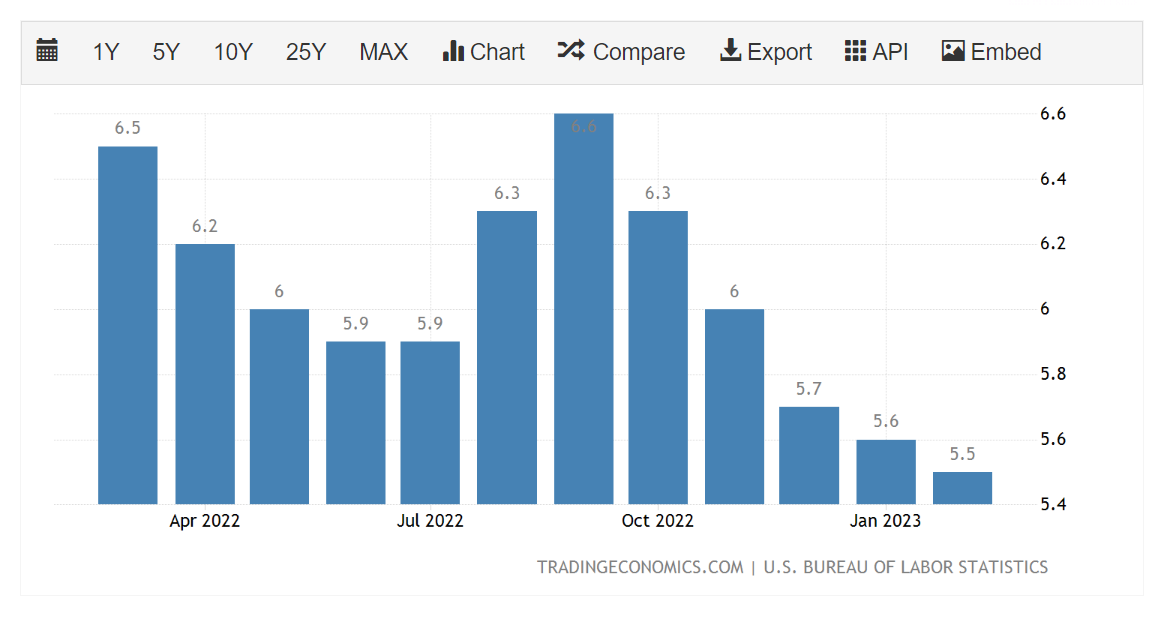

The fresh inflation data is in. Just as the analysts expected, inflation grew 0.4% over the previous month and 6% over the previous year, according to the Consumer Price Index (CPI) in February.

This is less than the 0.5% month-over-month increase and 6.6% annual gain seen in January. The 6% rise in inflation is the lowest increase in consumer prices in a year since September 2021.

More to read: From bank run to depression – a vocabulary of financial doomsdays

Analysts believed that “core” inflation, which doesn’t include the more volatile costs of food and energy, would go up 0.4% from one month to the next and 5.5% from February 2022 to the present. They were correct again. It went up 0.5% from the month before and 5.5% from a year ago. This is the lowest 12-month increase since December 2021. February year-over-year figure of the energy index went up by 5.2%. The food index went up by 9.5%.

US core inflation chart, source: tradingeconomics.com

As far as the main indexes go, S&P 500 gained 1.62%, with the Dow Jones up 1%. Nasdaq was the best gainer with more than 2% in the green on the close. Tech were pulling hard with Meta in the lead, as the social network announced another 10 000 job cut. Meta is up more than 7%.

Is banking re-gaining confidence?

These fundaments caused a rally in the banking sector, as Fed might hike less. SVB also gave a blow to the whole banking sector which might have Fed re-considering the rate hike.

Monday saw a decline in the share prices of major regional banks, while Tuesday saw a comeback. KeyCorp appreciated 10%. Comerica Inc increased by 3%, while PacWest Bancorp increased by 38%. The share price of First Republic Bank increased by 29%.

Also interesting: GBP/USD corrects yesterday’s gains, awaits US CPI

Traders, however, are not entirely clear on what will happen. The US dollar index closed flat, on the exact open price 103.207. EUR/USD also closed flat, with only a 0.1% gain.

The US dollar regained some of its lost value against the Japanese and Swiss currencies acting as a safe haven on Monday. USD/JPY ended up 0.75%, closing above 134 again. USD/CHF saw a slightly lower rebound, by 0.19% in the green.

Commodities are not enjoying the day

Oil is still feeling the banking sector’s sting. On top of that, Moody’s downgraded the sector’s rating, which sent the black gold even lower.

WTI crude closed at $71.33 a barrel, down $3.47, or 4.7%, from a two-month low of $70.94. Following WTI’s 2.4% decline on Monday, the US oil standard has dropped upwards of 7% since the beginning of the week.

Brent crude finished at $77.45, down $3.32, or 4.1%. Similar to WTI, Brent reached a two-month low of $77.05 earlier in the day. Since the beginning of the week, the benchmark crude oil price has fallen about 7%, with the 2.4% decline in the previous session.

Gold futures fell 0.43% on Tuesday, as traders pulled some of their gains. The yellow metal still remains over $1,900. Silver futures is similarly down 0.67%, closing at $21,777.

Comments

Post has no comment yet.