The Pound dipped slightly on Tuesday as investors took profits from the recent rally in anticipation of today’s another volatile event – US inflation figures.

UK jobs market remains strong

The latest data released by the Office for National Statistics (ONS) on Tuesday revealed that the United Kingdom’s (UK) ILO Unemployment Rate for January came in at 3.7% as opposed to the 3.8% expected, while the claimant count change showed a smaller-than-anticipated decrease for the month in question.

The number of individuals seeking unemployment benefits decreased by 11,200 in February, compared to a decrease of -12,000 projected and a decrease of -30,300 anticipated. In addition, the prior month’s data was corrected to reflect a decrease of 30,300 in the Claimant Count Change from the initial estimate of 12,900.

You may also read: From bank run to depression – a vocabulary of financial doomsdays

Today’s data helped to a greater extent to counterbalance a slowdown in UK wage growth statistics and has minimal impact on market expectations for more rate rises by the Bank of England (BoE) later this month, providing some support for the British Pound.

All eyes on US inflation today

On an annualized basis, the Consumer Price Index is predicted to dip to 6.0%. At the same time, the Core CPI, which excludes volatile food and energy costs, is projected to decrease to 5.5% from 5.6% in January.

Meanwhile, the headline monthly CPI figure is estimated to decrease to 0.4% in February from 0.5% in January. In the reporting month, the Core CPI is projected to remain unchanged at 0.4% MoM.

Since the Federal Reserve is dedicated to lowering inflation to its 2.0% target, the US CPI report will be most important. In addition, the Fed policymakers are in a “blackout period” before the March 22 meeting, so the inflation figures will have a significant market impact as they help the Fed evaluate the future policy course.

No more rate hikes?

In his appearance before the US Congress last week, Federal Reserve Chairman Jerome Powell supported a case for larger rate rises if incoming evidence warranted quicker tightening. Yet, the US banks’ collapse and conflicting job numbers dampened expectations for a more considerable Fed rate rise.

Goldman Sachs reduced its Fed rate rise forecast, predicting that the Federal Reserve would not raise interest rates at its meeting on March 22. Meanwhile, JP Morgan predicted a 25 basis point March Fed rate hike.

The Silicon Valley Bank (SVB) debacle caused a reassessment of traders’ expectations for the US interest rate trajectory, with rate reduction by the end of 2023 being factored in.

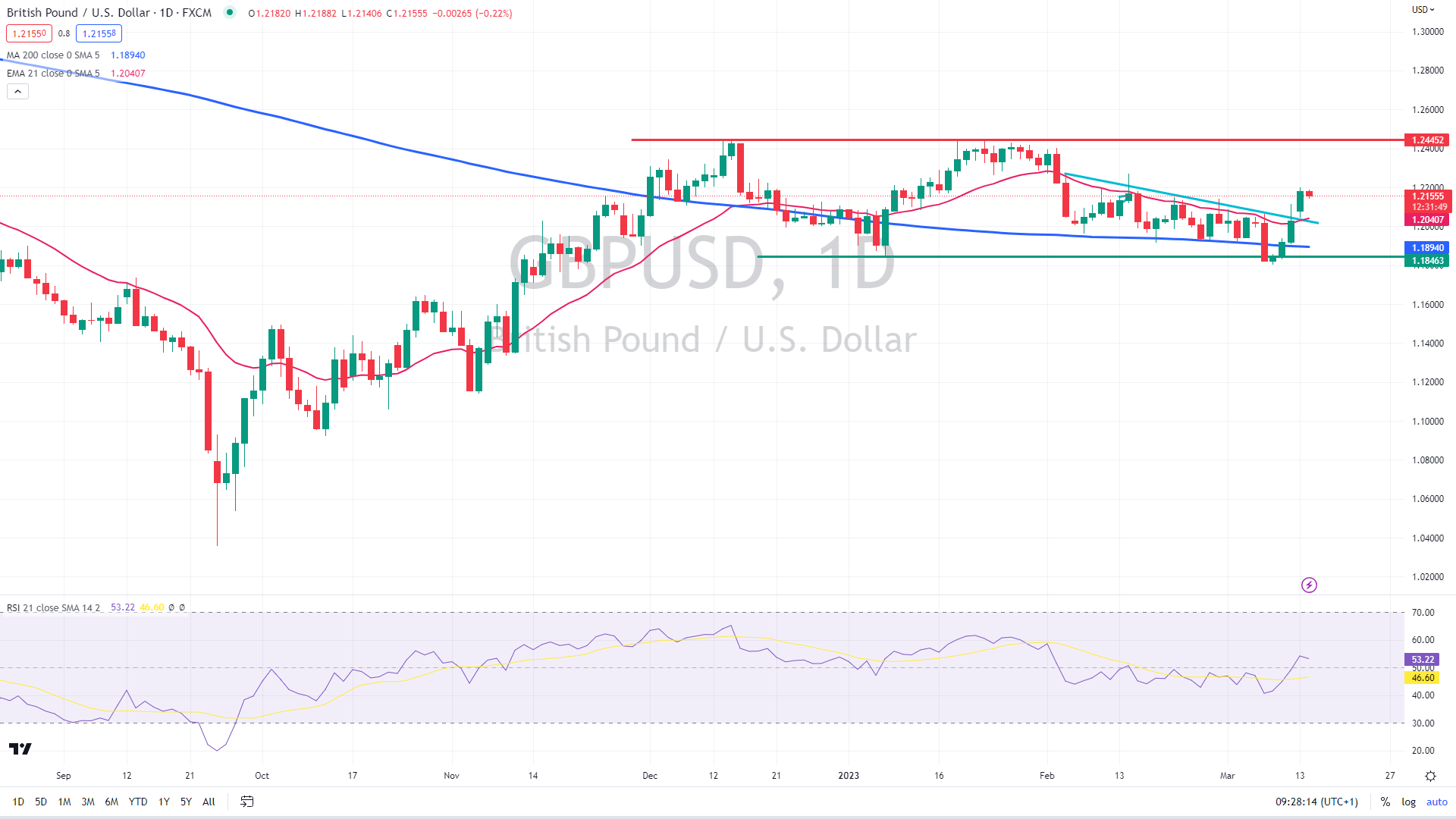

The breakdown below previous lows and the 200-day moving average turned out to be a bearish trap, with a strong rally starting afterward. Currently, the pair seems bullish as it has jumped above the downward trendline of the triangle pattern, likely triggering a new bullish wave toward 1.2450.

GBP/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.