Traders are cautious before the next big data

Although investor mood remained cautious ahead of the new inflation data coming Wednesday, the Dow was the star of the indices on Tuesday. The gain has been led by cyclical sectors of the market including energy and financial stocks.

The S&P 500 ended the day unchanged, the Nasdaq dropped 0.4%, and the Dow Jones 0.29%. Even though investors continue to worry that a weakening global economy could hamper energy consumption, energy stocks continued to lead the upward trend as oil prices piled up gains.

The largest gainers in the energy sector included APA Corporation, Devon Energy Corporation, and Halliburton Company, all of which had gains of about 2%. While big tech moved off its lows, it was still mostly under pressure. Microsoft was down 2% as China and the US debated whether to impose regulatory oversight of services using generative artificial intelligence.

More to read: Apple turns higher, remains bullish, and eyes next resistance

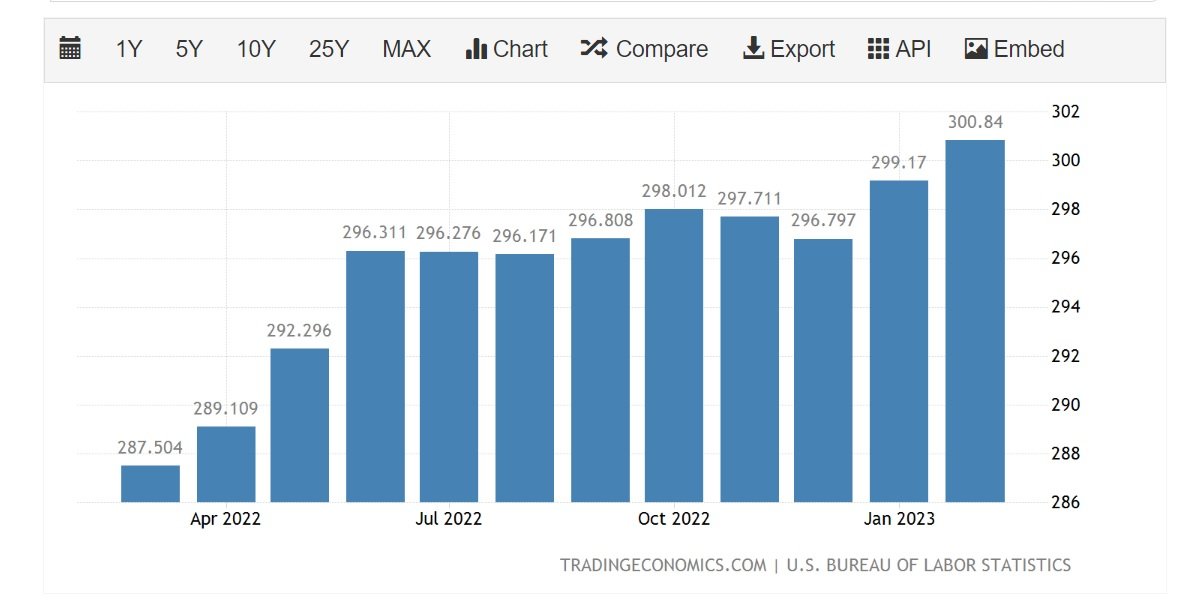

The increase on Wall Street comes only one day before crucial inflation data, which is anticipated to reveal that price pressures remained persistent in March, raising the possibility of another rate hike by the Fed next month.

US CPI chart, source: tradingeconomics.com

The US dollar moves lower with Fed clarity

The dollar dropped on Tuesday as traders awaited inflation statistics to see whether there were any more indications that price pressures were subsiding and what that may signify for future Federal Reserve interest rate increases.

On Wednesday, consumer price figures are anticipated to show a 0.2% increase in headline inflation and a 0.4% increase in core inflation for March. At its meeting on May 2-3, the Fed is anticipated to raise rates by an additional 25 basis points before halting in June.

Also interesting: What should you look for in a crypto broker?

The dollar index decreased by 0.26% closing at 102.20. The Aussie gained, closing in the green by 0.25%. The euro managed to close with a green finish against the greenback with a 0.41% increase at 1.0906.

After spiking on Monday as Bank of Japan governor Kazuo Ueda suggested no rush to wind down its huge stimulus, the dollar nudged higher versus the yen. At 133.73, the dollar was recently up 0.08% against the yen.

Oil got a second significant boost since the cuts rally

On Tuesday, WTI oil prices increased by nearly 2% to $81.55 per barrel as investors prepared for data that would reveal additional reductions in US oil and gasoline stockpiles. Additionally, a declining US dollar makes oil less expensive for investments using other currencies.

You may also like: 5 things to know before the stock market opens

West Texas Intermediate at $81.53 a barrel after rising $1.79, or 2.2%. Brent for the London market ended the day at $85.61, up $1.43 or 1.7%. Brent’s session high of $85.67 edged closer to the all-time high of $86.44 reached on April 3rd.

Gold futures are safely handling the prices above $2,000 again, with the yellow metal closing 0.76% higher at $2,019. Silver futures also cling onto the above $25 levels, with a 1% green close at $25.185.

Comments

Post has no comment yet.