A guide for investors

The world of the stock market is dynamic and complicated, requiring ongoing awareness and comprehension. To make educated choices about trading and investing, it is crucial to stay informed about current news and market patterns.

We’ll go over 5 topics in this piece that every investor should be aware of before the stock market opens.

Market futures

The futures market is one of the most crucial items to monitor before the market opens. Futures contracts are arrangements to purchase or sell a particular commodity at a specific price in the future. In the instance of the stock market, futures contracts let buyers make predictions about the index’s future price.

Investors can get a sense of the stock market’s performance for the day by examining the futures market before the market starts. The stock market will probably start higher if the futures market is showing a favorable trend, and vice versa.

More to read: Owning vs. renting – what is preferred choice of younger generations?

Market futures are agreements that let investors purchase or sell a preset quantity of a financial product at a fixed price at a later date. These contracts are frequently used as a safeguard against possible losses, and to speculatively predict future market trends. A broad variety of financial assets, including stock indices, commodities, and currencies, are accessible as futures contracts.

Economic indicators

Economic indicators are data that tell us how well a business is doing. These factors can significantly affect stock market trading because they can influence investor mood and give information about the state of the business as a whole. GDP, inflation, interest rates, consumer expenditure, and job figures are a few instances of economic metrics.

Economic indicators are closely monitored by traders and buyers because shifts in these indicators can indicate future market patterns. For instance, a rise in interest rates may be a sign that the economy is expanding and may cause asset values to rise. A decrease in customer purchasing, on the other hand, might signify a weaker economy and cause stock prices to drop.

Also interesting: How to invest in real estate

Traders and investors can get a better understanding of the condition of the economy and decide on their assets by keeping an eye on economic indicators. Economic indicator updates are frequently provided by financial news sources, and traders frequently use specialized software and tools to monitor and evaluate these indicators in real-time.

Company news

Before the stock market opens, investors and traders should give close attention to business news. The equity price can be significantly impacted by news about a company’s profits, new product releases, mergers, and acquisitions. Investors can learn more about a company’s performance and determine whether it represents a decent investment chance by following the newest news.

You may also like: Recession: what is it and how to protect against it?

Earnings reports, the introduction of new products, mergers, and acquisitions, and management or leadership shifts are a few examples of this news. Stock values can increase in response to good news like robust earnings reports or the introduction of new products.

They can fall in response to bad news like disappointing earnings or management changes. To make wise investment choices, traders and investors frequently pay careful attention to corporate news. They may also change their positions in response to this news.

Global events

Global events can have a significant influence on the stock market. Traders and investors need to be aware of them in order to make wise financial choices.

War, terrorism, and natural catastrophes are just a few examples of geopolitical occurrences that can have a big influence on the stock market. The stock market may be impacted by these events because they may interrupt supply networks, alter customer behavior, or modify governmental policies.

Next topic for you: How to invest $100,000? Read this before you do so

Social events, such as changes in consumer behavior and demographic shifts, can also affect the stock market, as they can impact the demand for products and services. Environmental events, such as natural disasters and climate change, can disrupt supply chains and affect the operations of companies, leading to changes in stock prices. By staying informed about global events, traders and investors can make more informed decisions about their investments.

Technical analysis

Before the stock market opens, buyers and sellers should also take technical analysis into account. Technical analysis is the process of analyzing historical market data to spot patterns and trends using graphics and other instruments.

Investors can obtain insight into how the market might behave in the future by examining past data. For buyers seeking to make short-term purchases, such as day traders, technical analysis can be a helpful instrument.

More like this: Can debt be good for personal finance?

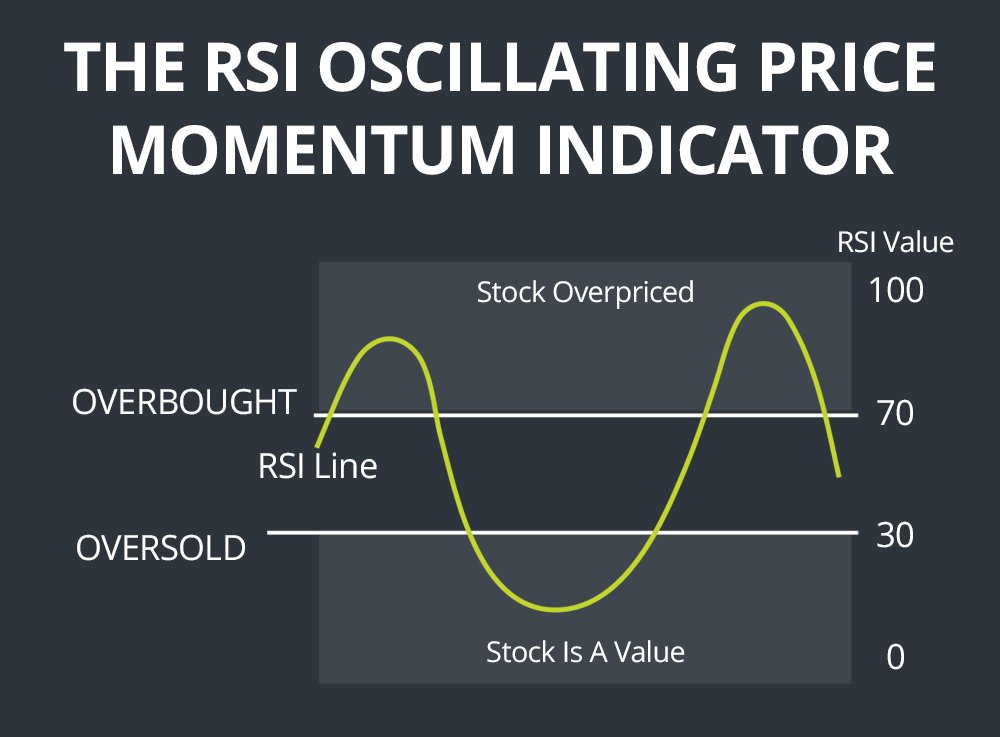

Technical experts contend that it is possible to forecast future price changes by using historical market patterns. They search for trends in market data that might point to a tendency, like a rise or a fall in price. Trend lines, moving averages, and technical indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence are some of the instruments used by technical analysts to evaluate market data. (MACD).

RSI indicator guide, source: scanz.com

The notion that markets are not random and that price movements are not solely dependent on fundamental variables, such as business profits or economic statistics, is one of the core tenants of technical analysis. Technical experts, on the other hand, think that market players, like traders and buyers, affect the market based on their feelings, convictions, and expectations.

Final words

In conclusion, traders should monitor market forecasts, economic data, business news, global events, and technical analysis before the stock market opens. Investors can make better financial choices and successfully navigate the complex stock market environment by being aware of these important variables.

All of these will help achieve goals, whether you are trading as a hobby, or a means to achieve serious wealth goals. Remember, your chances grow with preparation.

Comments

Post has no comment yet.