The S&P 500 index traded lower for the third consecutive day as investors are digesting the recent wave of weaker US macroeconomic data.

Labor market deteriorates notably

During the week ending April 1, there were 228,000 initial jobless claims, according to weekly statistics released by the US Department of Labor (DoL) on Thursday. The prior week’s reading was corrected from 198,000 to 246,000.

The advance seasonally adjusted insured unemployment rate was 1.3%, and the 4-week moving average was 237,750, a decrease of 4,250 from the prior week’s corrected average.

You may also read: EUR/USD continues toward 1.10 – will bulls breach it?

The DoL further said that the number of continuous claims for the week ending March 25 was 1,823,000, an increase of 6,000 from the previous week’s revised level.

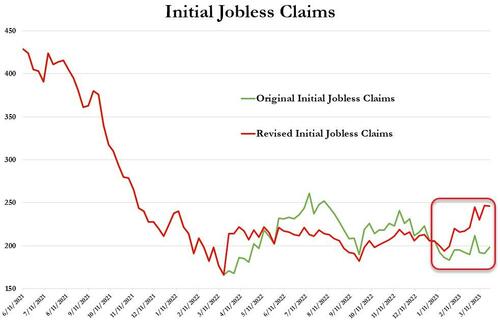

The so-called “adjustment” is seen below, as the previous three months have witnessed huge upward revisions. Last week’s claims were 246,000, revised from 198,000; the week before that, 247,000, revised from 191,000; and the week before that, 230,000, revised from 192,000. The labor market does not seem so solid anymore.

In a letter, Goldman Sachs calculated that seasonal factor distortions had “depressed reported seasonally-adjusted initial claims by 40,000 to 50,000 and concealed a roughly 45,000 increase in the official series since the beginning of the year.”

As a result of the COVID-19 outbreak and the ensuing difficulty in locating labor, employers have been hesitant to send workers home. The labor market is anticipated to soften in the second quarter as employers respond more to the Federal Reserve’s interest rate rises, which have slowed demand.

In light of this, the ADP private payrolls data released on Wednesday was lower than anticipated, adding to indications of a cooling labor market after US job vacancies plummeted to their lowest level in almost two years in February.

Investors remain concerned ahead of the official employment data, which will be announced on Good Friday when equities markets are closed. Analysts anticipate the economy added 239,000 jobs in March, a decrease from February and another indication that the many rate rises are negatively influencing the economy.

Another interesting topic: Natural gas experiences the worst quarter ever – more decline coming?

President of the Cleveland Fed Bank Loretta Mester stated on Wednesday that it is too early to tell if the central bank will need to raise its overnight benchmark rate in May. She also predicted that the Fed’s policy rate would rise above 5% and that the real Fed funds rate would remain in positive territory for some time.

Chart-wise, the index is now testing previous swing highs in the $4,060 area. If that level is defended, the bull market can continue, likely targeting February cycle highs in the $4,150 area.

S&P 500 daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.