In the last macro article, we researched into the problems and reasons why the SVB Financial Bank went out of business. On the asset side, we can say that it was doomed because of bad management, which led to unhedged bond portfolios.

On the liability side, clients quickly started to pull out their deposits, which was the reason to force sell of bonds with realized loss. As other small banks failed as well, the Fed, along with the FDIC and the Treasury, started working right away on a solution and possible short-term liquidity, which brought the balance sheet to stars once again.

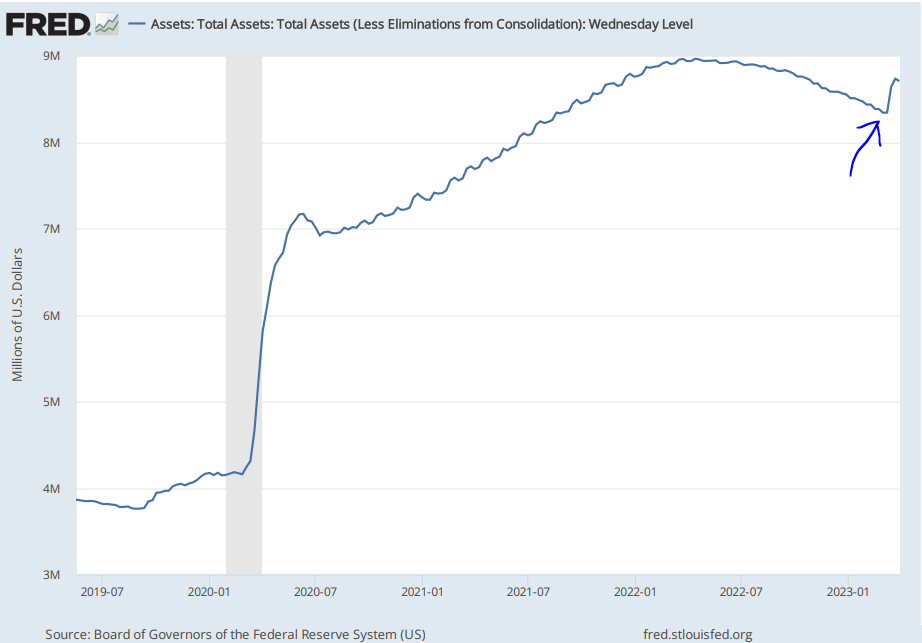

Total assets (Fed´s balance sheet), source: FRED

Fed´s balance sheet on a rise – what does it mean?

As the chart above shows, a lot of people were worried when the Fed’s balance sheet started to grow very quickly. It cut more than half of QT’s (quantitative tightening) work in the last three weeks. We think that a lot of analysts and people are wrong when they think that QE (quantitative easing), also known as “printing money,” is back. But we think it’s important to look at the Fed’s balance sheet to find out why the balance sheet grew and which part of the assets side did.

Examine our research on why the SVB failed – Silicon Valley Bank: Bankruptcy as a result of poor management

“QE,” which stands for “quantitative easing,” is tied to central banks buying bonds to bring down long-term interest rates and boost the economy and inflation expectations. It’s an indirect injection of cash, but with central banks buying bonds. It has also very great impact on commercial bank´s balance sheet, but its the theme for another article.

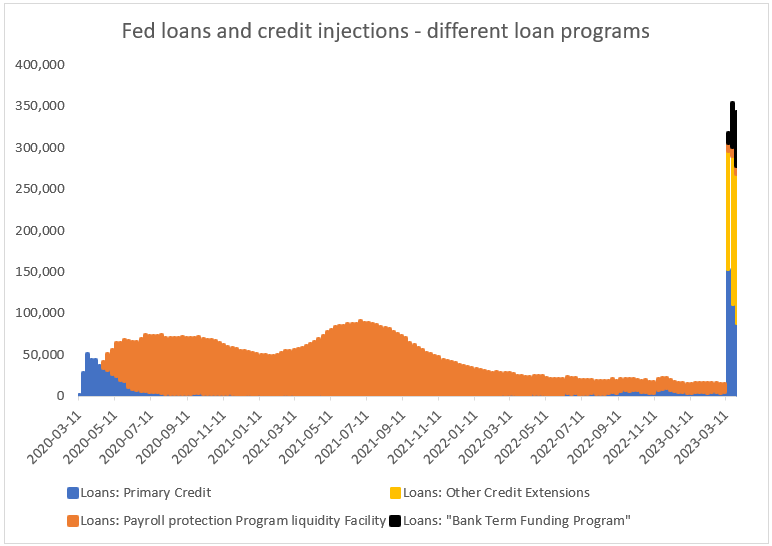

In recent years, the Fed’s balance sheet was mostly associated with the QE era, which grew rapidly after COVID-19 broke out in 2020. At that time, every bank tried to pump liquidity into the markets via special loan programs and financial system by lowered interest rates and buying huge amounts of bonds (as a result of very loosened central bank policy).

Increased Balance Sheet is a result of loan injection – its not QE

Almost all of the “securities held outright” (orange) on the Fed’s balance sheet are securities that were added to the central bank’s balance sheet during the massive QE programs of the past. The chart above shows the difference between “securities held outright” (bonds, MBS, and other assets that can be seen as a result of QE) and “Liquidity and Credit Facilities: Loans,” which is another important tool for increasing liquidity.

What is going on with Deutsche Bank: Deutsche Bank bleeds as contagion spreads

These programs just give out different kinds of credit, mostly in the form of loans, so it’s not like printing money. The Fed is willing to lend money to financial institutions as long as they meet certain requirements, such as putting up collateral and paying interest. Many times, the interest rate is equal to or even higher than the current Fed Funds Rate. This makes it so expensive for banks to get this kind of capital. As the last chart shows, the number of loans has gone up a lot in the last few weeks and is still going up.

Asset side – loans vs. securities in Fed´s balance sheet portfolio, source: Investro analytics team

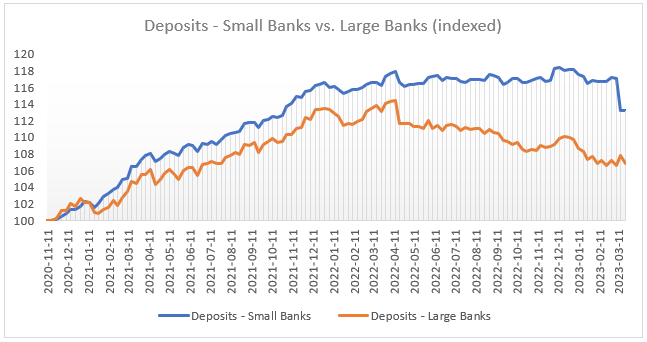

Deposits in commercial banks are declining significantly

Most of these loans went to regional and smaller banks, but some went to larger banks as well, to help them get back on their feet after losing a lot of deposits. This was due to the SVB bankruptcy via psychological effect and how it made people feel about other banks, as well as a result of the Fed’s tightening policy, which is making people save less.

In the last two to three weeks, liquidity problems in regional banking have had a big effect on the balance sheets of US commercial banks as a whole. Because of this, more than -$220 billion worth of deposits have left US banks in the last three weeks.

Development of deposits in small and large banks – indexed data, source: Investro analytics team

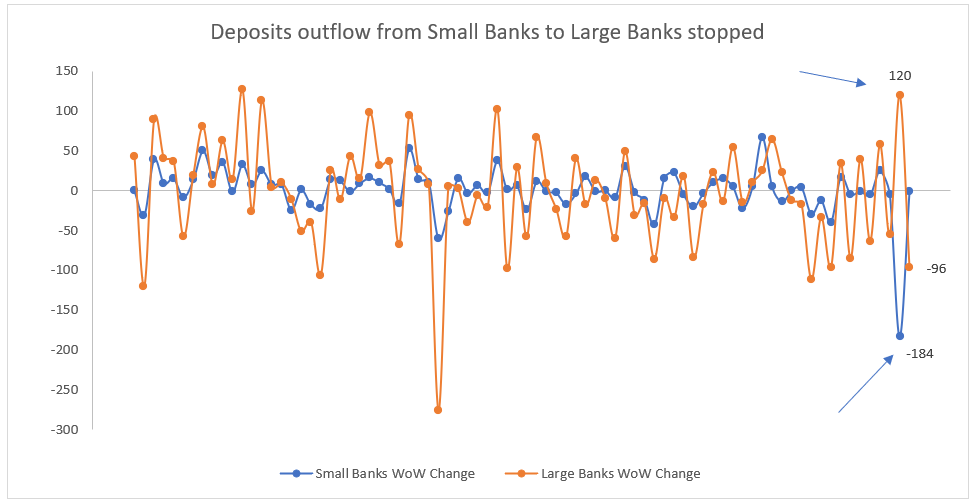

Looking more under the hood one can notice WoW changes and a very solid deviation from the trend, when small banks (SB) faced a significant outflow and large banks (LB) a great inflow in deposits. It meant that deposits and clients were cautious and move its deposits to the larger and more safe banks. Now, it seems as outflows from SB stopped, but large faced solid outflow.

Inflow/Outflow analysis of small and large banks, source: Investro analytics team

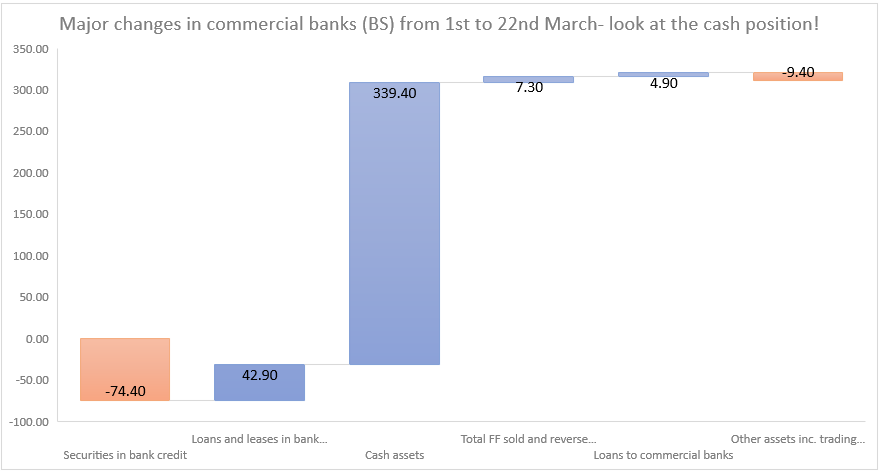

Commercial banks boosting its cash position

That´s not all. Looking at the changes in CB BS from 01th to 22th March, one can spot very unusual moves. Its like a preparation for a bank run. Look at the stunning increase in cash position. Almost entirely increase of commercial banks´ balance sheets is halted by increased cash position.

Major changes in CB balance sheets from 1st to 22nd March reveal the big caution in assets, source: Investro analytics team

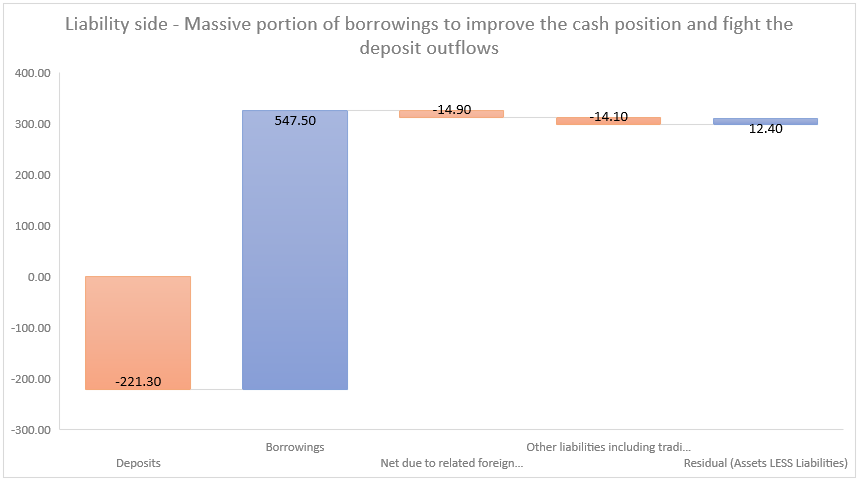

Okay, but where did all of these dollars come from? In a nutshell. CB had mainly borrowed from Fed and other market players. It is visible in liability side – borrowing section. The risk aspect makes this abundantly clear. Nearly $550 billion had been borrowed from the Fed and other entities to stem the flow of deposits (-$221 billion) and strengthen liquidity (the increase in cash position) ahead of a possible bank run.

Major changes in CB balance sheets from 1st to 22nd March – liabilities side, source: Investro analytics team

A liquidity injection from Fed – Bank Term Funding Program

The Bank Term Funding Program (BTFP) helped with the liquidity problems caused by withdrawal requests by providing more funds to depository institutions. Banks, savings associations, credit unions, and other qualified depository institutions can access loans from the BTFP for a year if they pledge U.S. Treasuries, agency securities, or agency mortgage-backed securities that the Federal Reserve Banks may acquire in open market operations at par value.

Learn from the best: How is Warren Buffett investing – top picks of legendary investor

As the BTFP may offer liquidity against high-quality assets, there will be no need to sell them during a crisis (as was the SVB´s case). To rephrase, banks can park their assets in the Fed’s accounts and get paid back in the event of losses on the asset side due to their portfolios, which is caused by the duration effect of Treasury and MBS securities and a lack of hedging (using swaps to protect against interest rate risks).

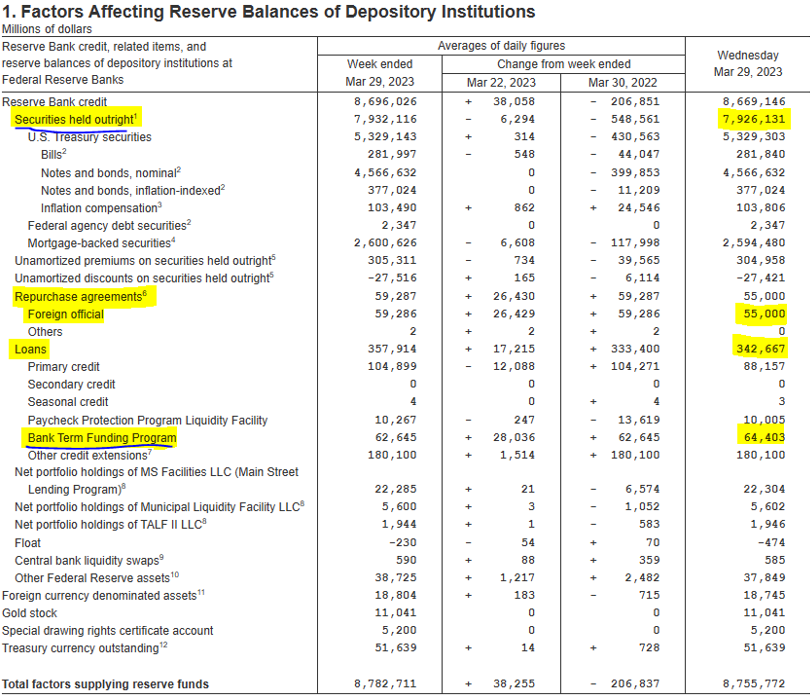

See the Fed’s asset side of the balance sheet and its major drivers in more detail down below. Bonds, notes, MBS, and other assets make up the bulk of the Fed’s BS, but loans, to which the Bank Term Financing Program specifically belongs, are also a significant component.

Asset side of Fed´s balance sheet, source: Investro analytics team

Let´s explain the program in example as stated in SA. Notwithstanding the loan type, as previously stated, the assets are valued at par, which means they are valued at the original purchase price (adjusted for losses). For instance, let’s say you paid $100 000 for long-term Treasury securities and had a $10 000 unrealized loss. As a result, the fair value is $90 000 rather than $100 000, but the Fed considers it to be at par and is only interested in the purchase price. It is only recognized as currency.

The problem is that since the Fed wants a greater rate of return on this loan, such a plan is completely unprofitable for banks over the long run. Looking more at “loans” provided by the Fed to commercial banks and other financial institutions, one can see that BTFP is not the only program that is highly used by financial institutions.

Fed loans and credit injections, source: Investro analytics team

While the headlines emphasized mainly the BTFP, it is not absolutely true. BTFP is shown in black in the chart above. Look at the different programs, which had been used in the previous crisis, such as Primary Credit and “Other Credit Extensions”. Although these numbers are stunning and massive, such liquidity has been indirectly injected into financial institutions. But don’t forget, it’s not QE; such tools are linked to loans, which force banks to be more cautious and tighten conditions. We believe it will lead to lower bank profitability.

Comments

Post has no comment yet.