Investing has been around for centuries, and it is a way to put interest on your money. The modern world allowed the creation of many different forms of investing, but one of the most time-tested and used methods is investing in stocks.

Investing is how you avoid inflation to depreciate your money and slowly put interest on it instead. There are numerous choices on how to invest in the stock market regarding risk, time and asset type. So how to get into stocks? This article will guide you through the most essential basics.

Stock investment introduction

While many people think that the stock market is “only for the rich,” the opposite is true. Investing is how rich people stay wealthy, but it is also a way how to put interest on your money, even if it is just a couple of hundred or thousands of dollars. The stock market has proven over time as one of the best ways to beat inflation and earn profit in the long run. However, there are risks involved that people need to consider.

Understanding the stock market

If you are not a Vegas type, Investro is exactly for you. And if you are, so be it 🤷♂️ 😎

➡ https://t.co/GO8D6xqguH ⬅#forex #commodity #crypto #stocks #market #trader #trading #investing #commodities #cryptocurrency #finances pic.twitter.com/RhpbjNuVTR

— Investro.com (@investrocom) October 3, 2022

Buyers and sellers of stocks connect, communicate, and conduct business on the stock market. The markets provide price discovery for stock in firms and act as a barometer for the state of the national economy. Because market participants compete in an open market, buyers and sellers may be sure that they will receive a fair price, a high level of liquidity, and transparency.

Also read: Everything you need to know about Ethereum Merge

The safe and controlled environment that stock markets offer allows market players to engage confidently in shares and other permissible financial instruments with little to no operational risk. Initial Public Offerings (IPOs) on the stock market enable businesses to issue and sell their shares to the general public for the first time. Involving investors in this activity allows businesses to obtain the funding they want.

History of the stock market

The London Stock Exchange was the first stock exchange, and it got its start in a café where traders gathered to trade shares in 1773. The first stock exchange in America operated in Philadelphia in 1790. The Buttonwood Agreement, which gave its name after the buttonwood tree under which it was signed, started New York’s Wall Street in 1792.

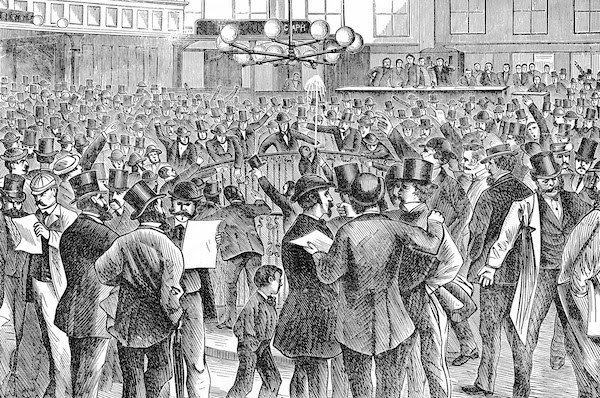

New York Stock Exchange in 1817, source: link

The document, which was signed by 24 traders, established the first securities trading association in the United States. In 1817, the traders changed the name of their company to the New York Stock and Exchange Board. From there, stocks started becoming more popular with time.

What do you need to know about stocks?

The main thing to understand is that stocks buy you a share in the company. That’s why they’re also called “shares.” Being a shareholder means you receive dividends if the company pays any, and you can partake in the company’s growth. Stocks like Facebook, Google, Apple, Amazon, PayPal, and many others delivered fantastic returns to those who decided to allocate them to their portfolio.

You can buy shares in one or a few companies or create a portfolio of 10-20 stocks to lower the risk. However, it is recommended that investors don’t “overdo it.” Diversification means splitting your investment into several assets, and while overdoing it can lower the risk even more, it will also halt the potential profit. This is how great investors like Warren Buffett or Peter Lynch achieved above-average market returns.

Warren Buffet, source: link

About stock indices

They didn’t invest in 100 stocks. You can do that by buying S&P 500 index or DAX 40, and you don’t even need to pick stocks by yourself. The proper diversification lies in approximately 20 assets, but opinions on this matter will differ greatly. What is very important to know about the stock market is the fact that US stocks are the best performing out of all in the world.

Read more: What is Uniswap – the leader of decentralized exchanges

Comparing European, American or Asian stock indices, US indices like Nasdaq, Dow Jones, and S&P 500 perform the best out of all because the whole world invests in America. People put their entire savings or retirement money into these indices because they’ve proven to rise in the long run, as the best companies in the world are in these stock indexes.

Risks of the stock market

What it's like to be an investor in 2022 😅#invest #crypto #memes #btc #eth pic.twitter.com/i6s0lhoPkw

— Investro.com (@investrocom) September 28, 2022

Investing is a commitment to put money down today in order to achieve a specific financial goal in the future. Risk can be classified into many different categories, with some asset classes and financial products being intrinsically riskier than others. Risk is a component of all investing. There is always a chance that your investment’s value won’t rise over time.

Blue-chip stocks

How to manage risk in order to accomplish financial goals, whether they be short or long-term, is thus a crucial factor for investors to take into account. One of the least risky stocks are blue-chip stocks like Coca-Cola and McDonald’s, as they are not prone to recessions. Whether there is a crisis or not, people will always want Coca-Cola or a happy meal. Even if these stocks fall, they always return stronger than ever and pay dividends to their stockholders.

Cyclical stocks

Then there are cyclical stocks like Apple, Meta, PayPal, and other tech companies that surge in value during economic prosperity but suffer when an economic downturn occurs. So while Coca-Cola’s share may make you 10% yearly in the long run, Apple’s stock can earn you 25% yearly. Moreover, if you add a compound interest to that, those returns may get even higher.

Penny stocks

The riskiest investing of all in the stock market are penny stocks. These companies have a very low valuation of just a few million dollars or tens of millions of dollars. These companies either failed to grow their business operations or fell over the years so much that Nasdaq or S&P removed them from its index and put them on the OTC (over-the-counter) market.

Stocks vs other asset classes

To better understand stocks, let’s look at the differences between stocks and other asset classes like real estate, Forex, cryptocurrencies, etc.

Stocks vs Forex

People should not mistake investing for trading. Investing is buying an asset with the believe it will appreciate in value in the long run. Trading is an action where a trader tries to profit from volatility in the markets. That is why stocks are for investing, although they are also heavily traded too, and forex is solely for trading.

Fiat currencies like euro or the US dollar are not assets. They are a way how to pay for goods and services or invest in assets. Fiat currencies do not appreciate in value in the long term as stocks do. If something, they depreciate because of inflation and if central banks decide to print more money.

Stocks vs real estate

Real estate is considered safer than stocks because of its smaller volatility, but it also has lower liquidity, which means it takes more time to sell or buy real estate. There are also significantly higher costs connected to investing in real estate. Real estate can also fall in value, as people experienced in 2008 and 2009. The same is happening in 2022, and it may continue throughout 2023.

People can actually invest in stocks and real estate at the same time by buying stocks that are focused on properties like Toll Brothers. Moreover, money can be invested in REITs (Real Estate Investment Trusts), which are companies that own many types of real estate, commercial buildings, offices, hotels, etc. Most REITs are publicly traded as stocks and have high liquidity compared to real estate.

Stocks vs commodities

While stocks rise in the long run, commodities are cyclical and do not move in the same way. For example, we’ve seen oil prices fall below zero in 2020, then rise above $100 in 2022. Now oil is traded at around $84 and keeps jumping up and down without stable growth like Apple’s stock. Many investors are gold believers, but history says gold has much smaller returns in the long-term than stocks.

You might want to read: What is Decentralized Finance (DeFi)?

Nevertheless, commodities can be traded through many instruments like CFDs (contracts for difference), futures, forwards, ETCs (exchange-traded commodities), ETFs (exchange-traded funds), etc. And yes, commodities can be traded as stocks, too, as there are big companies mining oil, gas or metals. These companies are Exxon Mobil or Shell, offering yearly dividends besides stock returns.

Stocks vs cryptocurrencies

Stocks have been around for centuries, while cryptocurrencies were created in 2009 and are only becoming mainstream in the last few years. Cryptocurrencies undoubtedly offer higher potential returns as their market capitalization is still relatively small, but they also possess higher risk. In addition, they are a new kind of asset class that is considered unknown and is prone to hacks, pump and dump movements and miss tax and legislative clarification.

Many stocks will probably never return to their all-time high levels, but there are more cryptocurrencies that will not return as well. Several cryptocurrencies like Bitcoin and Ethereum rise in the long-term and make a new all-time high every few years, but most of the cryptocurrencies fail to do so. As cryptocurrencies are becoming mainstream, their positive correlation with the stock market is increasing over time.

How to get started

Before you commit to investing or trading the stock market, make sure you take several steps. First, considering you want to get a certain return on your money for your whole life, you must define your risk tolerance, investment goals, investing style, broker and other aspects.

Guess where you can achieve this goal very easily? Follow us & stay tuned ✊

➡ https://t.co/GO8D6x8FD9 ⬅#forex #commodity #crypto #stocks #market #trader #trading #investing #commodities #cryptocurrency #finances pic.twitter.com/TVb7pmTzlv

— Investro.com (@investrocom) September 14, 2022

1. What’s your risk tolerance?

While many investors focus on potential profit, they forget to think about the risk. That was primarily true in 2022 when almost all investors’ portfolios are down. So how do you make money in the stock market? By taking risks, but calculated risks. Define your risk tolerance or how willing you are to take the potential of losing money if you invest.

Stocks can be divided into a number of categories with different risks. If you’re a risk taker, you can invest in technological stocks, new companies that entered the stock market, or even participate in wallstreetbets ideas. However, if you want the least possible risk, focus on blue-chip and value stocks with low volatility and dividend payouts.

2. What are your investment goals?

Investment goals and expectations are very important. Your goal may be to increase the amount of money in your account or protect your wealth against inflation. On the other hand, your goal might be speculation with a dream to get rich. The goal may include funding your retirement, buying a house, or making as much as you can for your kids. Make sure you are honest with yourself and realistic with expectations.

3. What is your investing style?

You can buy an endless number of stocks in the stock market, but you only need a few to make a profit. While some investors like the approach of “set it and forget it,” others desire to manage their money actively. Though your choice could vary, choose a strategy to begin with. So how to invest in a stock market?

- You can buy undervalued stocks like Warren Buffett and hold them for decades.

- You can also regularly change your portfolio and invest actively, but this approach is only going to work for you if you’re willing to put the time into this.

- If you’re only in this to compound and accumulate your wealth with the least risk possible, you can buy indices through ETFs (exchange traded funds), mutual funds or combine stocks with bonds to lower the volatility of the portfolio.

Of course, there are endless ways to invest, but these are the most popular investment styles adopted by many.

4. How should you invest money?

While you can buy ETFs by yourself with little cost, you can also let your financial advisor help you manage the portfolio. You can also put interest on your money by giving the money to your broker or a robot-advisor that is automated and costs less than a typical broker or financial advisor. People with six-figure wealth and higher can also invest in hedge funds or other wealth management companies.

Costs and fees of investing in stocks

Every platform you will ever use applies fees or commissions to execute your orders: some charge less, and some charge more. If you open an account at an online broker like Interactive Brokers, you will pay a few cents or dollars on every purchase, depending on your trade size. ETFs will charge a small yearly fee, like 0.3% or 0.5%.

A financial advisor may take an upward fee of several percent from your investment and then a little yearly fee. Hedge funds typically take 1% to 2% yearly and are part of your future profits. For example, the very famous Medallion fund took a 5% management fee and a 44% performance fee.

Bottom line

You can invest in stocks with a relatively small amount of cash if you’re just getting started as an investor. You’ll need to complete your research to determine your investment objectives, risk tolerance, and the expenses related to stock investing.

Once you do, you’ll be in a good position to benefit from the significant financial upside that stocks can offer you over time.

Comments

Post has no comment yet.