The recent events brought enormous volatility to financial markets, which caused even the largest stablecoins, in terms of their market cap, to depeg.

But wait, what is a depeg?

Stablecoins, such as Tether (USDT) and USD Coin (USDC), are backed one-to-one with the US dollar by keeping their reserves in dollars or in short-term US securities. Sometimes, these stablecoins depeg, which means the stablecoin is worth less than a dollar.

Related article: Are we in contagion, bank run or recession? What do the experts say?

A short-term depeg was a common event when stablecoins were relatively small, which was kind of acceptable. However, depegs are very worrisome nowadays as they handle transactions worth trillions of dollars.

Stablecoins that depegged

Recently, even USDC depegged from $1 to $0.9. That means if some investors bought it at $1 and panic sold at $0.9, they lost 10% of their capital. USDC is not alone, as most people remember Terra Luna’s collapse in 2022.

It was one of the biggest cryptocurrencies (LUNC) in terms of market cap and the largest algorithmic-backed stablecoin (USTC) on the market before it crashed. Since then, volatility does no good to other stablecoins as well.

USTC/USD chart, source: coinmarketcap.com

Binance USD, or BUSD, didn’t depeg but was forced to cease its operations in the upcoming months because of regulatory pressures. DAI, the fourth largest stablecoin also depegged by 10% from $1 to $0.90 on the 11th of March. This was DAI’s most significant depeg to the downside ever recorded.

DAI/USD chart, source: coinmarketcap.com

The list goes on, as USDD also fell with other large stablecoins, but almost all of them fully recovered back to parity (1:1). The common signs amongst all stablecoin depegs are extensive volatility and falling crypto prices. But is it really just that?

USDC depeg explained

The most notable news that spread fear across the crypto space was the fact that Coinbase, the company behind USDC, confirmed $3.3 billion stuck at the now-bankrupt Silicon Valley Bank (SVB).

Binance along with Coinbase immediately suspended USDC conversions due to unusual market turbulence. Coinbase also confirmed that around $240 million got stuck at Signature Bank crash, but funds should be safely returned sooner or later.

Read more: Another crypto giant goes under – Silvergate’s crisis explained

However, if Circle’s stablecoin is actually backed 1:1, there should be around $40 billion in total in this stablecoin. The $3.54 billion stuck at banks should not be disastrous as it represents less than 10% of the company’s assets. Still, the severe damage caused the company to act and use its own funds to cover the damage, which is probably the reason behind the short-term depeg.

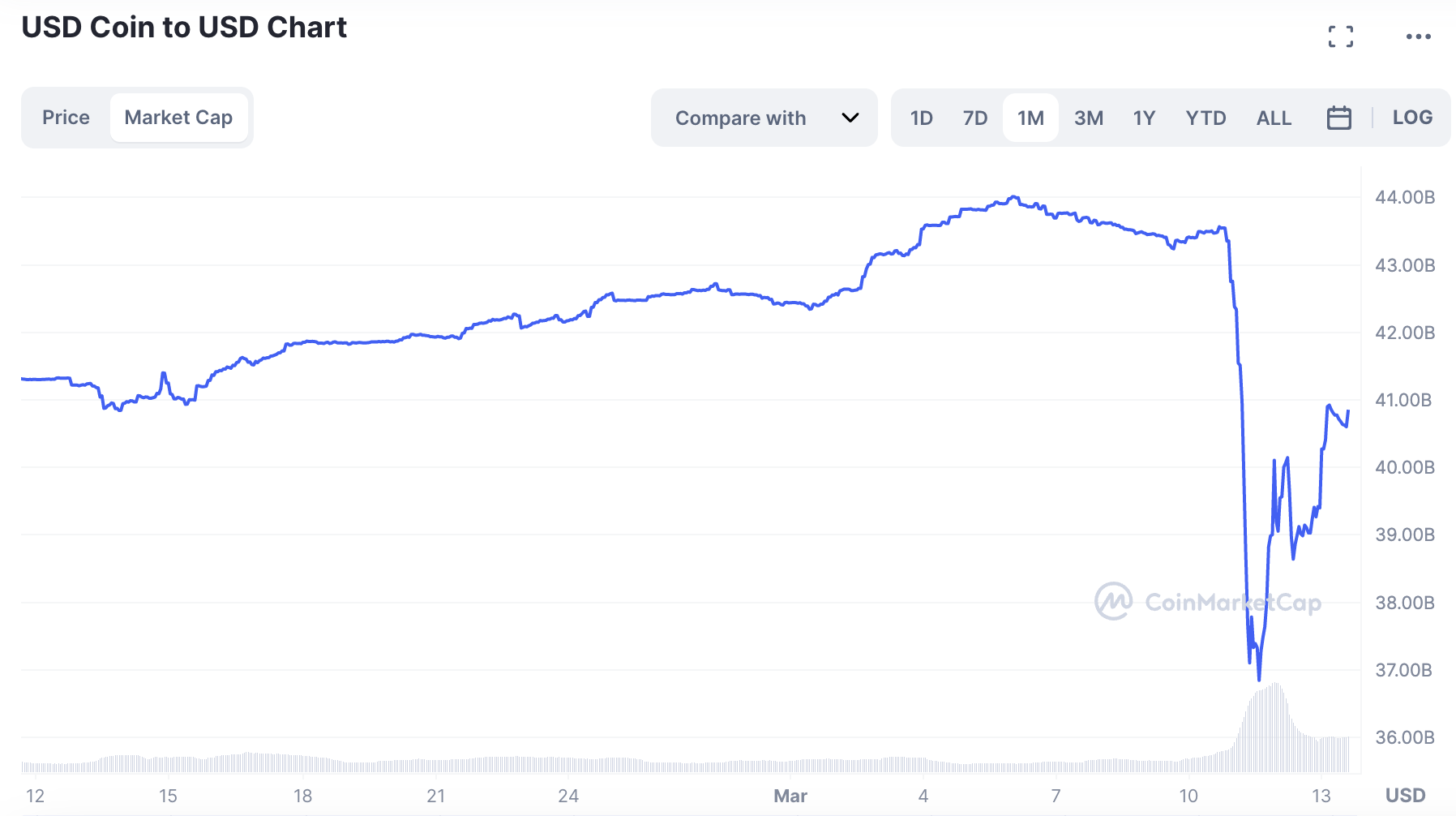

It is visible in USDC’s market cap, which declined by more than $6 billion as many investors also converted their USDC to other digital assets amid chaos. While most agree that this crisis is a “bank run,” it also looks like a “stablecoin run.”

USDC market cap chart, source: coinmarketcap.com

Some people chose to use this mayhem to profit. A Twitter user with the handle @Defi_maestro bought USDC at $0.87 with $114,000. As USDC got back to one dollar, it is expected he made a decent profit in just a few days’ time.

USDC trade by Defi_Maestro, source: twitter.com

Will stablecoins survive?

In my opinion, yes, without a doubt. Stablecoins provide a means for market participants to enter and exit positions independently of the price movements of cryptocurrencies. This is crucial for investors or traders as well as businesses that need a stable medium of exchange and a safe place to put their money.

Stablecoin pegs can also facilitate international trade, which is especially useful in countries where the currency is unstable (developing countries) or where access to traditional banking services is limited. When transferring money internationally, stablecoins may be a more efficient and cheaper option than using wire transfers or remittance services.

Also interesting topic: Financial sector bleeds amid bank failures; who’s next to go bust?

Stablecoins allow users to make payments as well as trade digital assets without the need for a traditional banking system or credit card, which can be especially useful in emerging and developing economies. Their usage has proved to be very useful although they currently suffer due to enormous volatility.

Final thoughts

The crypto space is threatened by the current market conditions. This is despite the fact that Bitcoin was actually created as a way for people to protect themselves from the traditional financial system.

If billions of dollars in assets get stuck and companies will be forced to sell their liquid assets, it could send the global financial market south for the next couple of months.

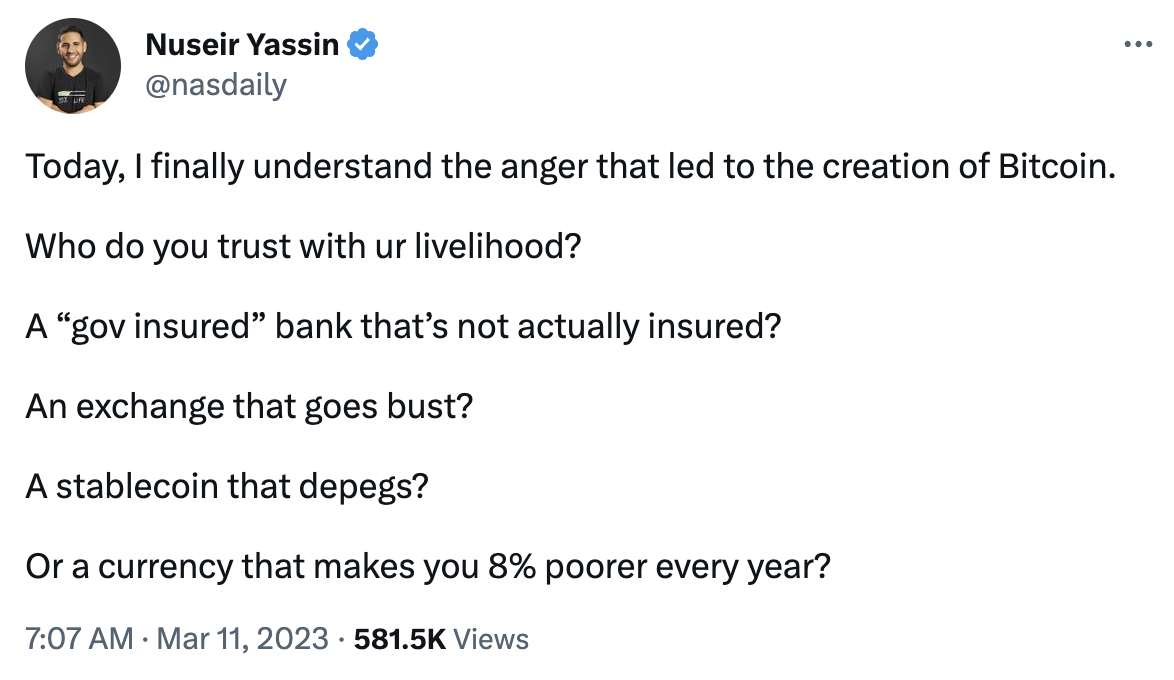

Continuing liquidity issues are forcing many businesses to shut down and many people ask when will this torture end. However, a Twitter user, Nuseir Yassin, shared an interesting point of view on why Bitcoin was created.

Tweet by Nuseir Yassin about Bitcoin, source: twitter.com

Comments

Post has no comment yet.