From Silvergate to Silicon Valley Bank

Last week was definitely not the best for the global economy. After the bankruptcy of Silvergate, a crypto-friendly bank, which happened in the middle of the week, Silicon Valley Bank, one of the biggest banks in the United States, also voiced their troubles.

Read also: Oil spikes after hot US jobs data

Most of the stocks of the banks in the United States tumbled, some even crashed significantly. The overall sentiment is far from ideal, with many pointing to the direction of several other financial institutions or banks that could be in trouble next.

What do the experts say?

The situation is currently really blurry. Not many details or information have been released by the institutions or regulators, which only plays into the narrative of FUD (fear, uncertainty, doubt).

You may also like: FTSE drops further after UK data, eyes critical support

Yet, some industry experts and analysts have tried to go down the rabbit hole of what is happening in the markets. Here are some of the best tweets and twitter threads describing the whole situation:

- An overview of the most important events of the past few days can be found for instance here. Nakul Gupta sketched out the most important events that took place in last 48 hours in connection to Silicon Valley Bank. This overview can give the readers a good insights into what is happening and why are people panicking.

- CFA Genevieve Roch-Decter summarized the troubles connected to Silicon Valley Bank in two twitter threads. While in the first one she looked at the overall picture in the markets, in the second one she went deeper into the problematic and tried to answer the question whether contagion is likely.

- A twitter user going by the name Wolf showed the unrealized loss of the biggest banks in the USA. The numbers have rose exponentially, with the unrealized loss being severe in 4 big banks. Wolf then also listed three different options that the people currently have with regards to their money. So what should you do if you are worried about the economy? Here are his three tips.

- This has been also supported by MacroAlf, who looked at the banking sector as such. He highlighted that mostly the smaller banks can be facing serious problems in the near future.

- Co-founder of NFTtech, Mario Nawfal, has already called the current situation as “Global Financial Crisis 2.0.” He believes that the situation will play out soon and will impact American workers and businesses significantly.

- A twitter user by the name of Compound248 has taken a deep dive mostly into the situation around Silicon Valley Bank and how it all unravelled. Compound248 looked at the basics of banking through which they tried to explain the situation around SVB.

- A similar approach with same level of depth and knowledge was applied by Ming Zhao. No matter the current situation, she believes that the markets have overreacted on Friday and possibly, the worst might be over. Yet, she adds that the situation will be pretty tight if SVB was about to sell all their assets.

What does this mean for markets?

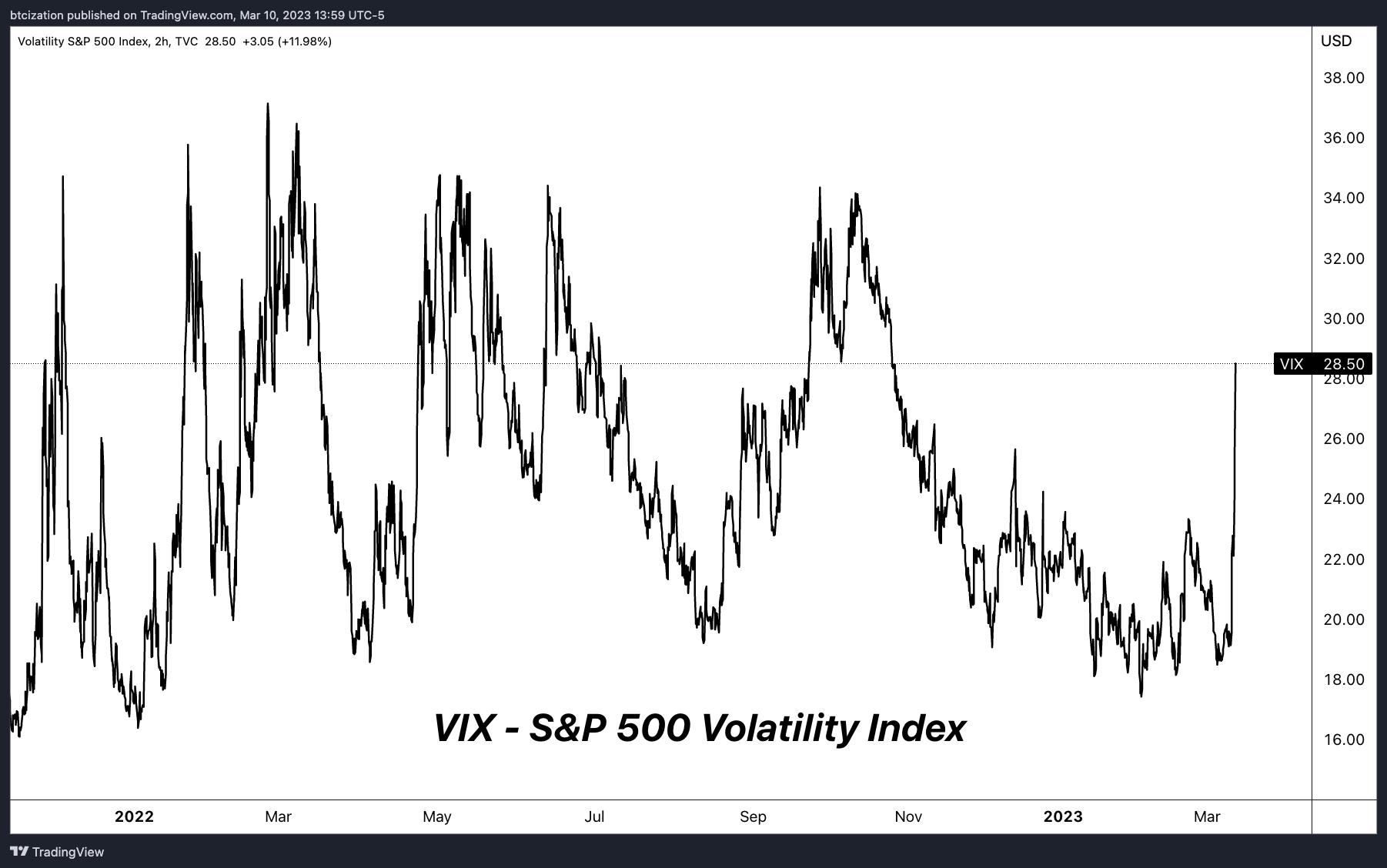

Whether contagion or bank run are likely cannot be clearly stated now. The signs might be there, but that does not mean that the situation will play out that way. Other than uncertainty and fear, Monday will most probably bring a huge spike in volatility. According to Dylan Leclair, Bitcoin analyst, this can already be seen through VIX.

S&P 500 Volatility index, source: twitter.com

Other than that, more explanations, releases or announcements are definitely to be expected at the beginning of next week. This means that the markets will definitely be much more volatile, so make sure that you are safe out there whether you are investing or trading and we will keep you updated on everything important that the next week brings.

Comments

Post has no comment yet.