The XLF ETF – tracking the financial sector in the US – was down another 4.5% shortly after the US opening bell, losing more than 12% from its last week’s highs as the panic continued in the financial sector.

Next one to fall?

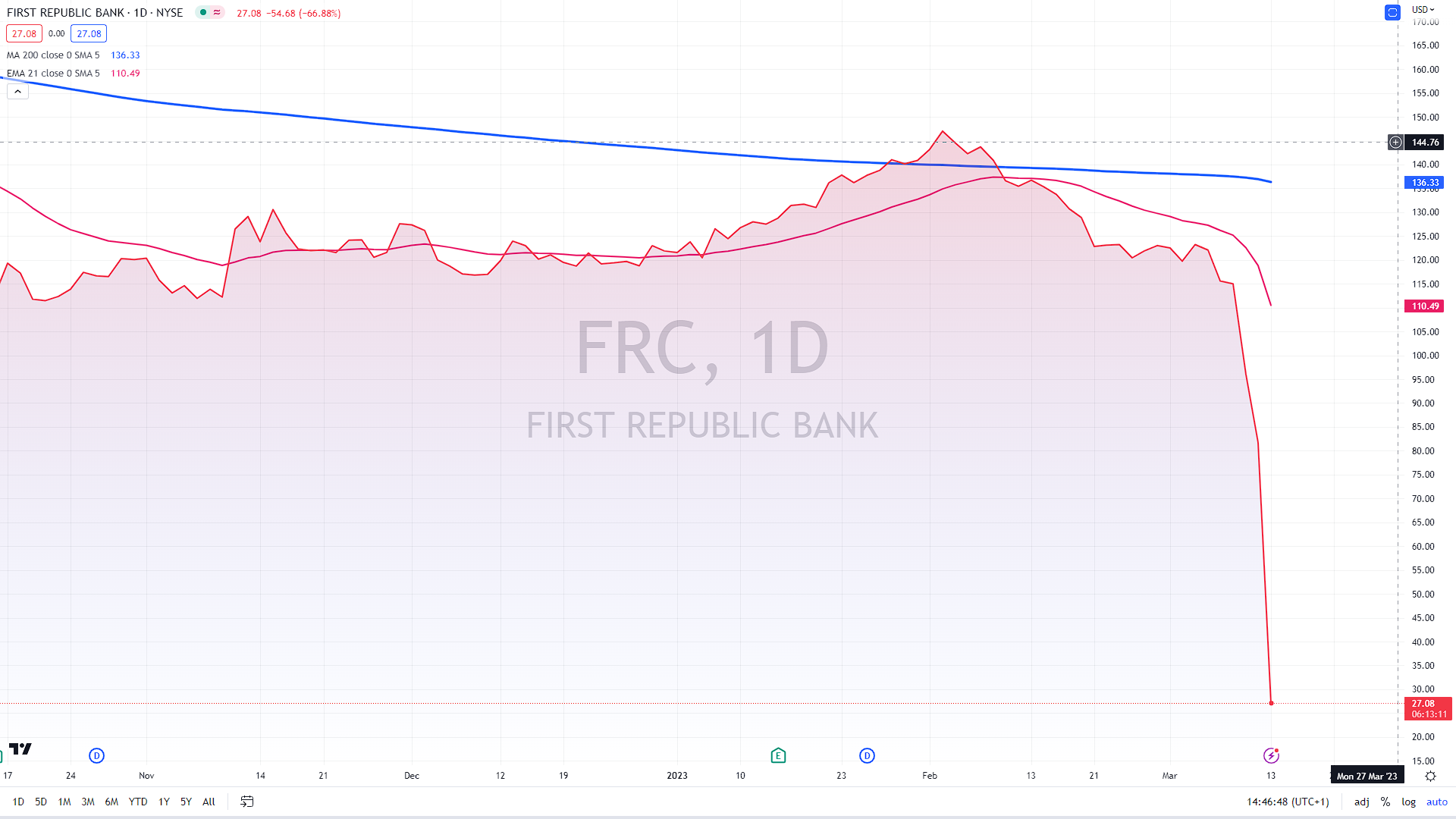

In New York’s trading, First Republic Bank’s stock plummeted following a statement made Sunday night that aimed to alleviate investor concerns about the bank’s liquidity condition in the wake of the bankruptcies of Silicon Valley Bank and Signature Bank.

Regional bank stock is down 60% in the US trading. In a statement released late on Sunday, the lender said it has more than $70 billion in unused liquidity to finance operations, including from agreements with the Federal Reserve and JPMorgan Chase & Co.

FRC daily chart, source: author´s analysis, tradingview.com

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies and further strengthens First Republic’s existing liquidity profile,” the bank said, adding that more liquidity is available through the Fed’s new lending facility.

According to the bank’s financial filings, its uninsured deposits at the end of 2022 reached $119.5 billion, or 67% of its total deposits.

Investors are beginning to doubt the capabilities of any lender that may remotely be in the same category as Silicon Valley Bank, as seen by the decline in its stock price.

Governments stepped in

On Friday, officials shut down San Francisco-based competitor SVB, operated by Silicon Valley Financial (SIVB), as depositors rushed to withdraw their funds. The majority of Silicon Valley Bank’s clientele were startups and venture capital businesses with accounts that far surpassed $250,000, the maximum amount insured by the Federal Deposit Insurance Corporation (FDIC).

Sunday, financial regulators declared that SVB depositors would be compensated in full and established additional facilities to support withdrawals of deposits across the banking sector.

Despite the Fed and Treasury’s announcement on Sunday of an emergency loan program to improve the availability of cash to fulfill bank withdrawals and avoid runs on other banks, concerns remain as other regional banks keep feeling severe pressure.

Among other regional lenders, PacWest Bank (PACW) and Western Alliance (WAL) are also down more than 35% and 50%, respectively.

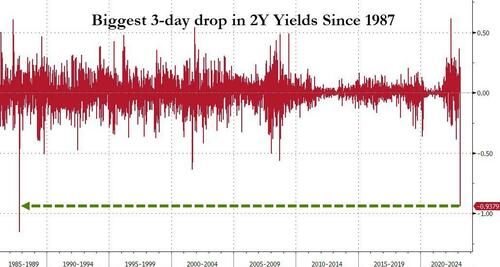

In light of this panic, investors rushed into safe-haven assets such as gold or US bonds. As a result, the 2-year US yield is down almost 100 bps (1%) in the last three days., posting the biggest 3-day drop since 1987’s “Black Monday”.

Source: Bloomberg

Comments

Post has no comment yet.