Once again, the volatility came back into the markets, despite VIX continuing to deteriorate. The market expected updated guidance from the FOMC and revealed upcoming monetary policy steps. Many important details were revealed in both the statement and the press conference.

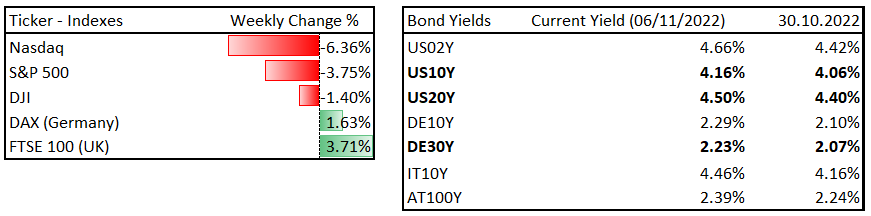

Recent asset price movements

As we warned last week in our macro report for the more downside moves before the FOMC, it also makes sense for the medium-term. The US stock market continued to decline, impacted by weaker results from the earnings season, but the main contributor was the FOMC.

Also read: The threats of CBDCs – why we should not take it lightly

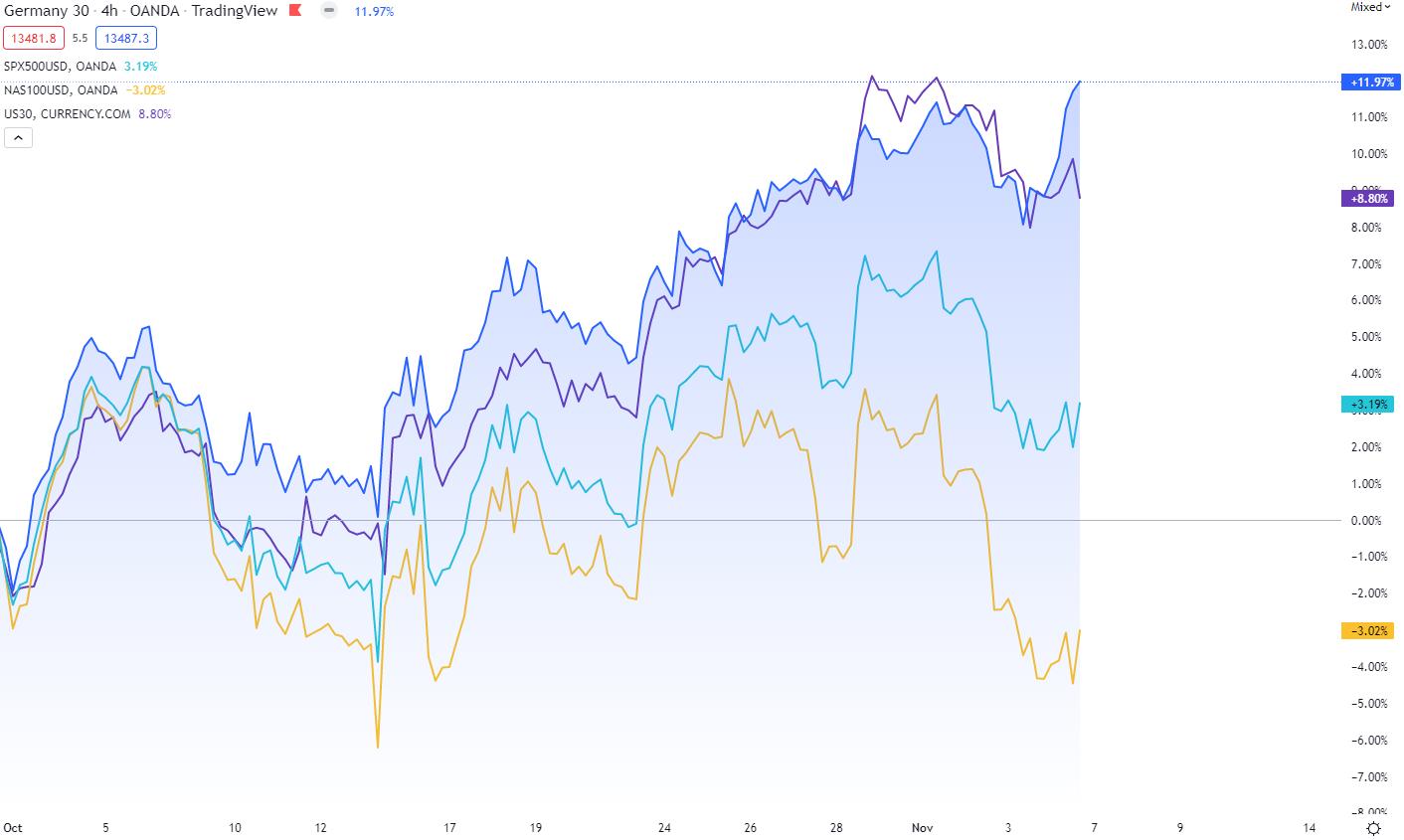

The detailed breakdown from the press conference is stated in the text below. The European stock market (DAX) kept going up, and since October, it has done much better than the S&P 500, DJI, and Nasdaq.

Asset movements, Source: Investro analytics team

The DAX’s outperformance was impacted by many factors: easing energy prices, mixed company results, and a less hawkish ECB. However, in the medium term, European stocks can be more under pressure because inflation is structural and impacted by energy prices as well (many companies have fixed contracts on energy bills), which could dump demand even more.

DAX outperformance, Source: Investro analytics team via Tradingview

FOMC breakdown

The Fed hiked by 75 bps and revealed more about the tightening policy. First of all, the statement was purely bullish:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

In other words, the FOMC statement was about how they tightened a lot already and that the full impact of the previous hikes will come into play in the real economy with lags, so in the following months. In that way, future hikes will be more about incoming data, the Fed will need to be cautious, and in the following meetings, the FOMC will deliver hikes, but at a much slower pace. The market rallied after this statement because it acted like a dovish message as they had “done enough” already.

However, in the press conference, Powell was clear and prudent about the FOMC’s goals. Although J. Powell said it was “premature” to think about a pause in this monetary cycle, it means that even the FOMC does not want to pause right now and will continue in hikes despite slowing the pace of hikes.

They want it to be “higher and for longer” until the Fed Funds Rate exceeds the CPI, and they want to hold it there until there is a clear message that the strong inflation rising cycle is over.

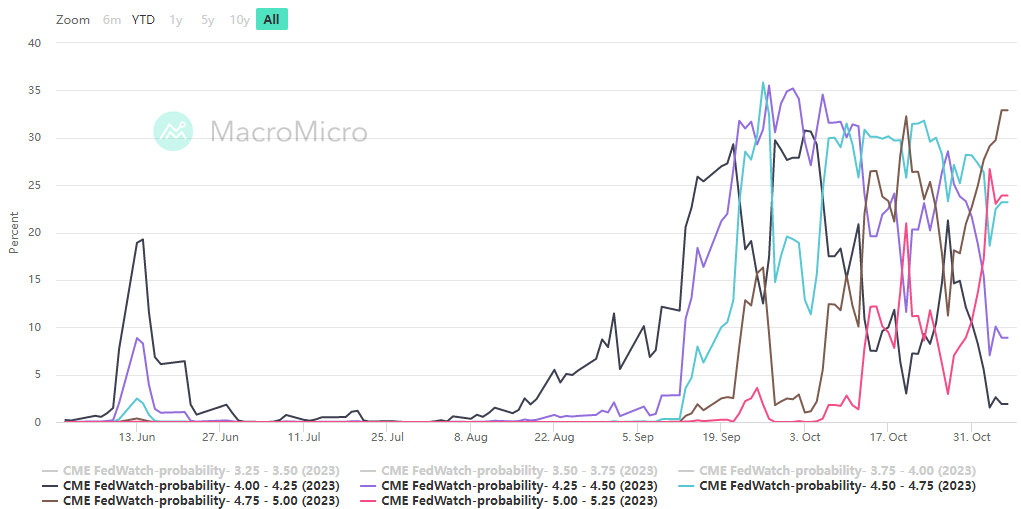

2023 Fed Interest Rates Projections at Yearend, Source: MacroMicro, CME

Looking at the probabilities above, the market priced in almost 80% probability that rates will be in a range of 4.25–5.25%. absolutely stunning, and fully lost the option of a tail event in which rates would be below 4%.

The second and the main key point from the meeting was:

”Prudent risk management suggests the risks of doing too little are much higher than doing too much. If we were to over-tighten, we could use our tools later on to support the economy. Instead, if we did too little we would risk inflation getting entrenched and that’s a much greater risk for our mandate’’.

This is absolute confirmation, which is more contradictory compared to other central banks. The Fed will rather “over-tighten,” which will for sure help bring the inflation down than do too little. Of course, the situation could be different if the unemployment rate were closer to 6–7%. This message only confirms that the Fed is serious. While they are still hoping for a “no recession” scenario, they are aware that they can cause a recession if it is the only option to tame inflation.

Further, the market gives (according to MacroMicro) only a 0.2% probability that rates will be below 4% at 2023 year-end, so the market did not price in a recession tail event (which would force the Fed to cut rates below 4%). This is a great contrarian move for bonds, where our team believes that downside risks in the prices are more limited. Or, in other words, the risk/reward scenario for bonds is much better and cleaner than for stocks in the medium term.

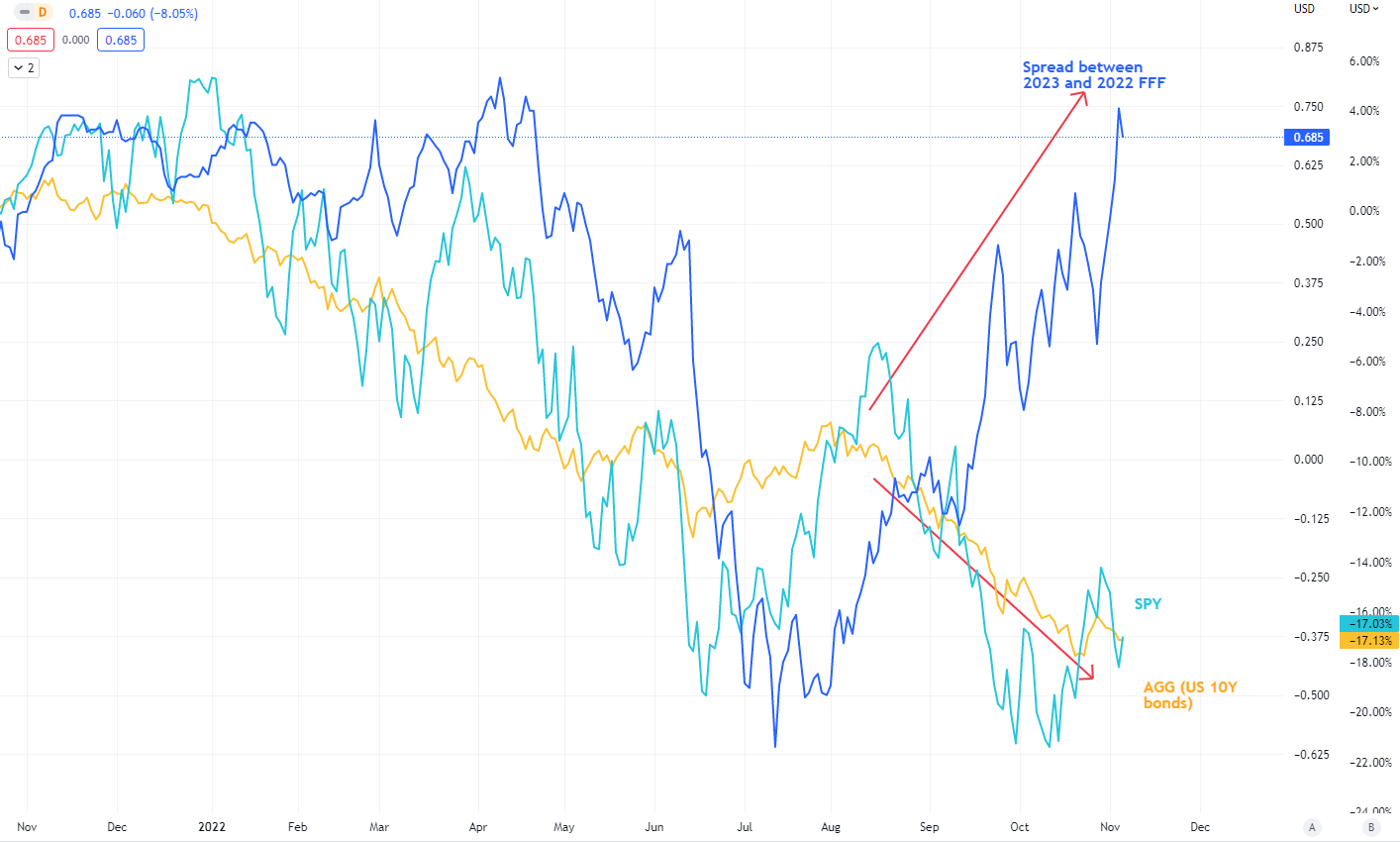

Fed Funds Futures (Rate), Source: Investro analytics team via Tradingview

Looking at the current market pricing, based on the FFF, for December 2023 and 2022, we see that the market continues to price in the following hikes in 2023. The spread widened as 2023 futures were priced at 4.83 %, while 2022 futures were at 2 4.15 %.

The implications for the stocks and bonds

The widening or narrowing of the spread has a material impact on bond and stock prices. As we stated a few weeks ago:

“Where the spread between such time horizons currently tells us that the market expects rate hikes to continue in 2023 (as the spread is positive between year-ends of 2023 and 2022), the significant lowering of the spread between could cause a short-lived or medium-lived bullish rally as there would be hopes for a pivot/pause/not delivering hikes as expected or rate cuts.”

“According to FFF, rate cuts are currently not priced in the bond and stock markets. We believe that this spread will narrow, which could lead to a solid bullish or bond market rally. This trend will depend on inflation data, but looking forward, we are convinced that we will see the spread narrowing and that is not currently priced in. In other words, there is still room for a bullish rally, looking forward 1-3 months.”

The yields on the bond market are lower (but only on the long-end yield curve). On the other hand, the, stock market reversed downward, impacted by the weak earnings season. For the medium term, we confirmed our view in last week’s macro report on stocks, because we believe the upcoming 1-3 earnings seasons will probably be worse by a lot. However, for long-term asset allocation, S&P 500 levels seem to remain attractive right now.

Spread between 2023 and 2022 FFF (rates), SPY and AGG, Source: Investro analytics team via Tradingview

On November 10th, the October inflation report will be delivered. The most important data for the Fed. MoM Core CPI is expected to rise by 0.5%, while headline CPI is expected to rise by 0.7% MoM. In our view, both figures are high estimates. Our team believes there is a great probability of delivering a better (lower) print. If such an event happened, it could lower the spread between rates and spark a bullish rally for stocks and bonds.

Read more: Globalization has been falling for years: What’s next?

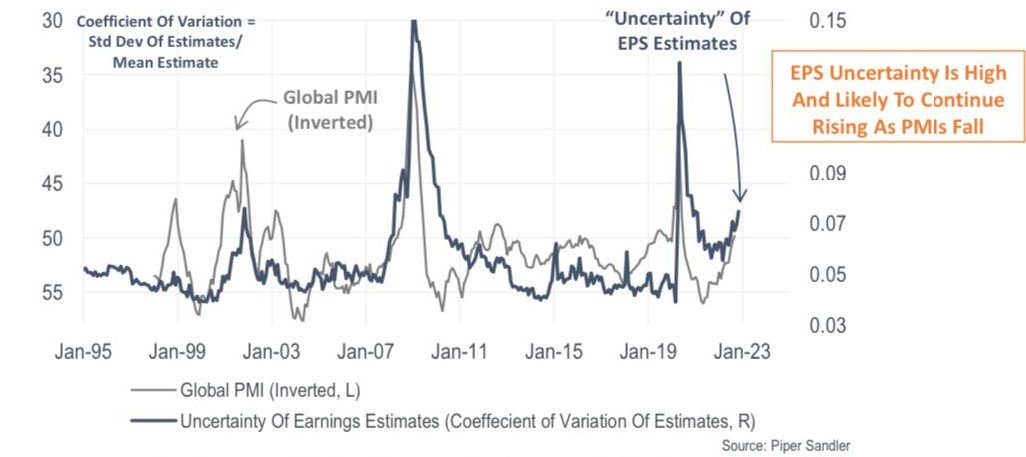

In summary, we share our view on the market. While we see great and favorable conditions on the bond market, we are not optimistic for stock indices in the medium term. With quite a significant certainty, we will see further EPS misses as global PMI slows, and at that point, the uncertainty of EPS estimates is higher. See the great chart below:

EPS Uncertainty is high, Source: Piper Sandler via @MichaelKantro

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.