The latest asset movements

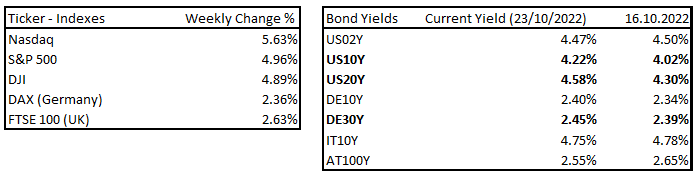

As we analysed the bond market a week ago, we said that there is an opportunity in the bond market for many reasons. We urge you to read the analysis as it is starting to be confirmed. As shown in the table, the stock and bond markets rose significantly following FOMC members’ statements – similar to forward guidance. In summary, the Fed has a better chance of pivoting by the start of 1Q-2Q2023 (as we believe). For these reasons, we see the bond market as very attractive right now, despite the many risks ahead.

The latest asset movements, Source: Investro analytics team

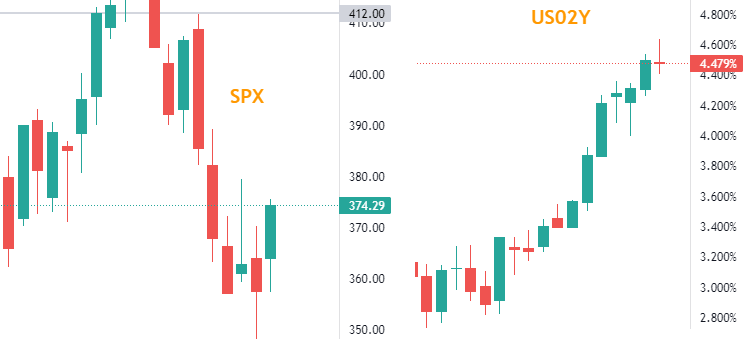

As the table truly reveals, the yields did not decline, just the opposite. However, a massive move in daily candles can be spotted at the end of the week, and at the weekly candles, giving a potential for a short-to-mid-term reversal, both for indexes and bonds.

SPY and US02Y candles, Source: Tradingview

FOMC members’ reactions led to a rally at the end of the week

In the following text, we will cover the latest statements made in the interview of Fed members and comment on them:

Fed’s Daly: We must consider synchronised global central bank tightening.

It appears that the Fed is becoming aware of “synchronized” tightening around the world, which is causing liquidity issues in the markets, particularly in bond markets. The world of “CONSIDER” implies that there will be a heated debate about the market’s stability and how to avoid breaking it. We saw the magnificent impact in the UK, where, as a result, the BoE pumped billions. of GBP into the bond market and, the fiscal policy stepped down from the tax cuts, which led (previously) to such a bad situation.

Related article: Where to invest for a profit during a recession?

While Fed is set to rate hikes additionally on the following meeting by 75 bps, but they will debate the future “size” of future hikes (WSJ).

Fed´s Daly: We will perform a step-down, but not a pause, to 50 or 25 bps increments.

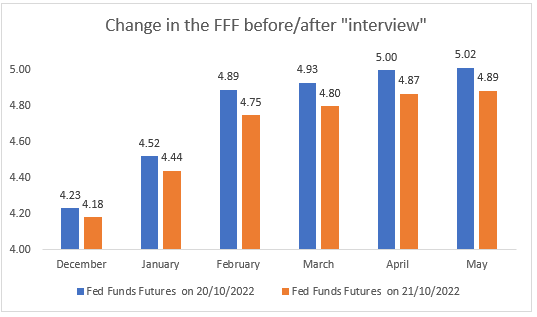

Our team will show you what was priced in before such statements and after them. However, the odds are clear about November 2022 meeting decision, resulting in expectations of about 75 bps. The future expectation of rate hikes has deviated and is likely to continue this week.

Change in FFR before and after” “interview” on Friday, Source: Investro Analytics Team

And it was just a Friday reaction. If there are no fundamental issues, such a move is possible to continue in the coming week. It is not a surprise that a market rallies on such “more dovish” news, or let’s say “less hawkish” news, as some traders closed some puts, which led to a bullish rally on Friday afternoon. Also confirmed by the previous chart, the current market participants can follow the thesis of a potential “pivot” as being bullish for the markets.

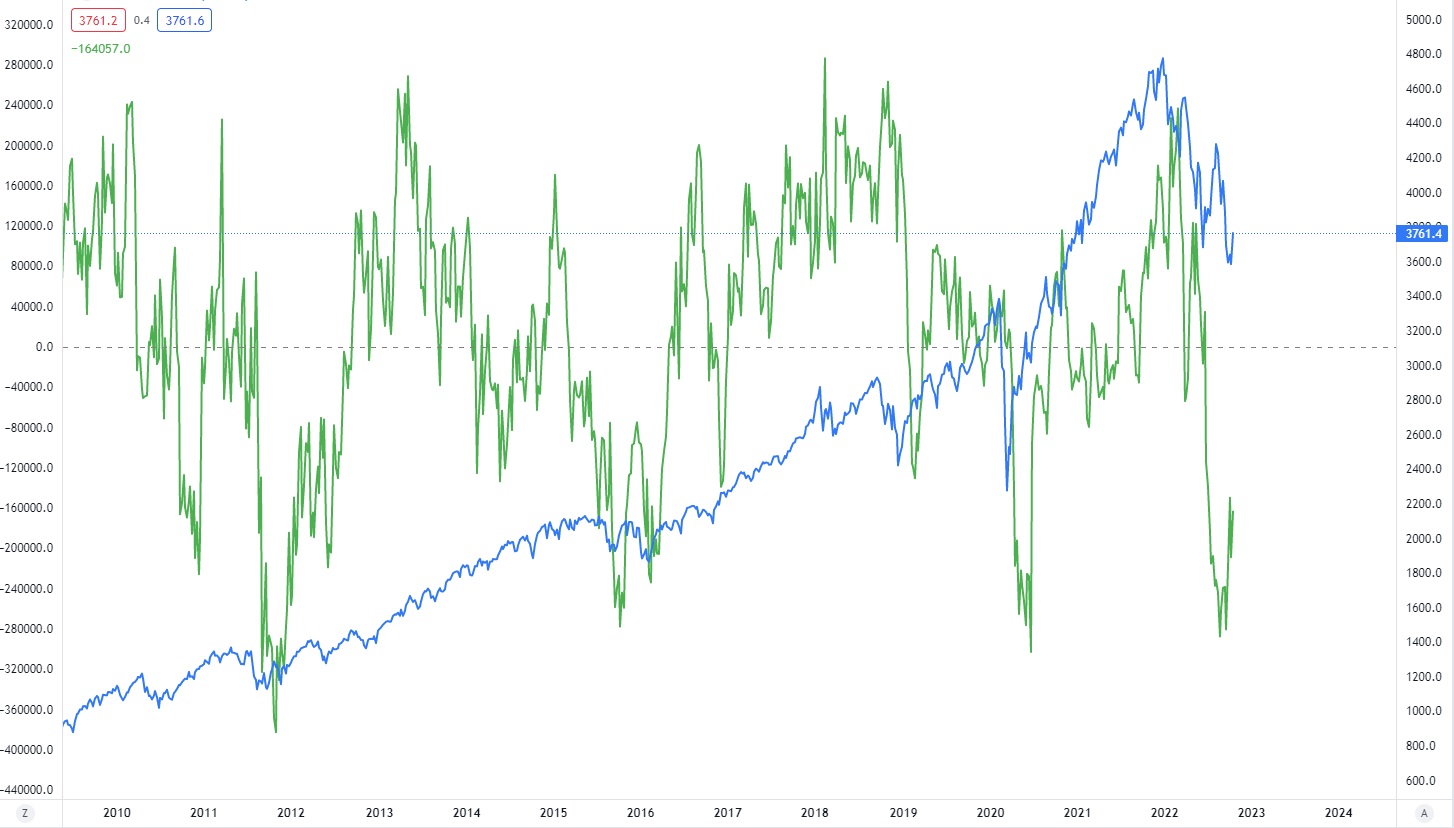

Looking at the chart, where ocean blue represents a spread between December 2023 and December 2022 rate expectations and turquoise represents the SPY moves, suggests the following (according to our team):

Where the spread between such time horizons currently tells us that the market expects rate hikes to continue in 2023 (as the spread is positive between year-ends of 2023 and 2022) and to be higher at the 2022 year-end, the significant lowering of the spread between could cause a short-lived or medium-lived bullish rally as there would be hopes for a pivot/pause/not delivering hikes as expected or rate cuts.

According to FFF, rate cuts are currently not priced in the bond and stock markets. We believe that this spread will narrow, which could lead to a solid bullish or bond market rally. This trend will depend on inflation data, but looking forward, we are convinced that we will see the spread narrowing and that is not currently priced in. In other words, there is still room for a bullish rally, looking forward 1-3 months.

Read also: S&P 500 shoots higher after WSJ report

But this is just our opinion, and the market has also an “EPS factor” where negative results compared to estimates could bring the market down a lot, even if the lower rates were priced in.

Spread between Dec 2023 and Dec 2022 FFF and SPY, Source: Investro Analytics Team via Tradingview

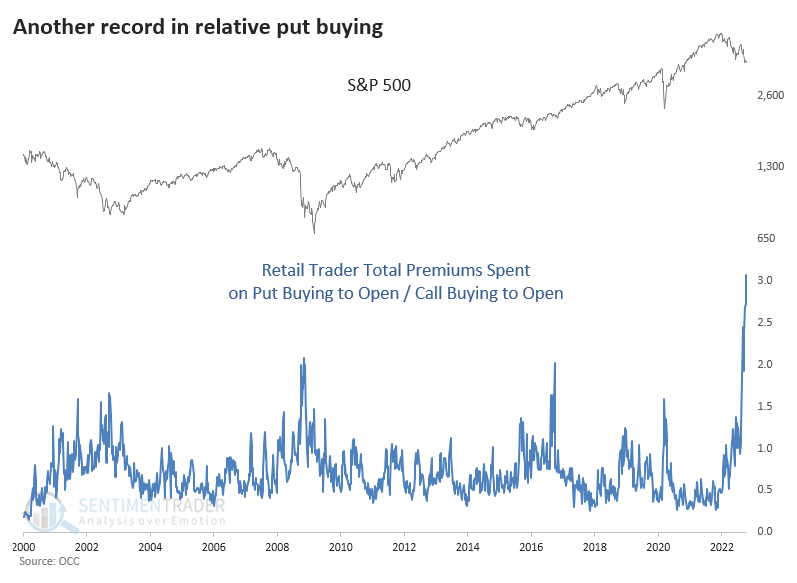

Many institutional players are net sellers, and also retail pays the biggest premium for puts (not seen yet). We can prove it with the following charts:

S&P 500 and Non-commercial positioning, Source: Investro Analytics team via Tradingview

While non-commercial (hedge fund) players are still net short on the S&P 500, the position bottomed out in late September and has since bounced. In other words, during the last two-three weeks, the big players started to close their short positions (but still are short). If this trend persists, we could see a supportive thesis for the next bullish rally. If that is the case, we do not know. In the following chart we can see an aggressive retail trader put premiums, currently at all time-highs. The highs are mainly the reversing signal. It could also be this once, and if the trend reverses, the market could rally further. That is just our opinion and not the conclusion.

Another record in relative put buying, Source: OCC, Sentiment Trader via @jasongoepfert

Trading idea

We think we have got a clear message to our readers. However, there is some mid-term potential for a bullish rally in stocks and bonds, but mainly in the bonds – because stocks are vulnerable to Q3 earnings results. From this point of view, it is better for bond allocation, following the fundamentals we analyzed from the latest FOMC statements. Non-commercials are still net short, but they closed many bearish positions during the previous weeks. On the other hand, retail hedging activities, as measured by the total premiums paid, are at an all-time high. This suggests that a possible short-term reversal could also help to spark a short-lived rally.

Given a bullish narrative in bonds, there are also risks. These risks are more concerning to international markets than the continuing deterioration of the inflation data. Perhaps you’re wondering why. Briefly, we saw that many currencies significantly depreciated against the dollar. Looking forward, it would make sense for central banks to start selling their device reserves held in cash and US bonds. If that happened, yields could continue to surge. However, we have some signs that this move is happening right now – look at the BoJ.

Warning: The fully covered text is not investment or trading advice. It represents only the author’s point of view and thoughts, and we do not bear responsibility for your potential loss. The article serves only for analytical and marketing purposes.

Comments

Post has no comment yet.