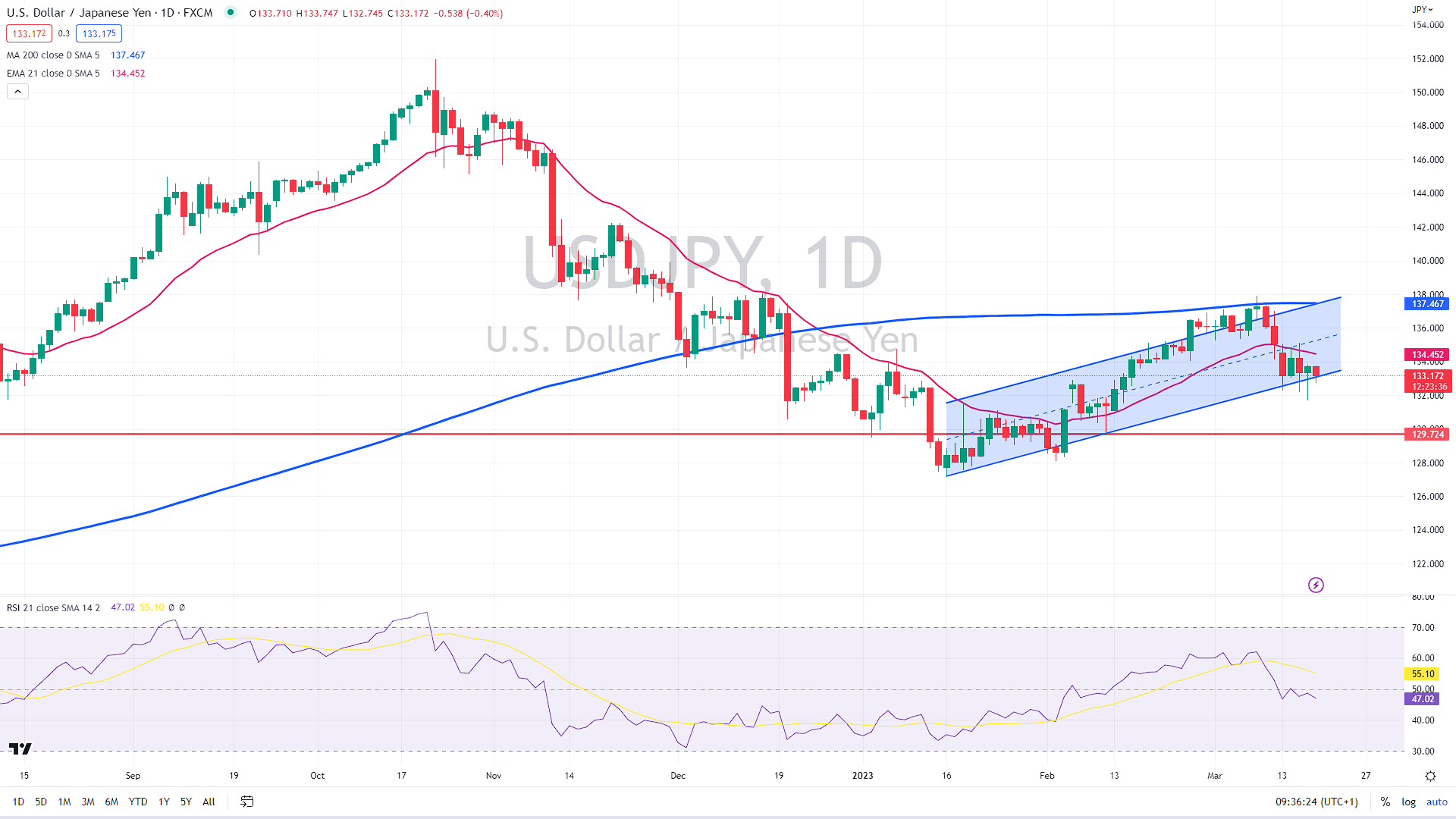

The barometer of the market risk sentiment – USD/JPY – has so far managed to stay within the medium-term uptrend channel, indicating the rally in assets could continue.

Another multilateral bailout

On Thursday, news spread that Citigroup, Bank of America, JPMorgan Chase, Wells Fargo, Goldman Sachs, Morgan Stanley, BNY-Mellon, PNC Bank, State Street, Truist, and U.S. Bank will deposit $30 billion in uninsured funds with First Republic Bank.

The actions of the top US banks demonstrate their trust in the nation’s financial system and assure that First Republic will continue to serve its clients.

You may also read: EUR/USD hardly moves after today’s ECB decision

According to the mentioned banks, following the receiverships of Silicon Valley Bank and Signature Bank, a limited number of institutions saw withdrawals of uninsured deposits. The American financial system is among the greatest in the world, and the nation’s banks – major, midsize, and community banks – exceptionally fulfill the banking requirements of their clients and communities. The banking system’s credit, liquidity, capital, and profitability are all excellent. Recent developments have had little effect on this.

This bailout is remarkably similar to the LTCM bailout in 1998 when fourteen banks and brokerage companies invested $3.6 billion in Long-Term Capital Management L.P. (LTCM) to avert the firm’s imminent collapse; the LTCM rescue was arranged by the Federal Reserve but did not include Fed funds. LTCM was a hedge fund and hence not a direct rival.

All eyes are on Fed; yields under scrutiny

In recent weeks, the failure of multiple US banks was mostly caused by a decline in bond prices, to which Silicon Valley Bank was particularly vulnerable.

Next week, the Fed is expected to raise interest rates by 25 basis points, a lesser increase than anticipated by the markets just a few days ago.

As a result of the recent market chaos, US yields have dropped massively to multiple-month lows as investors are now pricing more than 1% of rate cuts in the year’s second half. Two weeks ago, markets had priced four more additional rate hikes this year and no rate cuts.

Another exciting topic: Credit Suisse gets fresh liquidity from SNB, but trust seems broken

The March Consumer Sentiment Survey from the University of Michigan and the US Federal Reserve’s (Fed) Industrial Output figures for February will be analyzed for additional momentum later in the day.

If the mentioned uptrend channel is not held, the USD could decline quickly toward previous lows near 129.80 or possibly test the cycle lows at around 128. On the upside, if sentiment improves, we might see a rally toward the middle of the channel at 136.

USD/JPY daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.