The EUR/USD pair traded flat following the latest ECB monetary policy update, showing no desire to start a meaningful trend.

ECB hikes by 50 bps

The European Central Bank just raised interest rates by 50 basis points, confirming that Europe’s financial crisis will likely worsen before (if) it improves.

The Governing Council today “agreed to increase the three key ECB interest rates by 50 basis points following its commitment to ensuring the prompt return of inflation to the 2% objective over the medium term.”

With this decision, the interest rates on the primary refinancing operations, marginal lending facility, and deposit facility will increase to 3.5%, 3.75%, and 3%, respectively.

According to the ECB, “the elevated level of uncertainty reinforces the importance of a data-dependent approach to the Governing Council’s policy rate decisions, which will be determined by its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation, and the effectiveness of monetary policy transmission.”

You can also read: Banking added another blow to stocks – US dollar to the rescue

Yet, the ECB quickly emphasized that “the Governing Council is closely watching recent market tensions and is prepared to act if needed to ensure price stability and financial stability in the euro area.”

In addition, it was stated that “the euro area banking sector is resilient, with strong capital and liquidity positions” and that “the ECB’s policy toolkit is fully equipped to provide liquidity support to the euro area financial system if necessary and to maintain the smooth transmission of monetary policy.”

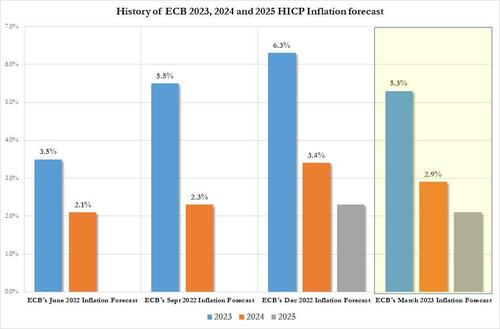

Overly optimistic projections, as always

As for the economic projections, ECB staff now see inflation averaging 5.3% in 2023, 2.9% in 2024, and 2.1% in 2025, while they expect (economic) growth to pick up further, to 1.6%, in both 2024 and 2025, underpinned by a robust labor market, improving confidence and a recovery in real incomes.

ECB inflation projections

Moreover, probably most significantly, the ECB omitted from offering any guidance and forecasting any future rate rises in the statement, as it did in the past.

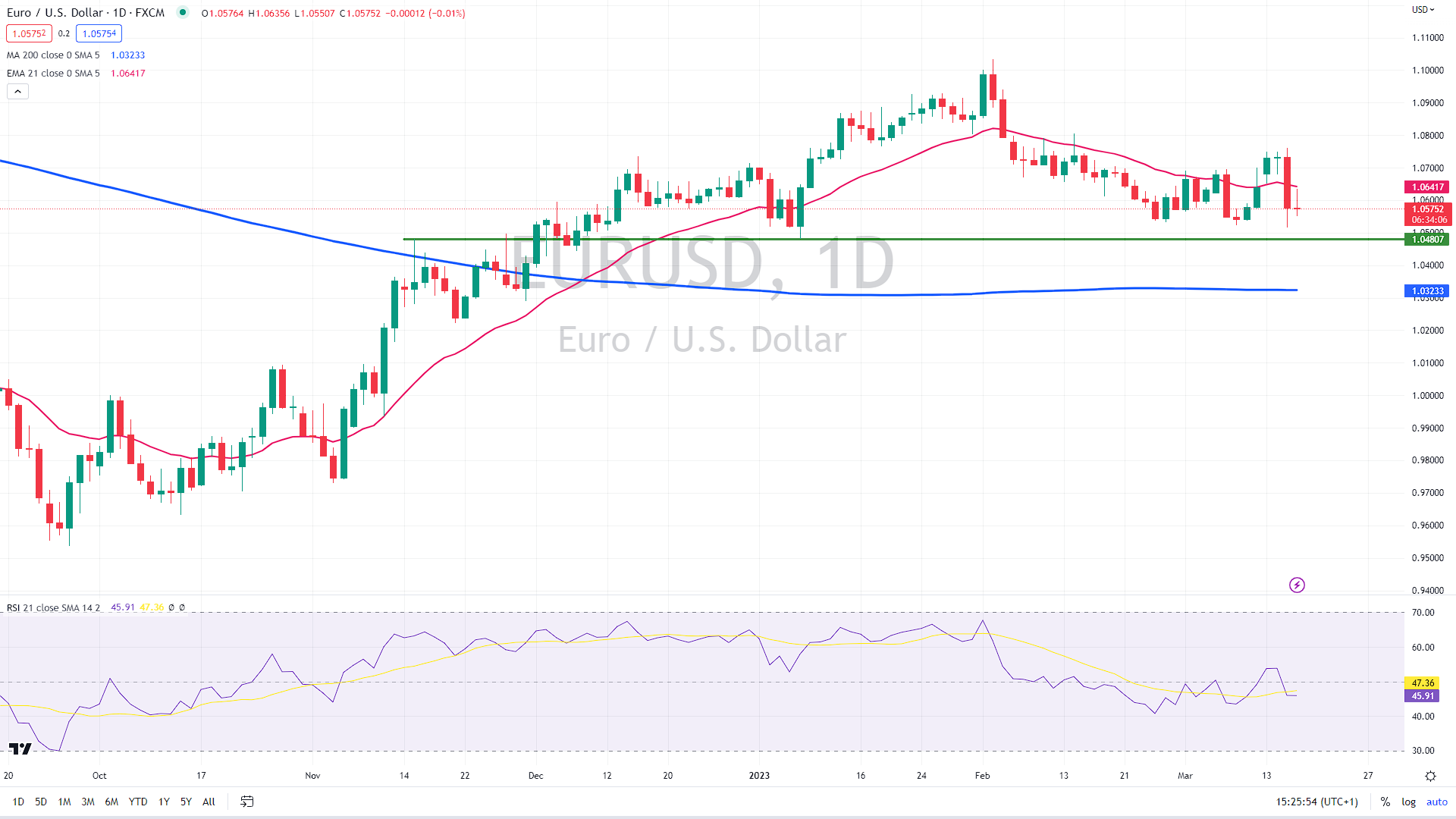

Technically speaking, the EUR/USD pair remains above the critical support of 1.0480, thus, maintaining the medium-term uptrend. Furthermore, another support is seen at the 200-day average (the blue line) near 1.032. On the upside, the likely target for bulls would be at this week’s highs near 1.0750.

EUR/USD daily chart, source: author´s analysis, tradingview.com

Comments

Post has no comment yet.