We can easily conclude that Paypal has a great balance sheet. It is a healthy company from a financial point of view and its investors should not worry about paying its liabilities or potential bankruptcy in some tail-event. Liquidity ratios are strong, as are the solvency ones. Financial leverage ratios indicate that the company is loading a small portion of debt relative to its total capital or assets. The company will have no problem with additional debt financing (if profitability remains stable or easily slows), and it makes no difference whether Paypal chooses loan financing or bond financing.

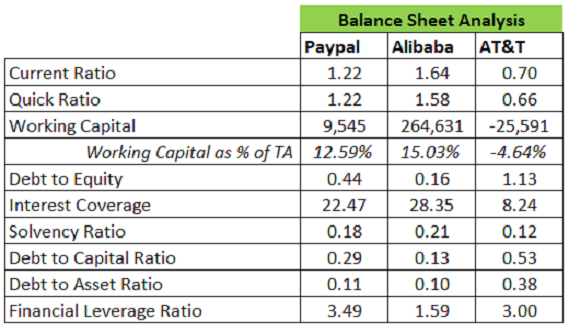

You can easily follow these steps for every stock you want to analyse. Make sure you dispose of solid data. As we said previously, we would like to make a balance sheet comparison between Paypal, Alibaba, and AT&T, to let you see the differences among the sectors. Following the previous steps, the results are just like that:

Source: Author’s calculation (03/2022)

Comments

Post has no comment yet.