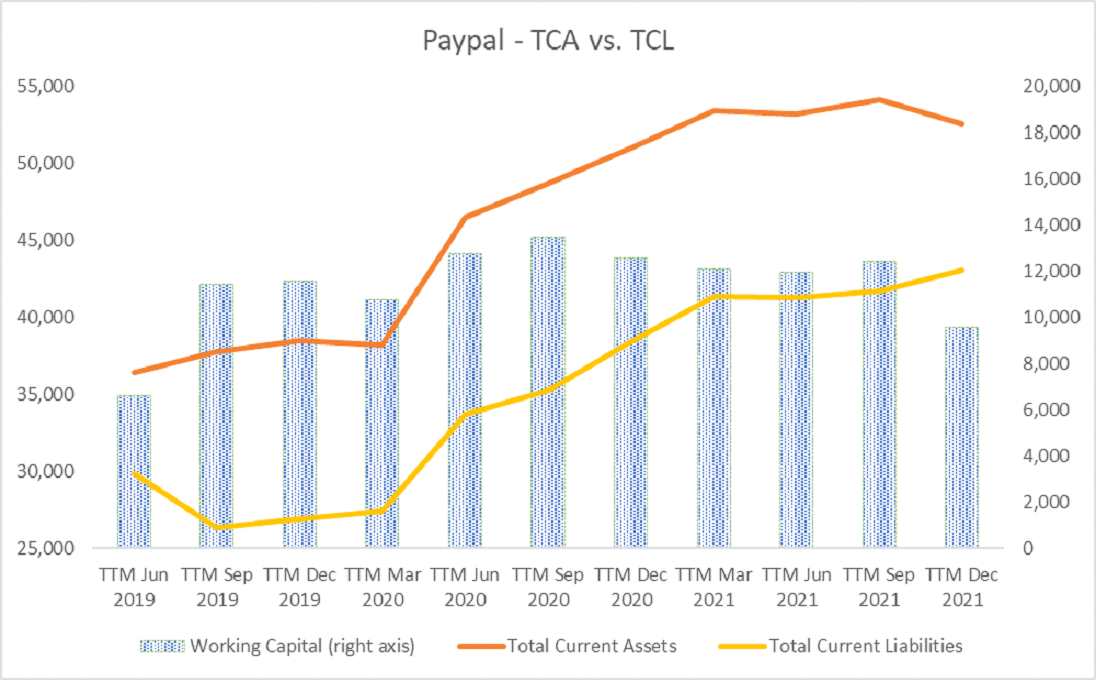

Now let’s continue. We need to look at the development of total current assets and total current liabilities and some of the liquidity ratios in case of need.

Source: Author’s calculation using SeekingAlpha’s database

This is purely a positive sign because it means a company is increasing its current assets in the long term. The same with current liabilities. However, the difference between TCA and TCL is called “working capital” and is very important because it tells us if a company has a “cash” or liquid buffer in case of some event. Unfortunately, from September 2020, the working capital has been slightly declining, but is still big enough to say that Paypal has a great buffer. In summary, we can confirm this is a responsible step from management.

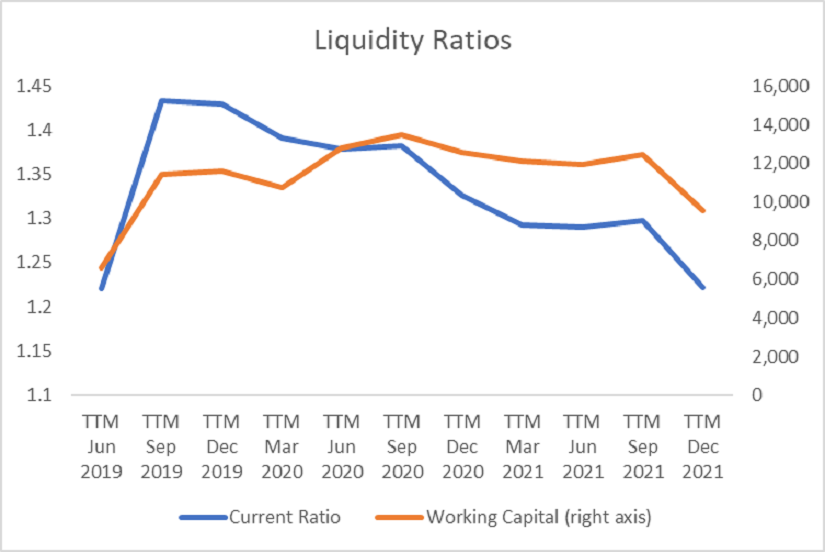

Source: Author’s calculation using SeekingAlpha’s database

We calculated the current ratio very easily (current assets/current liabilities). The quite negative message from that is that CR is slightly declining. However, the ratio above 1.2 is satisfactory but not excellent. On the other hand, maybe you ask why we did not calculate the quick ratio. Yes, we did, but it seems exactly like the current ratio. It is due to its calculation and Paypal’s core business (lack of inventories) that the quick ratio is equal to (TCA-Inventory)/TCL. Paypal’s inventory is zero, so the calculation will be the same as for the current ratio. And the quick ratio above 1.2 is very good.

Comments

Post has no comment yet.