So the first step:

- Look at the discount and determine, why it happened. Find the reasons, the threats, the potential of a turning point. Check the latest news as well as company 10K and 10Q filings. Read the previous analysis on Seeking Alpha (or different portal) to dig deeper. You can check the latest news on Finviz or Finance Yahoo. However, it is the most time-consuming machine here. Currently, we will only do the first step, and that is to check the decline in the stock price. We’d like to emphasize that this is not required. Watch your own watchlist and if you want to buy the dips, just watch your stocks and keep your analysis up to date. You do not have to buy the stocks only when discounts in their stock prices occur. However, it can give you an advantage of buying their stocks in times of panic or in oversold conditions, which is highly appreciated.

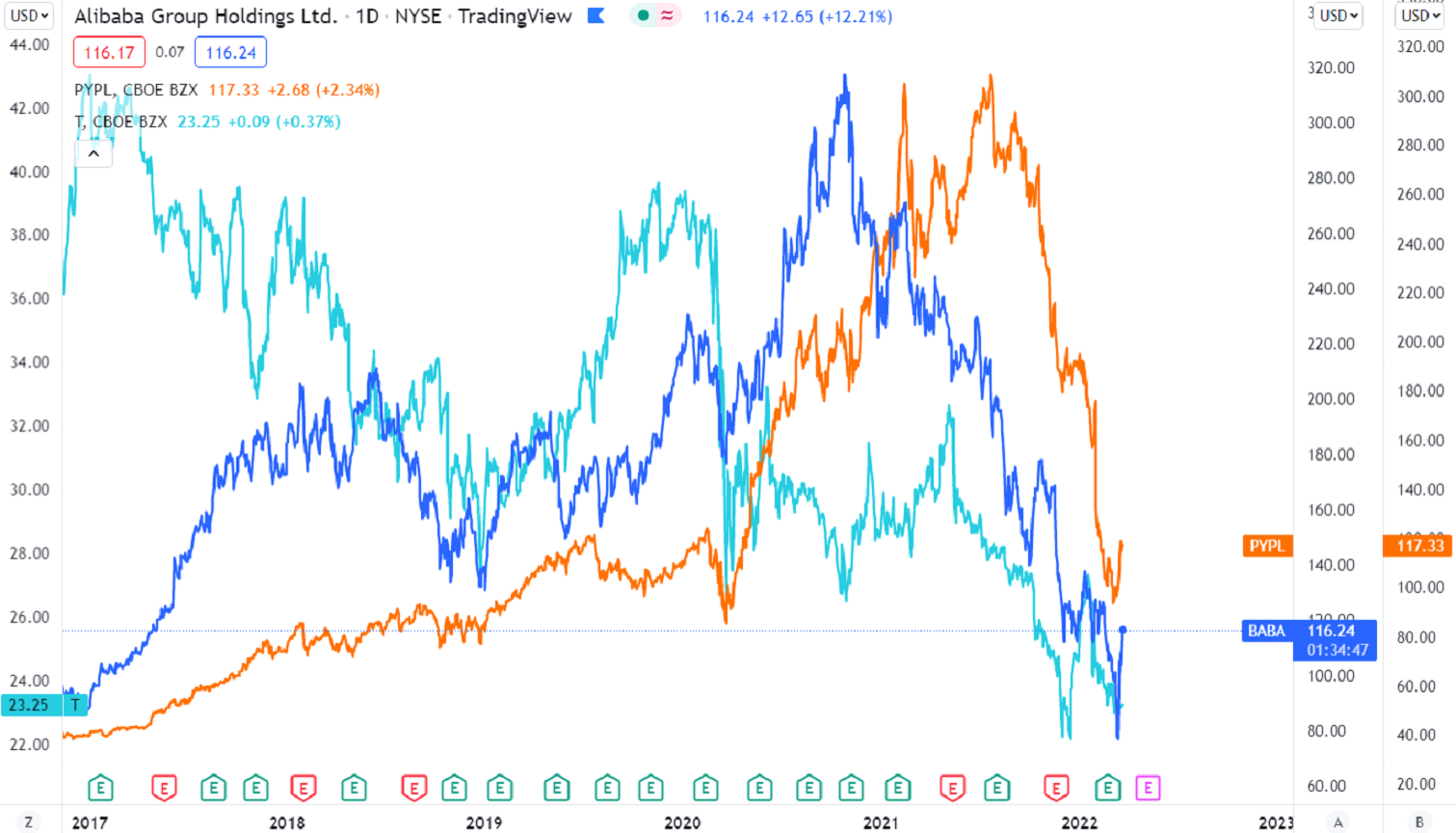

Source: Tradingview

We have randomly chosen three stocks, which should trade independently of each other (or should not correlate with each other in the long term) as their core business is very different. The one key point here is that Alibaba (blue) and Paypal (orange) have declined more than 60% from their highs during the last few months. However, looking at AT&T’s stocks, it seems there is a bearish trend. However, we need to ask this way: Is there any hidden value? Are their balance sheets healthy or not? How about profitability and valuation? Why are their shares trading at these levels? Ask these questions, and we need to find answers to decide if it is worth investing in or not.

Comments

Post has no comment yet.