So we have been going through TCA, TCL, TA, TL, equity development, and we have covered liquidity ratios too. The next step now is to move on to Solvency Ratios.

Source: Author’s calculation using SeekingAlpha’s database

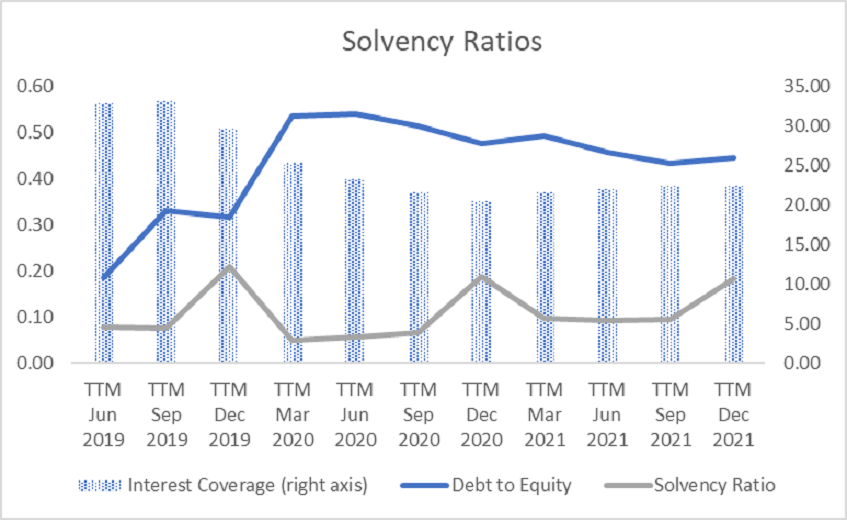

Debt to overall equity is declining. This is given due to two factors. Firstly, the total debt (short term debt + long term debt + capital leases) is stagnating or very slightly decreasing, which we can see in the previous chart. Secondly, our next variable, equity, has a solid and strong rising movement upwards in the long-term. This is why the debt to equity ratio is slightly declining and found the bottom in the 3Q of 2021. Currently, it stands at 0.44. In other words, the total debt represents 44% of the amount of the shareholder s equity.

Interest Coverage, which is represented on the right axis, currently stands at 22. It means that, with the current annual EBITDA (Earnings before Interest, Tax, Depreciation, and Amortization) and a given amount of interest expenses, Paypal generates enough cash from its operations to cover current interest payments for years. Interest coverage is so high, which is really appreciated for investors because they can not have to be stressed about the financial situation.

Yes, in the case of worsening years, which would cause a strong decline in EBITDA, the ratio would be significantly lower, but is still strong enough to cover its interest payments or financial liabilities. From this point of view, it is very safe.

Comments

Post has no comment yet.