Stocks end flat despite volatility

Stocks recovered some of their losses on Wednesday, but as the earnings season heated up, gains were held back by mixed quarterly reports. The S&P 500 got a notable blow from the streaming juggernaut Netflix. The Dow Jones dropped 0.21%, while the Nasdaq increased 0.2%. The S&P 500 increased by 0.1%.

After releasing mixed first-quarter earnings and projections that fell short of expectations, Netflix saw a more than 3% decline. The streaming giant postponed plans to intensify its assault on password sharing. Disney stock fell as well when it was revealed that it will be laying off 15% of its entertainment workforce.

More to read: Nvidia maintains traction due to AI – analysts changed price targets

Morgan Stanley posted first-quarter earnings above Wall Street expectations. However, the strength in deal-making activity caused a 19% decline in profit, which overshadowed those results.

The US dollar prevailed despite of strong sterling

Although the pound excelled on Wednesday as a result of UK inflation statistics, the dollar on Wednesday benefited due to higher Treasury rates. Since the inflation rate is still above 10%, more rate increases by the Bank of England are anticipated for May and maybe June.

Markets are becoming less confident that the Fed would lower interest rates later this year. As a result, the dollar index, which measures the value of the dollar against a basket of its counterparts, was up 0.206%.

You can also listen to: #3: Organizing Bitcoin-only conference with Jordan Walker

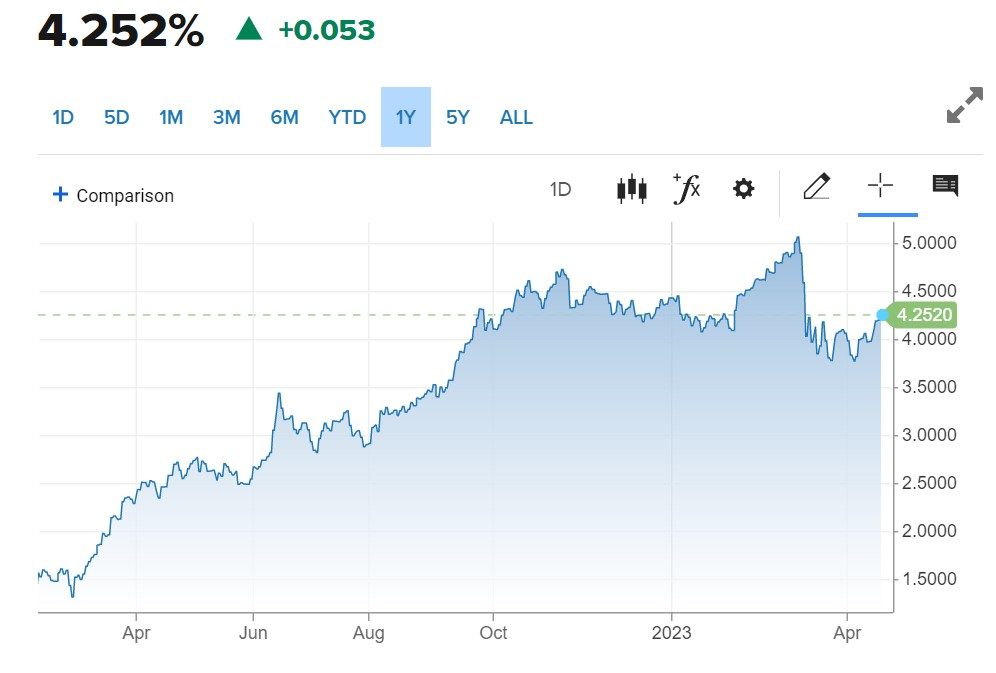

The dollar increased 0.46% versus the rate-sensitive yen at 134.71, after briefly rising over 135 for the first time in a month. Sterling was last trading at $1.244, up 0.13% on the day. The yield on two-year US Treasury bonds increased to 4.252% from a one-month peak of 4.286%.

US-2year yield chart, source: CNBC

Commodities gave up gains

The US crude inventory fell by the most in three weeks, but it wasn’t enough to hold the benchmark barrel above $80. After hitting a session low of $78.56, WTI finished down $1.70, or 2.1%, at $79.16 a barrel.

The price of London-traded Brent, the world’s standard for petroleum, dropped by about 2%, or $1.65, to $83.12. As with WTI, Brent fell by about 4% during the past week.

Yuo may also like: Copper sees extremely low level of stockpiles – what does it mean?

Gold futures for June also closed a red day, with a 0.64% decline to $2,006.75. The yellow metal was able to hold it’s critical above-$2,000 level. The gold’s little brother silver, was able to close a green day at $25.378 with a 0.46% increase.

Comments

Post has no comment yet.